- Analytics

- News and Tools

- Market News

- EU session review: Asian currencies gain

EU session review: Asian currencies gain

Data released:

08:00 Germany IFO business climate index (April) 110.4 111.0 111.1

08:30 UK PSNCR (March), bln 24.8 - 7.0

08:30 UK PSNB (March), bln 16.4 - 10.3

08:30 UK Retail sales (March) 0.2% -0.5% -0.8%

08:30 UK Retail sales (March) Y/Y 1.3% 1.0% 1.3%

Asian currencies climbed, led by Singapore’s dollar, on speculation regional central banks will tolerate faster appreciation and raise borrowing costs to tame inflation.

The Bank of Thailand raised interest rates yesterday, for the sixth time in less than a year, and signaled more increases are likely.

Chinese Premier Wen Jiabao and People’s Bank of China Deputy Governor Hu Xiaolian have said in the past week the yuan’s flexibility may play a role in countering the fastest inflation in 32 months.

The MSCI Asia-Pacific Index of regional stocks rose 1.2% after U.S. companies, including Apple Inc., reported better results than analysts had forecast.

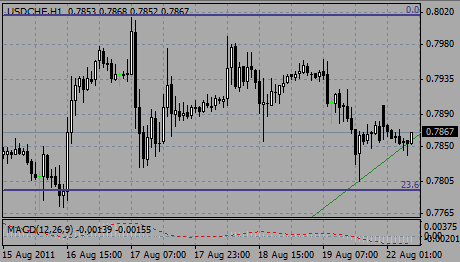

The dollar dropped to its lowest level in more than two and a half years.

The Australian dollar surged to a fresh 29-year high against the dollar.

EUR/USD rose to session highs on $1.4650. Strong resistance and offers were able to cap the rally and euro retreated to $1.4611.

GBP/USD rose strongly from $1.6430 tо $1.6570 before it set stable.

USD/JPY holds tight within the Y81.85/Y81.20 range.

US data starts at 1230GMT, when initial jobless claims are expected to fall 17,000 to 395,000.

At 1400GMT, the Philadelphia Fed index is forecast to fall to 36.0 in April after hitting a 27-year high in March.

Also at 1400GMT, the index of leading indicators is expected to rise 0.3% in March after the 0.8% rise in February.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.