- Analytics

- News and Tools

- Market News

- AUD/USD bulls pack-up for the day, just shy of 1 April pivot of 0.7532

AUD/USD bulls pack-up for the day, just shy of 1 April pivot of 0.7532

- AUD/USD has been in a parabolic daily rally that could face headwinds.

- US yields are trying to make a comeback and that should support US dollar.

AUD/USD has been an impressive show mid-week, rallying from a low of 0.7465 and reaching a high of 0.7522. It was a US dollar story to start the day with risk sentiment upbeat and as investors focused on rising commodity prices which supported the Aussie. Into the Wall Street close, the bulls are trying and have shied away from the 0.7532 target as the April 1 lows. Instead, the price is levelling out near 0.7520.

The US dollar fell from a one-year high against a basket of other currencies last week with other central banks also sounding the alarm with regards to inflation and a need to act. Both the Reserve Bank of New Zealand and the bank of England are expected to lift off immanently which has stolen the greenback's thunder of late. However, the Federal Reserve is also expected to raise rates sooner than expected to quell rising price pressures, so the Us dollar remains a strong contender for the leader board in the forex space also.

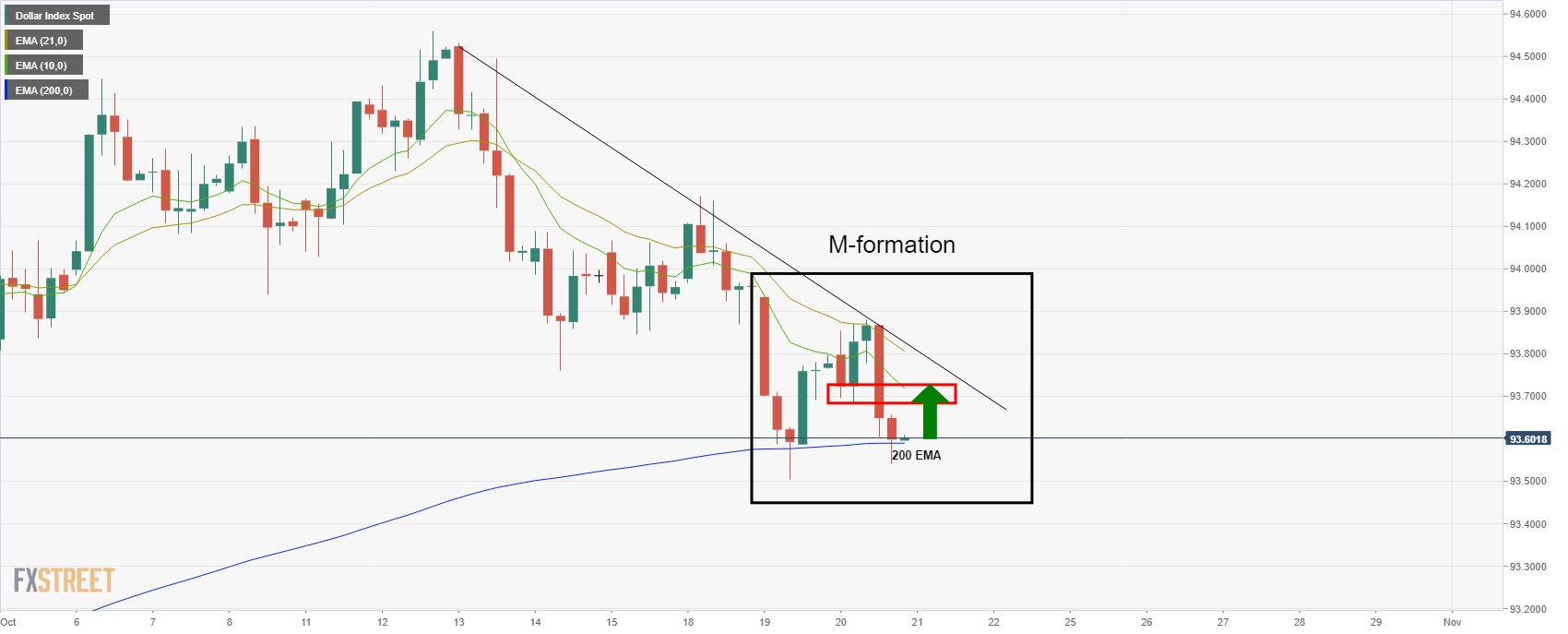

AUD/USD vs US yields

There is also a technical case for a rebound in the 10-year US yield which sank to 1.62% on Wednesday from a high of 1.673%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

Should the US yields break higher and take the US dollar for a ride to the upside as well. This could prove a major headwind for commodity currencies for the end of the week's sessions.

Meanwhile, the markets are going to be watchful of Reserve Bank of Australia's governor, Phillip Lowe tomorrow who is making a speech, but he is unlikely to reference Australia's monetary policy specifically at the Conference on Central Bank Independence, Mandates and Policies. Next week's RBA’s November statement is the next key AUD risk event for this cross.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.