- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls under pressure, but stagflation risks should underpin

Gold Price Forecast: XAU/USD bulls under pressure, but stagflation risks should underpin

- Gold is firming at a critical level of support on the daily chart.

- Stagflation risks are being weighed as a driver for gold.

- Oil prices are parabolic and supply chain disruption supports the bullish outlook for gold.

The price of gold on Friday plummetted following signs that the US economy may not be declining at a rate that could spark stagflation in 2022. Data at the end of the week was surprisingly strong in US Retail Sales which, coupled with strong earnings on Wall Street, pressured the remaining bulls on the day to cash in and step aside. XAU/USD fell from a high of $1,796.49 to a low of $1,764.86 on Friday.

At the open of the week, the price is 0.14% higher as bulls look to protect a strategic layer of support, as illustrated below, and trades near $1,770. The high of the day so far has been $1,772 and the lows were $1,764.

The week ahead will have plenty of Federal Reserve speakers, and the Fed’s Beige Book could give further insight into the breadth and depth of bottlenecks facing US industry. Depending on the Fed's rhetoric, gold prices will likely be caught in conflicting sentiment with regards to inflation, stagflation, timings for tapering and final liftoff.

Oil risks are higher still

In this regard, the oil price will be closely monitored which has been at the crux of the recent concerns for stagflation:

-637701131428474499.png)

In the above monthly chart of the world's benchmark for oil prices, Brent, the price is moving parabolic and towards the 2018 highs. They temporarily broke through $85/bbl as the global energy crisis escalates and this spells stagflation risk to the gold markets.

''A tight supply-demand outlook that is particularly fueling upside momentum in Brent crude and heating oil, which can be exacerbated by up to 1 million bpd of incremental winter demand due to natural gas switching for crude and fuel oils,'' analysts at TD Securities explained.

Meanwhile, looking at positioning data, the analysts also noted that ''speculators continued to increase exposure to WTI crude, adding longs and cutting shorts as the ongoing energy crisis remains a substantial risk. With supply risks remaining extremely elevated, OPEC did not offer much to cool the price action.''

''Two-way risks remain elevated,'' the analysts said, ''but the right tail remains the fattest suggesting speculators will be happy to hold on to length in the short-term.''

Arguments against stagflation risks

For the week ahead, it will really be a matter of what side of the argument the markets want to fall on. There are plenty of arguments against stagflation risks brewing just as fast as the arguments for it have risen in recent weeks. For one, analysts at ANZ bank argued that ''activity and price data for September out last week ran counter to the stagflation narrative – there was broad-based strength in retail sales while a range of inflation measures, though still elevated, came in softer than expected.''

Additionally, the analysts noted that ''the Atlanta Fed Wage Growth Tracker, a measure we follow closely, jumped to 4.2% y/y in September up from 3% in May. The increase is largely owing to a sharp rise in wages for low-skilled workers in leisure and hospitality.''

Moreover, the analysts explained that ''President Biden is working with ports on the west coast to ease backlogs. In addition, a number of large logistic and retailing companies are set to expand the use of non-peak hours to ease supply-chain logjams.''

Gold technical analysis

For the latest in-depth technical analysis of gold, see here: Gold Chart of the Week: XAU hit the $1,800 target, now what?

However, at a snapshot, we are likely to see some consolidation to start the week off.

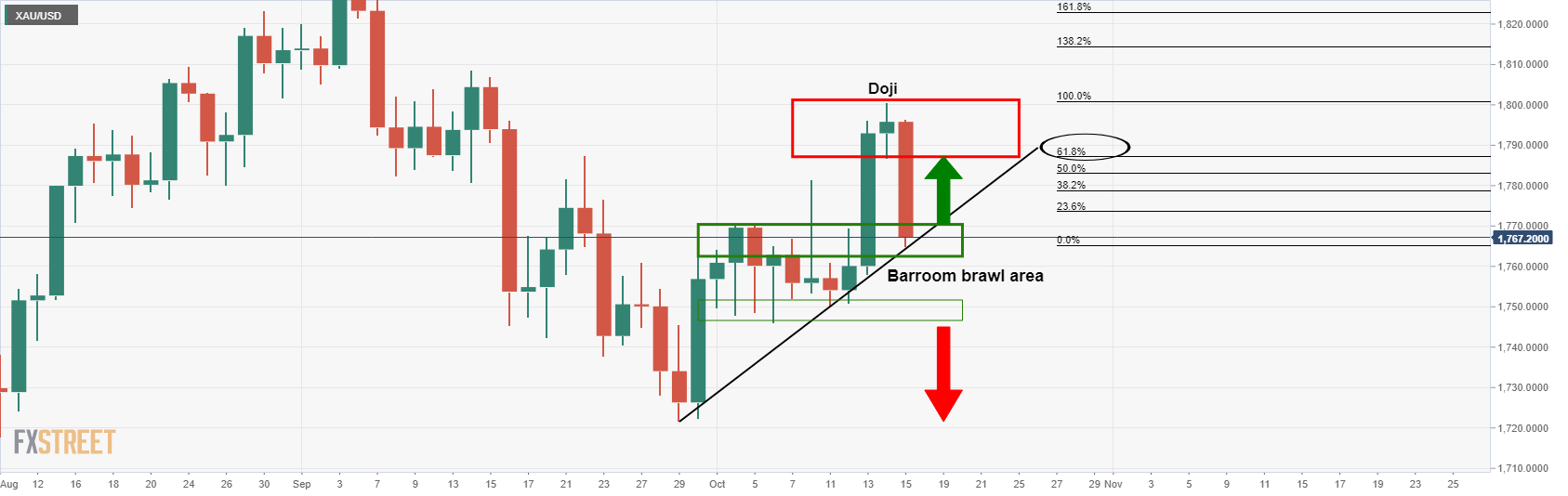

''As illustrated above, the price is testing not only dynamic support but horizontal also. This would be expected to hold initial tests and potentially lead to a restest of the prior day's lows of the Doji candle which has a confluence with the 61.8% Fibonacci retracement level near 1,786.''

''If gold does manage to break the dynamic trendline support, there is still going to be room into the 1,750s where price could find itself stuck in a range, aka, the ''barroom brawl''.

If, on the other hand, the price holds and moves up beyond 1,770 again, that would be bullish.''

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.