- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

07:00 Germany CPI, m/m (Finally) January -0.6% -0.6% -0.7%

07:00 Germany CPI, y/y (Finally) January +1.3% +1.3% +1.2%

08:15 Switzerland Producer & Import Prices, m/m January 0.0% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, y/y January -0.4% -0.3% -0.3%

09:00 Eurozone ECB Monthly Report February

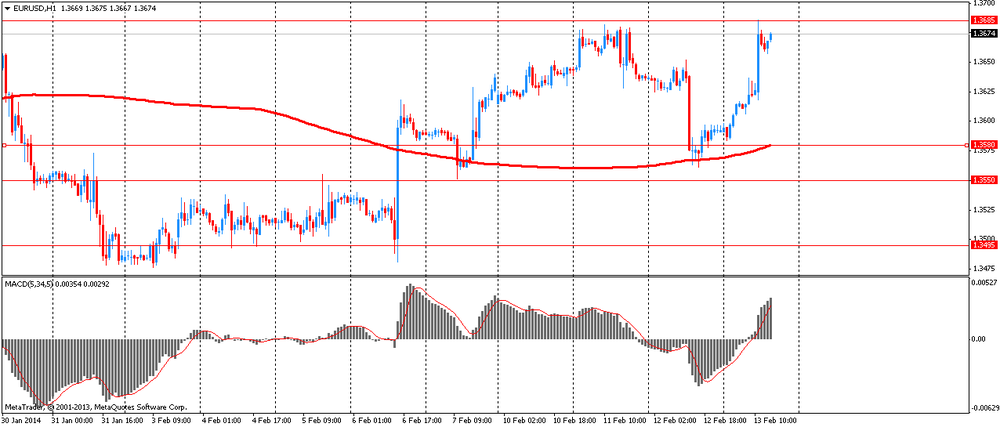

The euro rose against the U.S. dollar on a background of the ECB Monthly Report and data on inflation in Germany .

ECB in its February report indicated that inflation in the euro area should remain low for an extended period of time before it starts to gradually recover to the target of 2%. " Comparison with the monetary analysis confirms the reduced prices in the euro area in the medium term ," said the ECB.

According to a study of professional forecasters , forecast HICP in 2014 was revised to 1.1 % from 1.5% previously . Forecast for 2015 was lowered to 1.4 % from 1.6 % in Q4 . , The forecast for 2016 was 1.7 %.

With respect to data for Germany , inflation, agreed by EU standards , remained unchanged in January, according to preliminary estimates . These are the latest data from the Federal Statistical Office. Harmonized index of consumer prices (HICP) increased by 1.2 percent per annum in January , the result was unchanged compared with the growth rate in December . Outcome corresponded to preliminary estimates . HICP fell by 0.7 percent compared to December , when it recorded a growth of 0.5 percent . Monthly changes are also consistent with preliminary estimates .

Statistical Office also reported that consumer price inflation fell to 1.3 percent in January from 1.4 percent in December , according to initial estimates . Moderation in inflation mainly reflects a downward trend in prices for mineral oil products. In contrast, the cost of electricity and solid fuel increases. In monthly terms, the consumer price index fell by 0.6 percent in early 2014. This followed an increase of 0.4 percent in December .

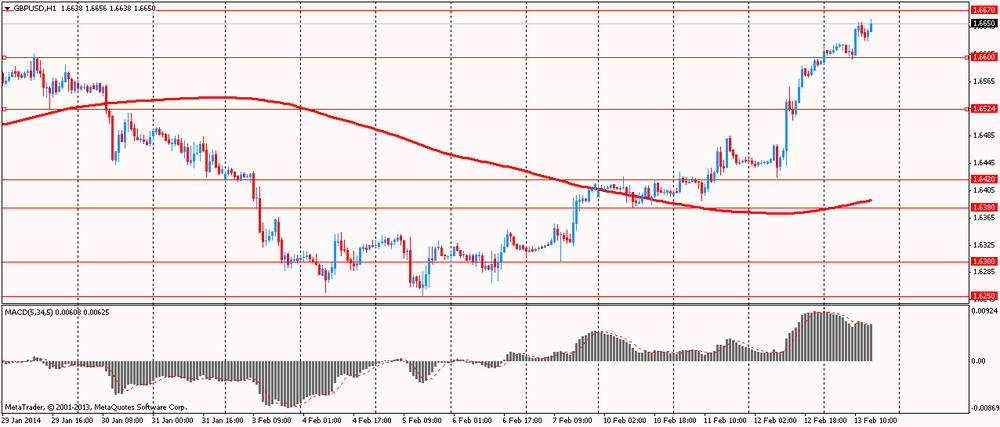

The British pound strengthened against the U.S. dollar. Published data on the UK housing market , according to which in January house price balance of RICS ( Royal Institution of Surveyors ) fell to 53 %, compared with 56 % earlier in December. Recall that the index is calculated as the proportion of subtraction of respondents who reported a decline in prices, the share of those who reported an increase in prices.

Nevertheless , it is worth noting that the demand for homes remains strong. " It's no secret that we have seen a rise in prices in many parts of the country due mainly lack of objects represented in the market. Given the fact that more people are now attuned to buying a home than at any time in recent years , the number of objects is simply not enough to meet demand. The result is a rise in prices in many areas , and it seems to continue for the foreseeable future "- says Peter Bolton King of the RICS.

The survey also showed that the evaluators continue to expect prices to rise over the coming year .

EUR / USD: during the European session, the pair fell to $ 1.3686

GBP / USD: during the European session, the pair rose to $ 1.6656

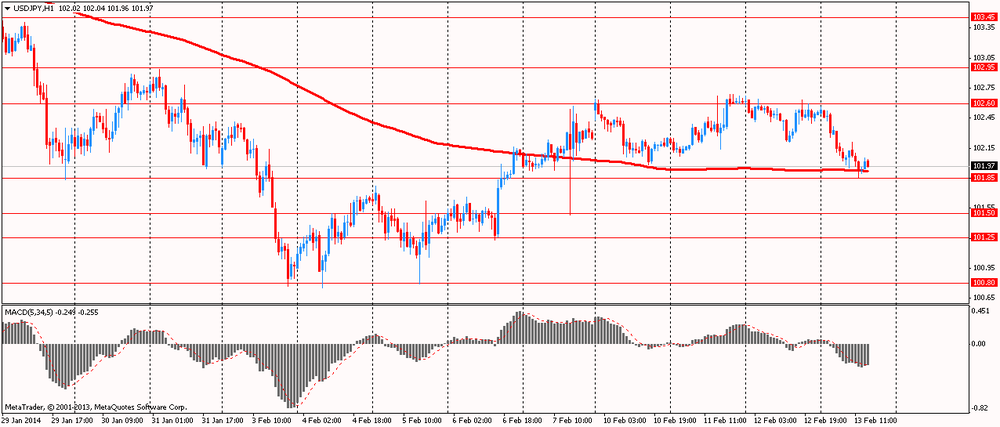

USD / JPY: during the European session, the pair dropped to Y101.86

At 13:30 GMT , Canada will release the housing price index on the primary market in December. In the U.S. at 13:30 GMT will change in the volume of retail trade , the change in retail sales excluding auto sales , the change in volume of retail trade turnover , excluding sales of cars and fuel for January to 15:00 GMT - change in stocks in commercial warehouses for December .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.