- Analytics

- News and Tools

- Market News

- AUD/USD posts tentative recovery, but rallies back above 0.7300 remain subject to being sold

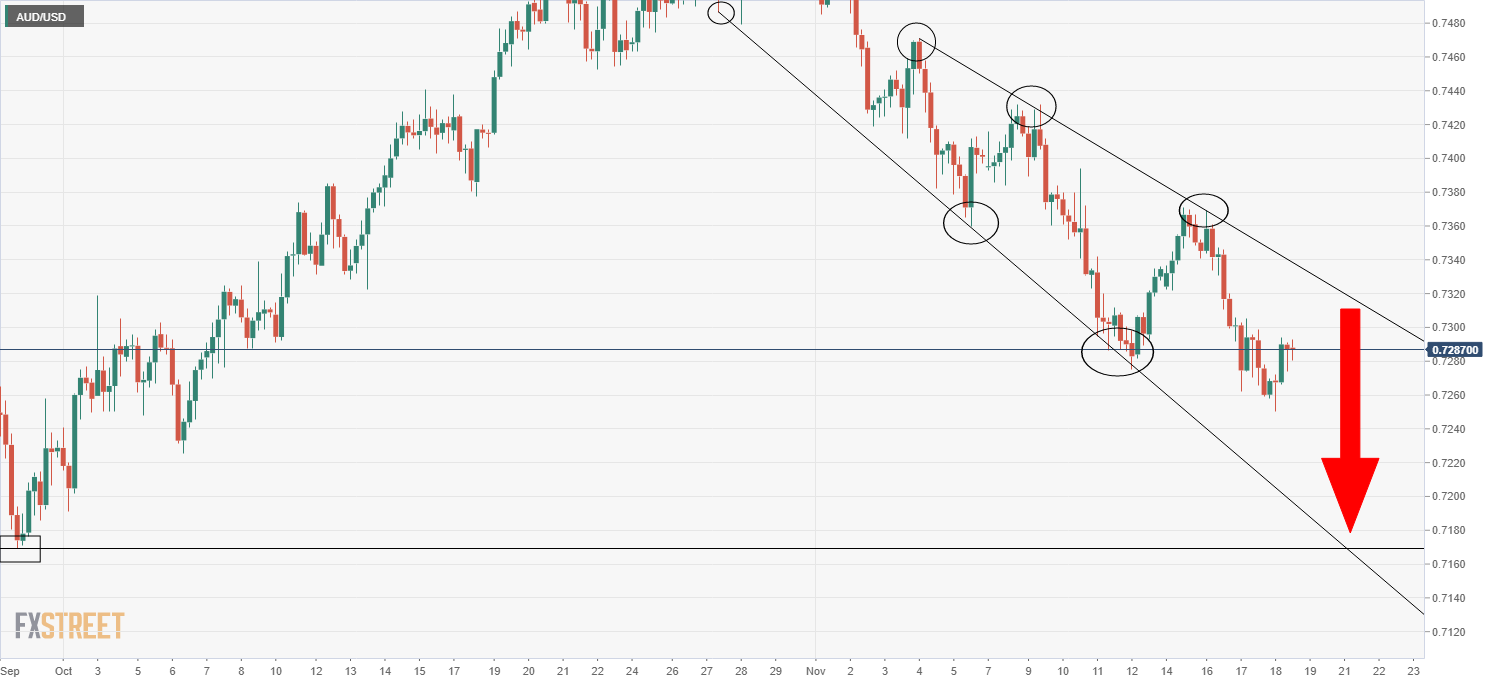

AUD/USD posts tentative recovery, but rallies back above 0.7300 remain subject to being sold

- AUD/USD has rebounded slightly on Thursday after hitting six-week lows on Wednesday just above 0.7250.

- Profit-taking on recent shorts, positive reopening news and NZD strength are all likely helping.

- The pair’s near-term technical bias continues to look bearish and rallies above 0.7300 remain subject to being sold.

Technical buying followings it's run of recent losses, as well some positive Australian economic reopening headlines, have helped AUD/USD post a decent rebound thus far this Thursday. The pair hit six-week lows just above 0.7250 late on Wednesday but has since recovered back to the 0.7280s. That means AUD is currently trading with gains of about 0.2% on the day versus the US dollar. The head of Australian state Victoria announced on Thursday that most Covid-19 related restrictions would be lifted from midnight. Over the last few weeks, restrictions, which were the toughest in Australia’s most populous states New South Wales and Victoria, have been eased. This is expected to provide the economy with a boost in Q4.

AUD/USD may also be getting a boost from strength in its antipodean cousin the kiwi. NZD is the best performing G10 currency on the day, up 0.6% versus the buck, after a quarterly survey of business managers one-year inflation expectations rose to an 11-year high at 3.7% from 3.02% in Q3. Traders said the data boosts the odds that the RBNZ opts to go with a 50bps rate hike at its policy meeting next week. AUD and NZD are typically closely correlated.

But zooming out to look at AUD/USD’s short/medium-term prospects, the technicals continue to look bearish. AUD/USD has been falling within a descending trend channel since the end of October. At the start of the week, the pair tested and rejected resistance in the form of the top of the descending trend channel. Any recovery back to the north of the 0.7300 level remains subject to being sold. To the downside, bears will be targetting the September lows just under 0.7200.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.