- Analytics

- News and Tools

- Market News

- USD/INR Price News: Indian Rupee on the verge of an upside breakout

USD/INR Price News: Indian Rupee on the verge of an upside breakout

- USD/INR is attempting a breakout of the daily flag pattern.

- Bulls have their eyes on a run towards 75.60 recent highs.

USD/INR has been drifting higher on Thursday and is on the verge of a significant breakout to the upside. The following illustrates the relationship to the performs in the US yield curve, the greenback as measured by the DXY index and USD/INR.

USD/INR daily chart

-637709826224775283.png)

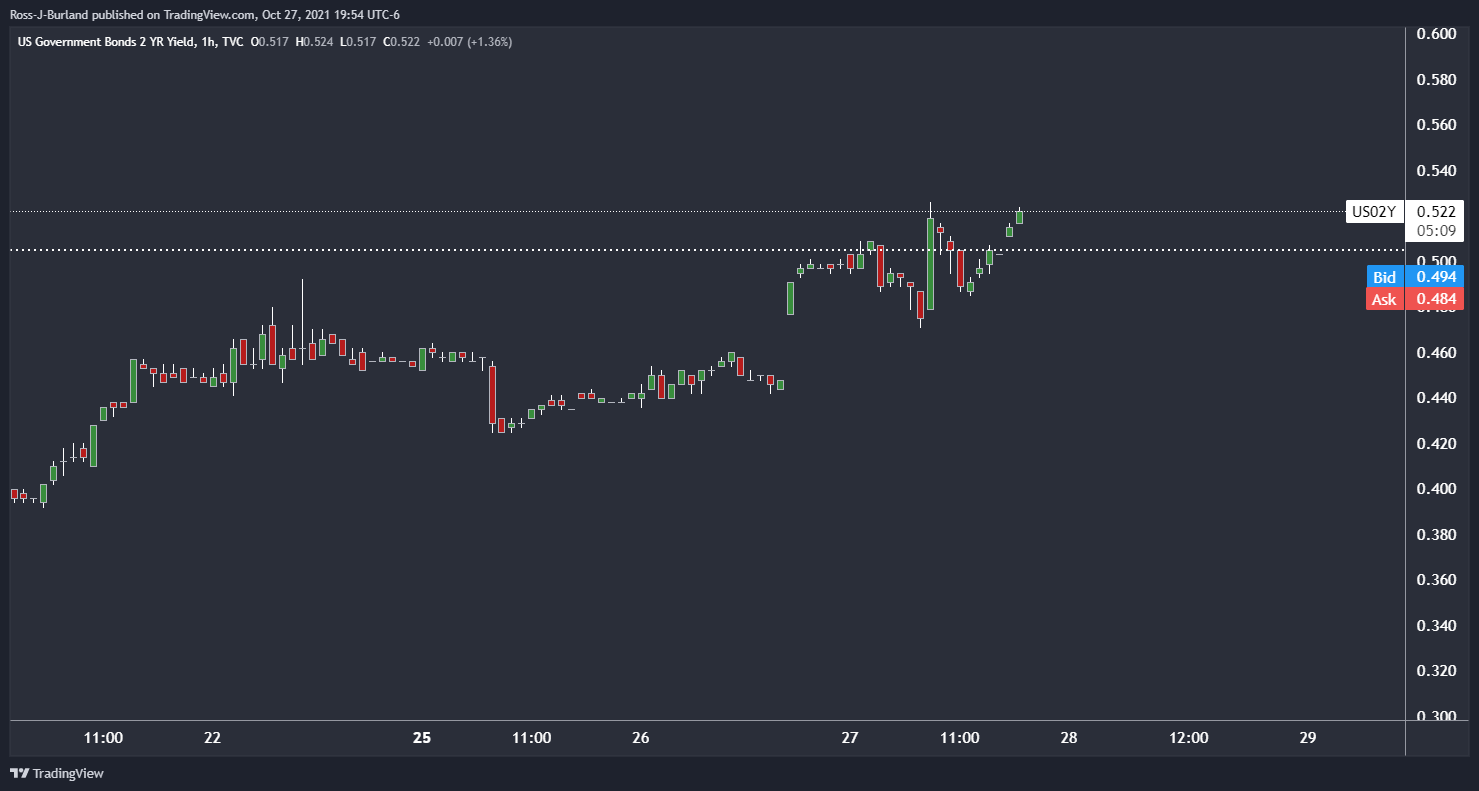

The price is creeping higher and despite the overnight drop in 10-year US yields on Wednesday. US benchmark 10-year Treasury yields dropped to a two-week low while the 2-year Treasury yields hit 19-month highs, further flattening the yield curve, as the possible timing of the Federal Reserve's first interest rate rise came into sharper focus.

The US dollar remains firm regardless but it is being helped along in Asia by a rise in the 2-year yield which has extended the prior day's jump of 17.5%. Today, they are up 3.3%.

The DXY, however, struggles to break the daily horizontal resistance as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.