- Analytics

- News and Tools

- Market News

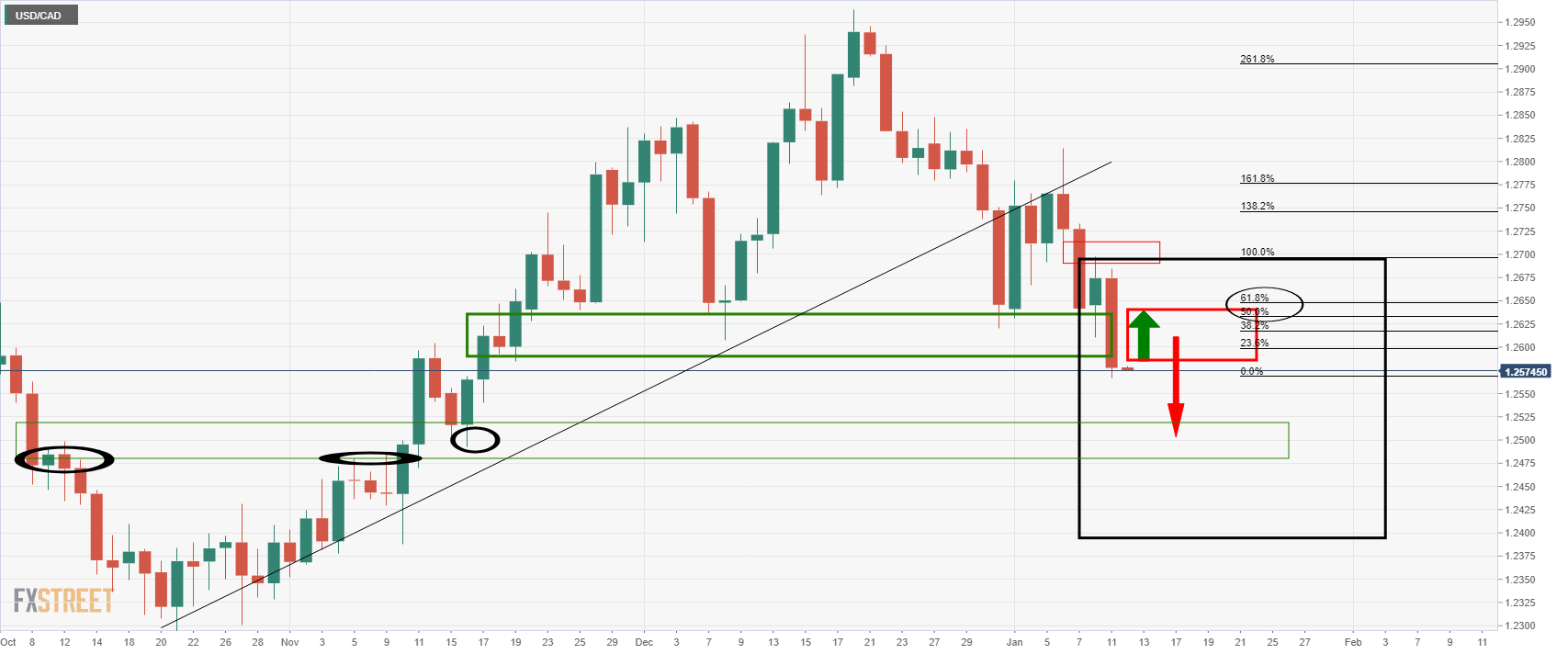

- USD/CAD's daily bearish close below 1.2580 could be significant

USD/CAD's daily bearish close below 1.2580 could be significant

- USD/CAD closed below 1.2580 on Tuesday amidst USD weakness.

- This could open the door to more downside for the foreseeable future.

USD/CAD was making a fresh cycle low on Tuesday as oil continued to recover and print higher and as the US dollar melted. This was so despite sentiment for a faster run down of quantitative easing and a faster pace of interest rate hikes from the Federal Reserve. At the time of writing, USD/CAD is trading at 1.2570 and consolidates above the overnight night low of 1.2567.

Fed will tackle inflation

Investors were reassured that the Fed will tackle inflation which led to stocks rebounding overnight and reversing the recent downward trend. Fed Chair Jerome Powell reassured explained in a testimony that the Fed is prepared to tighten monetary policy to maintain price stability.

Powell commented, “if we see inflation persisting at higher rates than expected then we will raise interest rates… we will use our tools to get inflation back.”

Analysts at ANZ Bank explained that the chair ''expects supply-side pressures to ease somewhat but said if that doesn’t happen then there is a risk that inflation becomes more entrenched and therefore the Fed would then need to respond. He also said he expects the economic impact of the Omicron variant to be short-lived.''

This is a common theme between banks which is starting to outstrip demand for the greenback. Investors are inclined to move into riskier assets and the onset of inflation is a plus for the commodity sector as well. Commodities tend to perform well in the face of inflation for which the loonie trades as a proxy. Oil, for instance, is heading higher for all the reasons noted here.

National Bank of Canada said in a note today, ''the Bank of Canada's commodity price index for 26 commodities produced in our country and sold on world markets stands at a new record high early in Q1 2022 when expressed in Canadian dollars. That’s good for the trade balance, profits, job creation, and the Canadian dollar.''

All in all, ''rising commodity prices, a current account surplus, a strong labour market and positive interest rate differentials argue for an appreciation of the Canadian dollar,'' analysts at the bank added.

The fundamentals tie in with the following technical outlook:

USD/CAD technical analysis

- USD/CAD Price Analysis: Bears to target 1.2480 on a breakout below daily H&S neckline

The price closed below the neckline of the head and shoulders formation. A restest of the old support between here and 1.2650 (61.8% Fibonacci retracement area) would be anticipated to hold and lead to a downside continuation for the days ahead which puts 1.2490 on the map.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.