- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD approaches $1,805 hurdle on softer yields, Fed's Powell, inflation eyed

Gold Price Forecast: XAU/USD approaches $1,805 hurdle on softer yields, Fed's Powell, inflation eyed

- Gold extends two-day rebound from a monthly low, recently picking up bids.

- Market sentiment dwindles amid inflation, Fed rate hike chatters.

- Fed’s Powell cites upbeat economic momentum, robust labor market to back the pledge against inflation.

- Gold Price Forecast: Quick pullback from 1,800 area hints at further slides

Gold (XAU/USD) picks up bids to $1,802 during a quiet Asian session on Tuesday, keeping the previous two-day advances.

The bullion rose during the last two days as markets braces for this week’s US inflation data and the US Treasury yields have been on the defensive despite the refreshing multi-day high of late.

The gold’s latest upside takes clues from mildly bid S&P 500 Futures and softer US 10-year Treasury yields. That said, the US stock futures rise 0.12% while the benchmark bond yields drop one basis point (bp) to 1.77% after easing from the yearly peak the previous day.

Behind the recent market optimism are the hawkish comments from Fed Chair Jerome Powell, per the prepared remarks for today’s Testimony. The Fed Boss said, “The economy is growing at its fastest rate in years, and the labor market is robust,” to back his pledge to stop higher inflation from getting entrenched.

Additionally, comments from Merck’s official saying, “Expect Molnupiravir mechanism to work against omicron, any covid variant,” could also be cited as positive for the risk appetite.

Previously, steady US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), joined higher inflation components of the December NY Fed’s survey of consumer expectations to portray inflation fears. The same propelled US bond coupons to refresh multi-day peaks and drown the equities before providing a mixed daily closing.

Looking forward, gold traders will keep their eyes on Powell’s testimony for intraday moves even as the prepared remarks are out. However, major attention will be given to Wednesday’s US Consumer Price Index (CPI) data for fresh impulse.

Read: Inflation and rising yields to guide investors

Technical analysis

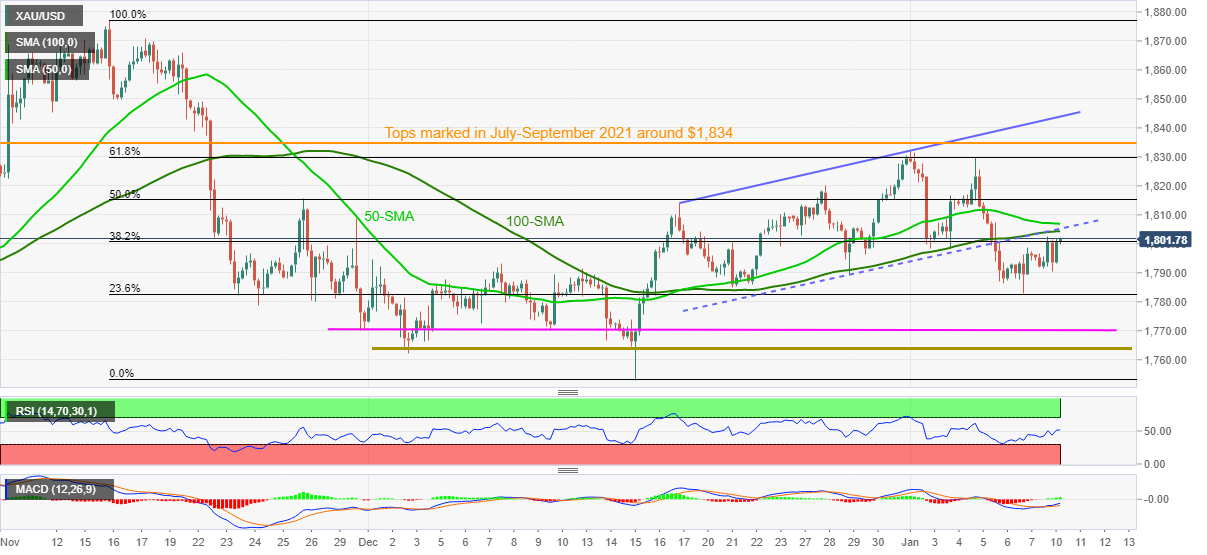

Having confirmed a bearish bias by breaking a short-term ascending trend channel and 100-SMA support, gold prices bounced off 23.6% Fibonacci retracement (Fibo.) of November-December declines. However, the metal remains below a convergence of the stated support-turned-resistance, around $1,805, amid sluggish MACD and RSI lines to keep sellers hopeful.

That said, the 23.6% Fibo. retest, near $1,782, acts as immediate support during the quote’s fresh declines, before directing gold bears towards the $1,770 and $1,760 levels.

In a case where gold prices remain weak past $1,760, December’s low of $1,753 and September’s bottom surrounding $1,721 will be in focus.

Alternatively, recovery moves remain elusive below $1,805 resistance confluence, previous support. Also challenging gold buyers is the 50-SMA near $1,808 and 50% Fibonacci retracement level of $1,815.

Given the gold buyer’s dominance past $1,815, 61.8% Fibonacci retracement level around $1,830 may act as an immediate resistance before the tops marked in July and September of 2021, close to $1,834. Also acting as an upside filter is the upper line of the ascending trend channel, close to $1,843.

Overall, gold’s failure to keep Friday’s corrective pullback hints at the commodity’s further weakness.

Gold: Four-hour chart

Trend: Further weakness expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.