- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

06:30 France GDP, q/q (Preliminary) Quarter IV -0.1% +0.2% +0.3%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.2% +0.6% +0.8%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.3% +0.3% +0.4%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.1% +1.3% +1.4%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.1% -0.1% +0.1%

10:00 Eurozone Trade Balance s.a. December 16.0 14.5 13.7

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.2% +0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV -0.4% +0.4% +0.5%

The euro rose to almost three-week high against the U.S. dollar after the rate of economic growth in Germany, France and the euro area slightly exceeded expectations. Eurozone economic growth accelerated in the fourth quarter, more than expected , according to preliminary estimates by Eurostat . Gross domestic product grew by 0.3 percent on a quarterly measurement that was faster than the growth of 0.1 percent posted in the third quarter and above economists' forecast of 0.2 percent . GDP grew the third consecutive quarter in late 2013 . In annual terms the economy grew by 0.5 percent , breaking the trend of declining by 0.3 percent in the third quarter . Projected growth of 0.4 percent. For the entire 2013 , GDP fell by 0.4 percent in the euro area and rose by 0.1 percent in the 28 countries of the European Union.

German growth accelerated in the fourth quarter , due to the positive contribution of foreign trade and investment , according to preliminary data from the Federal Statistical Office . Gross domestic product grew by 0.4 per cent compared with the previous quarter ago , while it was expected that he would remain stable at 0.3 percent.

According to preliminary calculations consistent growth in exports of goods and services was significantly higher than import growth . In terms of the expenditure side , government spending remained at the level of the previous quarter , while household spending on final consumption was slightly lower . Positive contribution was recorded in part of fixed capital formation , which was significantly higher in the sector of machinery and equipment , and construction. Nevertheless , stocks declined significantly , which slowed economic growth. Calendar adjusted GDP increased by 1.4 percent year on year , which is also faster than the growth of 0.6 per cent , which is seen in the third quarter and higher than economists expected 1.3 percent growth.

The French economy grew at the end of 2013 after stagnating in the third quarter , helped by the improvement in external demand , data showed the European statistical office Insee. Gross domestic product grew by 0.3 percent in the fourth quarter , after zero growth in the third quarter . The expenditure breakdown of GDP shows that as household spending and government spending accelerated in the fourth quarter , to 0.5 percent and 0.4 percent respectively. Investment rose for the first time since the end of 2011 , 0.6 percent in the fourth quarter . Exports grew by 1.2 per cent , 1.6 per cent drop changing ago quarter . Meanwhile, import growth slowed to 0.5 percent from 0.8 percent.

The Australian dollar rose after the publication of positive inflation data from China. Today, the National Bureau of Statistics in Beijing stated that in January consumer price index rose at the same pace as in December , by 2.5 % compared with the same period a year earlier. Producer price index fell by 1.6% in line with expectations . Recall that China is the largest trading partner of Australia and New Zealand .

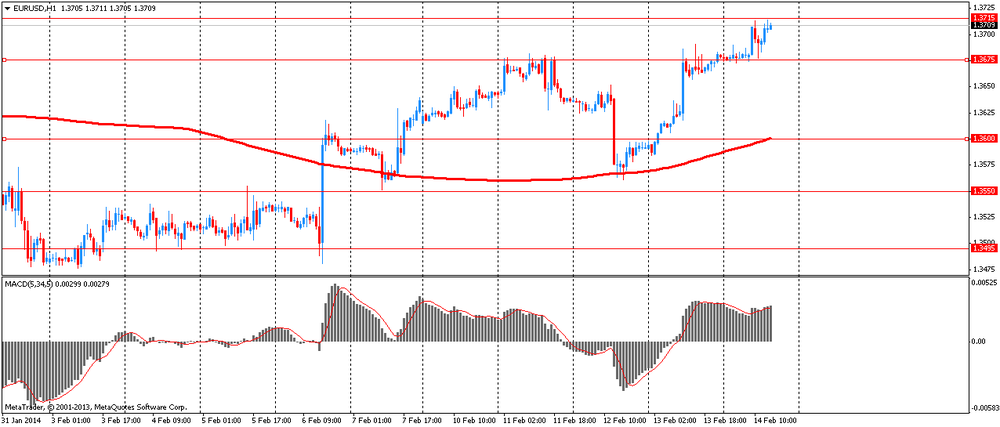

EUR / USD: during the European session, the pair rose to $ 1.3714

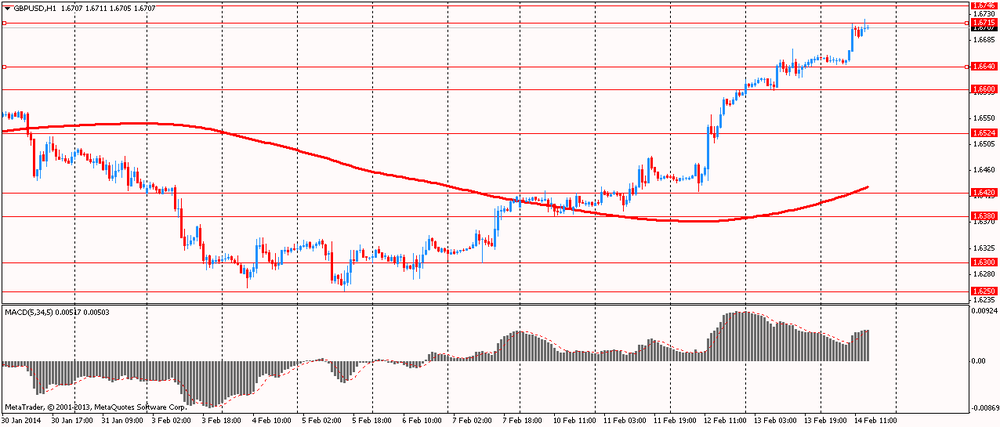

GBP / USD: during the European session, the pair rose to $ 1.6722

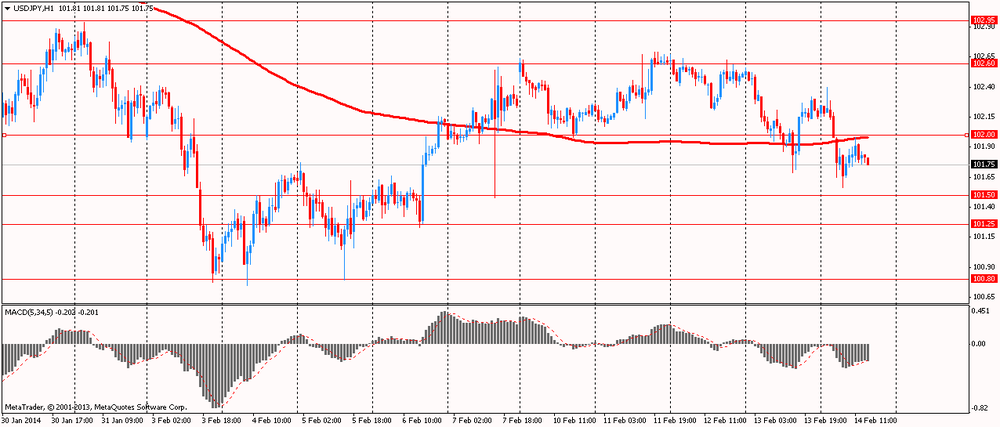

USD / JPY: during the European session, the pair dropped to Y101.71

At 13:30 GMT , Canada will release the change in volume production shipments in December. In the U.S. at 13:30 GMT will import price index for January to 14:15 GMT - capacity utilization , change in industrial production for January to 14:55 GMT - consumer sentiment index from the University of Michigan in February.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.