- Analytics

- News and Tools

- Market News

- EU session review: Euro holds tight after ECB decision and ahead of Trichet's speach

EU session review: Euro holds tight after ECB decision and ahead of Trichet's speach

Data released:

08:30 UK CIPS services index (April) 54.3 55.8 57.1

10:00 Germany Manufacturing orders (March) seasonally adjusted -4.0% 0.6% 2.4%

10:00 Germany Manufacturing orders (March) not seasonally adjusted, workday adjusted Y/Y 9.7% 15.5% 20.1%

11:00 UK BoE meeting announcement 0.50% 0.50% 0.50%

11:45 EU(17) ECB meeting announcement 1.25% 1.25% 1.25%

The euro hovered close to a 17-month peak against the dollar and hit a 13-month high against the pound on Thursday as investors awaited the Trichet's speach.

But in Europe the euro dragged lower on release of much weaker than expected German mfg orders data (-4.0% m/m versus median +0.4%).

While no move was expected from the ECB at today’s meeting following April’s 25 basis point rate rise, investors were set to focus on comments from Jean-Claude Trichet, ECB president, for clues as to future monetary tightening. Forecasts were split as to whether Mr Trichet would signal a move in June or July.

Ulrich Leuchtmann at Commerzbank said it was more likely that Mr Trichet would signal a rate rise in June than July.

“If we are right, the euro should find strong support against the dollar and we would not be able to exclude an attack on the psychologically important $1.50 mark,” he said.

The Bank of England has kept UK interest rates at a record low of 0.5%.

The pound suffered after a survey suggested activity in the UK services sector slowed markedly in April, further denting expectations that the Bank would move to abandon its ultra-loose monetary policy stance.

The UK services sector purchasing managers’ index dropped 54.3 in April, below expectations for a reading of 56.0.

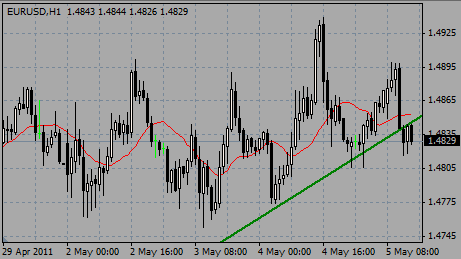

EUR/USD tested $1.4900, but failed to break above and fell to a new session lows around $1.4815 on weak German news. Later rate recovered to $1.4825.

GBP/USD fell from $1.6545 to $1.6455 after the dissapointed data. Rate tried to recover and was back to $1.6500.

USD/JPY continued to go down and printed lows around Y79.55. Later rate recovered, but in general remained weak as the Japanese FinMin is reported as saying that current FX moves different from time of G7 intervention in March.

US data also comes at 1230GMT, when initial jobless claims are expected to fall 19,000 to 410,000 in the April 30 week after rising sharply in the previous week.

At 1330GMT, Fed Chairman Ben Bernanke delivers a speech to the Chicago Fed's Annual Conference on Bank Structure and Competition.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.