- Analytics

- News and Tools

- Market News

- EU session review: Euro falls after S&P says Greece may be in ‘selective default’

EU session review: Euro falls after S&P says Greece may be in ‘selective default’

Data released:

09:00 EU(17) PPI (May) -0.2% -0.1% 0.9%

09:00 EU(17) PPI (May)Y/Y 6.2% 6.3% 6.7%

USA Independence Day

The euro weakened versus the yen after Standard & Poor’s said a debt-rollover plan for Greece may prompt a “selective default” rating for the country.

The euro earlier advanced on speculation the European Central Bank will increase interest rates this week. The ECB on July 7 will increase its benchmark rate to 1.5% from 1.25%, according to economists.

“Sentiment was undermined with those S&P comments,” said Jeremy Stretch at Canadian Imperial Bank of Commerce. “Markets are reluctant to aggressively sell the euro, though. We need to see what the other rating agencies are going to suggest.”

The Swiss franc declined after data showed retail sales fell 4.1% in May from a year earlier. The Swiss currency has advanced 9.3% versus the dollar this year as investors sought a haven amid the euro-area debt crisis.

“There is a response to domestic data, undoubtedly,” said Steve Barrow at Standard Bank Plc.

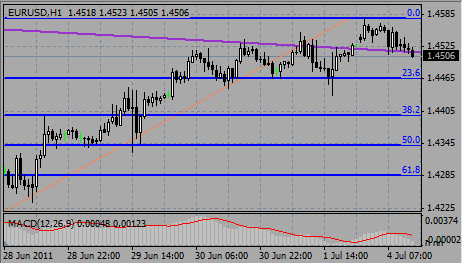

EUR/USD set stable around session lows after it earlier failed to go ahead the resistance at $1.4580. Rate holds at $1.4515/20.

GBP/USD fell under $1.6100from session highs on $1.6140 following the release of Construction PMI data.

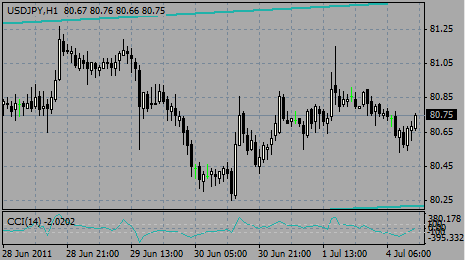

USD/JPY recovered from session low on Y80.52 and currently holds around Y80.71.

Traders expect a low volume session, with US markets closed for the Independence Day holiday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.