- Analytics

- News and Tools

- Market News

- Asian session review: tight ranges in low activity

Asian session review: tight ranges in low activity

The yen was little changed in spite of statements of the Bank of Japan board member Makoto Sakurai. During his speech today Sakurai announced a number of different options for the purchase of new bonds and increasing the asset purchase program. However, the banker noted the absence of an acute need to run all of these mechanisms at the next meeting in September. "The Bank of Japan may make some technical changes to its monetary policy, however, is unlikely to change its attitude on the target inflation rate of 2% and nothing decisive at the September meeting" - said Sakurai. The official added that it is important for the regulator to analyze the effects of negative interest rates and the strengthening of the national currency.

The euro traded almost unchanged after yesterday's announcement of the ECB's Novotny. The official noted that the main reason for such low interest rates in the region is a negative situation in the European economy. "In the long term, low rates of economic growth will continue, and it is difficult to name the reason for this" - he said.

Today, investors' attention will focuse on key employment report in the US, which will be published today at 12: 00GMT. According to forecasts, the number of people employed in non-agricultural sectors grew in August at 180 thousand after increasing by 255 thousand. In July. The unemployment rate is likely to decline to 4.8% from 4.9%. The growth rate of the average hourly rate is estimated to have slowed to 0.2% from 0.3%.

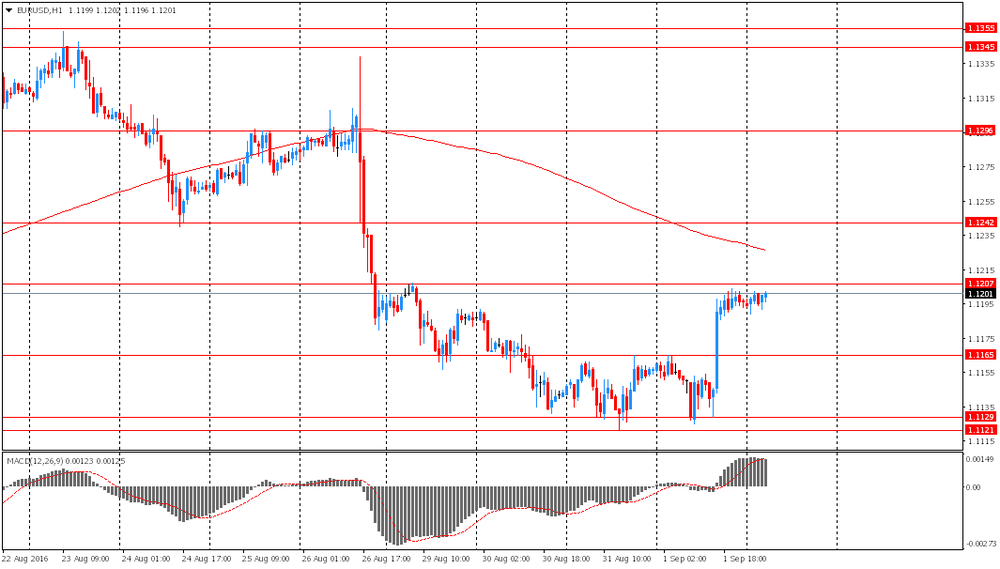

EUR / USD: during the Asian session, the pair is trading in $ 1.1190-1.1205 range

GBP / USD: during the Asian session, the pair rose to $ 1.3290

USD / JPY: during the Asian session, the pair was trading in Y103.10-103.40 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.