- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAG/USD rebounds and trims losses, eyes 24.00

Silver Price Forecast: XAG/USD rebounds and trims losses, eyes 24.00

- Metals stabilized after sharp slide, DXY hits monthly highs above 94.00.

- The strong US dollar keeps metals under pressure ahead of next week’s FOMC meeting.

- XAG/USD falls for the fourth day, but moves off lows.

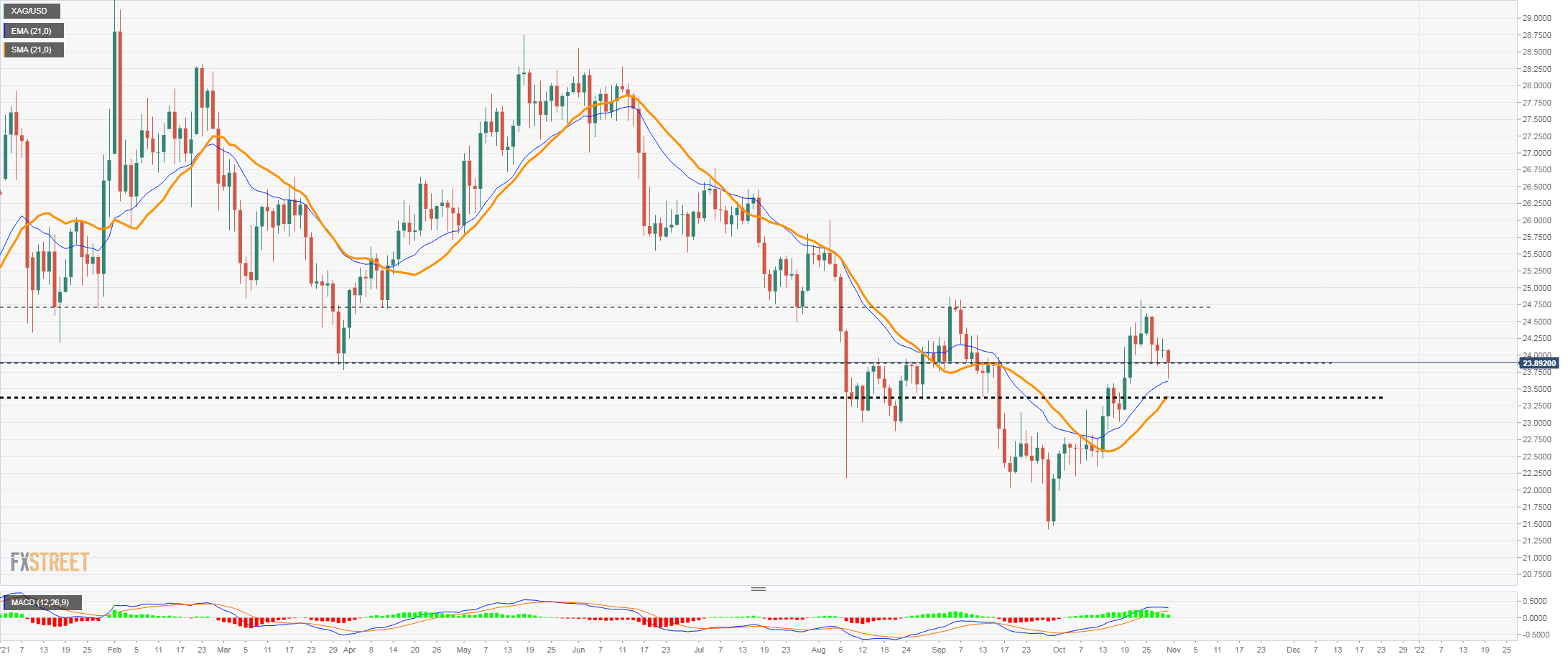

Silver and gold are falling sharply on Friday. A rally of the US dollar pushed XAG/USD to 23.68$, the lowest level in a week. During the last hours, silver recovered ground and rose to 23.90$ It is about to end the week lower, after finding resistance at the 20-week moving average around 24.40.

The DXY is up by 0.90% on Friday, trading at monthly highs at 94.20, boosted amid end-of-month flows and ahead of next week’s FOMC meeting. The Federal Reserve is expected to announce a tapering of its QE program. The latest round of economic data, including today’s Core CPE did not alter market expectations.

US stocks are modestly higher. Not even risk appetite is avoiding the rally of the greenback. For metals, a pullback in US yields favoured a consolidation.

The bias in the daily chart in XAG/USD still shows some bullish arguments, with price above key moving averages. The move off lows on Friday is another fact. Now silver needs initially to recover 24.25$ to gain momentum, and then break the key 24.75$ resistance to clear the way to more gains. A slide below 23.50$ on the contrary would increase the negative pressure.

Silver daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.