- Analytics

- News and Tools

- Market News

- USD/TRY clinches another all-time high past 9.3000

USD/TRY clinches another all-time high past 9.3000

- USD/TRY extends the upside above 9.3000 on Monday.

- Turkey 10-year bond yields surpass 19.00%, highest since May 2019.

- The dollar remains bid and pushes the pair higher.

The lira remains well on the defensive and now helps USD/TRY recording a new all-time high just above the 9.3000 yardstick at the beginning of the week.

USD/TRY looks fragile ahead of CBRT event

USD/TRY entered its third consecutive week of gains on Monday on the back of extra depreciation in the Turkish currency and the moderate recovery in the greenback. Indeed, the pair advanced in six out of the last seven weeks since the beginning of September and was (once again) the worst performer EM currency during last week.

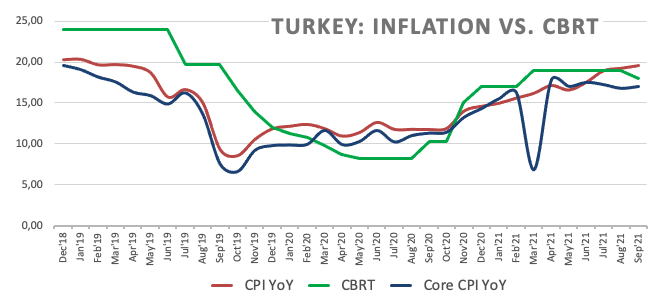

The depreciation of the Turkish currency intensified in past sessions after President Erdogan dismissed three CBRT officials who were against the latest decision by the Turkish central bank (CBRT) to reduce the One-Week Repo Rate by 100 bps at the September event.

Still in Turkey, it is worth recalling that the IMF revised up its GDP forecast for the country and now expects the economy to expand 9% this year and 3.3% in 2022.

Later in the week, Turkey’s Consumer Confidence is due on Thursday ahead of the key CBRT monetary policy meeting. Consensus among investors now expect the central bank to reduce further the policy rate by another 100 bps to 17%.

USD/TRY key levels

So far, the pair is gaining 0.33% at 9.2864 and a drop below 9.0379 (10-day SMA) would aim for 8.9221 (20-day SMA) and finally 8.8317 (monthly low Oct.4). On the other hand, the next up barrier lines up at 9.3060 (all-time high Oct.18) followed by 10.0000 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.