- Analytics

- News and Tools

- Market News

- EU session review: Pound at three-week low as oil, retail sales sparks concern about recovery

EU session review: Pound at three-week low as oil, retail sales sparks concern about recovery

Data released

07:00 Germany GDP (Q4) preliminary 0.4% 0.4% 0.7%

07:00 Germany GDP (Q4) preliminary Y/Y 4.0% 4.0% 3.9%

07:45 France Consumer confidence (February), new method 85 85 85

09:00 Italy Retail sales (December) adjusted 0.2% - -0.3%

09:00 Italy Retail sales (December) Y/Y unadjusted 0.4% - 1.0%

10:00 Italy Business confidence (February) 103.0 103.8 103.4 (103.6)

10:00 EU(17) Economic sentiment index (February) 107.8 106.7 106.8 (106.5)

10:00 EU(17) Business climate indicator (February) 1.45 - 1.45 (1.58)

11:00 UK CBI retail sales volume balance (February) 6% 31% 37%

The pound slid to a three-week low against the euro on concern a surge in oil prices may derail the global economic recovery, and a report showed retailers expect no growth next month.

Sterling fell after oil surged to a 30-month high of more than $119 a barrel. Central bank policy maker David Miles said officials shouldn’t rush to raise interest rates to prove they are “tough” on inflation as forecasts warrant a “very gradual” tightening.

“Rate expectations are being pushed back a bit because the market is seeing the oil price as being stagflationary,” said Steve Barrow at Standard Bank Plc. “It’s both inflationary and a source of weaker growth. That’s something which is likely to weigh on sterling.”

Retailers saying sales volumes increased from a year ago outnumbered those reporting declines by 6 percentage points, compared with 37 percentage points in January, the Confederation of British Industry said today.

Brent oil surged after Barclays Capital estimated that political revolt in Libya, which holds Africa’s biggest crude reserves, caused it to cut two-thirds of output. As much as 1 million barrels of Libya’s 1.6 million barrels of daily oil production, the ninth-largest among the 12 members of the Organization of Petroleum Exporting Countries, may have been lost, Barclays said in a report yesterday. Goldman Sachs Group Inc. estimated disruptions at 500,000 barrels a day.

Britain’s currency has gained 3.6% against the dollar this year amid mounting pressure on the Bank of England to raise its key rate from a record low 0.5% as inflation persists above its target. Consumer-price growth accelerated to 4% last month, a Feb. 15 report showed, the 14th consecutive month above the 2% goal.

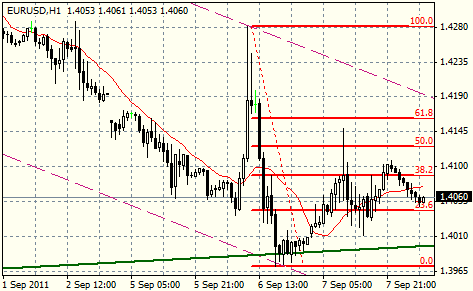

EUR/USD rose from $1.3700 to $1.3808 before retreated to $1.3750 and currently holds within the $1.3750/85 range.

GBP/USD recovered to $1.6212 following its decline to $1.6140. In general rate remains under pressure.

USD/JPY set stable a bit higher lows on Y81.85. A break of Y8175 to open a deeper move toward next support area between Y81.65/50.

US data starts at 1330GMT, when initial jobless claims are expected to fall 5,000 to 405,000 in the February 19 week after rising in the previous week.

At the same time, durable goods orders are expected to surge 3.0% in January after the 2.3% drop in December.

At 1500GMT the New Home Sales data is due, where the pace of new home sales is expected to slow to a 305,000 annual rate in January after the December spike.

The weekly EIA Crude Oil Stocks data is due at 1600GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.