- Analytics

- News and Tools

- Market News

- NZ CPI supports analysts forecast for a series of rate hikes from RBNZ

NZ CPI supports analysts forecast for a series of rate hikes from RBNZ

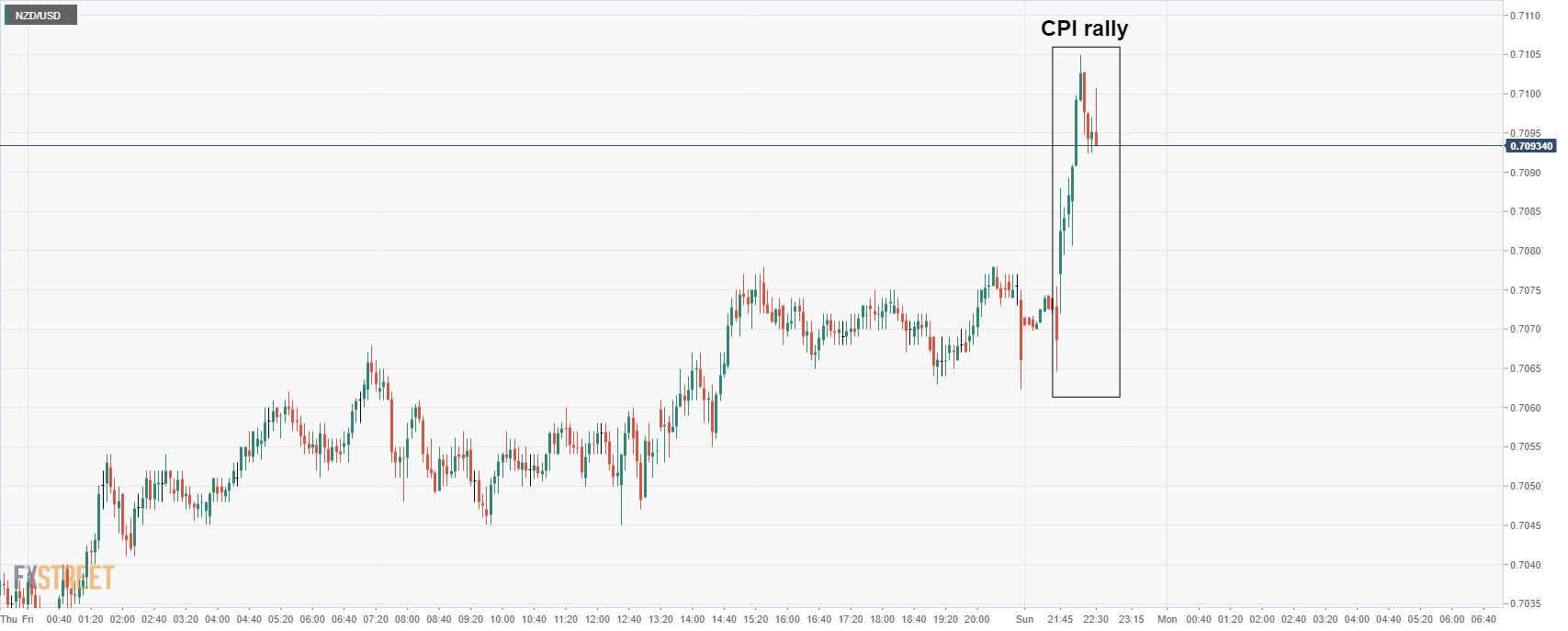

New Zealand Consumer prices rose 2.2% in the September quarter, taking the annual inflation rate to 4.9%. This sent the kiwi 0.2% higher vs the greenback to print a fresh cycle high through 0.71 the figure.

The data came in as the highest level since 2011's GST related spike and was well above both the market and Reserve Bank of New Zealand's forecasts. Inflation pressures are broad-based which traders will now anticipate a more aggressive resolve by the central bank, underpinning the downside in AUD/NZD and upside in NZD/USD for the foreseeable sessions ahead.

Consumers Price Index, September quarter 2021

- Quarterly change: 2.2%

- Market expected +1.5% (Range 1.2% to 1.8%).

- Annual change:4.9%, RBNZ: 4.1%.

Analysts at Westpac released a note after the release and explained, ''inflation is being boosted by increasing supply-side pressures, including disruptions to global manufacturing and distribution, as well as increases in international oil prices. Those pressures have been reinforced by strong domestic demand, which has allowed many businesses to pass cost increases through to final prices.''

''Today’s result supports our forecast for a series of rate hikes from the RBNZ over the coming months.''

''Inflation is expected to remain above the RBNZ’s target band through much of the coming year as New Zealand continues to be buffeted by a perfect storm of inflation pressures. In large part that’s due to global supply disruptions and other supply-side pressures. Those pressures are likely to endure for some time yet, and could become even more pronounced over the coming months as we head into the holiday shopping season here and abroad.''

Meanwhile, analysts at ANZ Bank said, ''for the RBNZ, today’s data will only reinforce that hiking the OCR in early October was the right move.''

''Underlying inflation is too high, and further removal of monetary stimulus is needed to get things back on an even keel. With lockdown creating downside risks to employment and growth, uncomfortable trade-offs could quickly emerge. But with inflation this strong, the RBNZ won’t want to play fast and loose with their inflation-targeting credibility.''

NZD/USD spiked

The data lead to a spike in NZD/USD as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.