- Analytics

- News and Tools

- Market News

- CFTC Positioning Report: EUR net shorts extended further

CFTC Positioning Report: EUR net shorts extended further

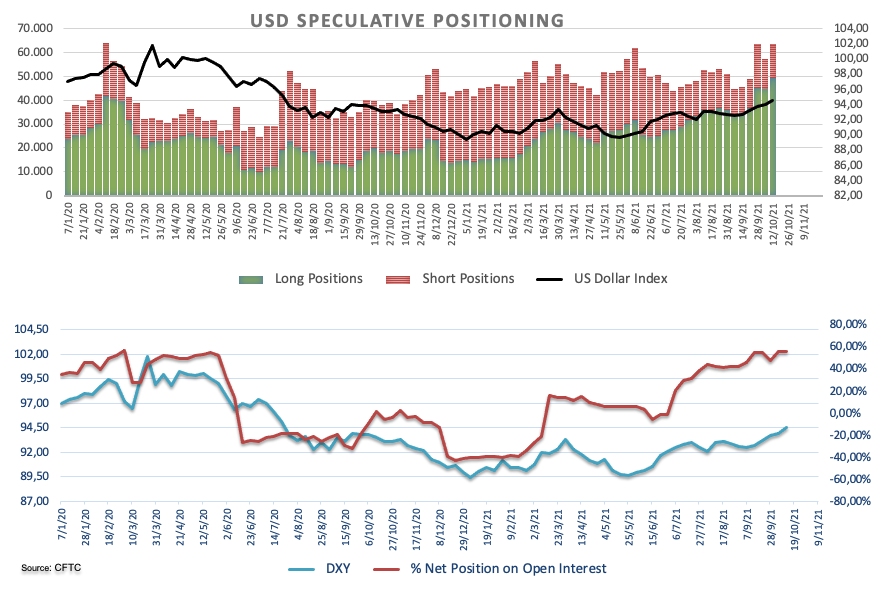

These are the main highlights for the CFTC Positioning Report for the week ended on October 12.

- Speculators remained on the bearish side regarding the euro for the second consecutive week, although net shorts eased from the previous week as well as the net position to open interest to -2.65% (from -3.22%). Higher yields following the debt ceiling truce and rising cautiousness ahead of the release of the Nonfarm Payrolls kept the risk complex under pressure and forced EUR/USD to drift lower to new 2021 lows.

- USD net longs climbed to levels last seen around 3 years ago just past the 35K contracts, while the net position to open interest stayed near 55%. US yields advanced after the federal government extended the funding at least until early December while Fedspeak continued to support a November tapering announcement, all sponsoring a fresh YTD peak in the US Dollar Index (DXY) past the 94.50 level.

- In the safe haven galaxy, net shorts in CHF receded to 2-week lows and net shorts in JPY climbed to levels last seen in early May 2019. The Japanese yen accelerated its losses and pushed USD/JPY to new 2021 highs well past 113.00 the figure.

- Net longs in crude oil move higher to levels last seen in early August around 405K contracts. The continuation of the rally in crude oil prices remained propped up by the relentless energy crunch as well as the steady hand from the OPEC+ at its meeting on October 4.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.