- Analytics

- News and Tools

- Market News

- Oil prices rose today

Oil prices rose today

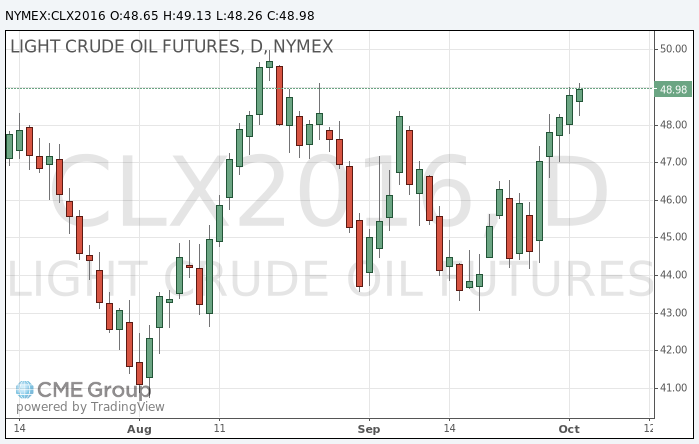

Oil prices rose slightly, although earlier in the day they traded almost unchanged. Investors assessed the ability of OPEC to cut oil production.

Oil quotes are supported in connection with the arrangements of the Organization of Petroleum Exporting Countries (OPEC) to cut production to 33 - 32.5 million barrels per day. Oil prices are roughly 9% higher since the end of the OPEC meeting in Algeria. Opinions of investors about the prospects of a cartel deal are now a major force in the market, said Scott Shelton of ICAP PLC.

Although many investors doubt the success of the OPEC agreement, less skeptical market participants point to the increasing pressure on other members of the cartel on the part of Saudi Arabia, its actual leader.

"The economic and geopolitical issues have reached a critical point, which could lead to major geopolitical differences between the Middle East countries, - wrote in a note chief market economist at First Standard Financial Peter Cardillo -. We believe that to the news should be treated with care. "

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 49.13 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 51.37 dollars a barrel on the London Stock Exchange ICE Futures Europe.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.