- Analytics

- News and Tools

- Market News

- US Dollar Index remains depressed below 95.00, looks to data, Fedspeak

US Dollar Index remains depressed below 95.00, looks to data, Fedspeak

- DXY appears under pressure in the area of recent lows sub-95.00.

- The dollar stays offered in the wake of US inflation figures.

- Weekly Claims, Producer Prices, Fedspeak next in the docket.

The US Dollar Index (DXY), which measures the greenback vs. a bundle of its main rival currencies, remains well on the defensive and drops further south of the 95.00 support.

US Dollar Index weaker post-CPI, looks to upcoming data, Fedspeak

The index loses ground for the third consecutive session on Thursday and accelerates losses below the 95.00 mark, always on the back of the improved sentiment in the risk-linked galaxy and the corrective downside in US yields.

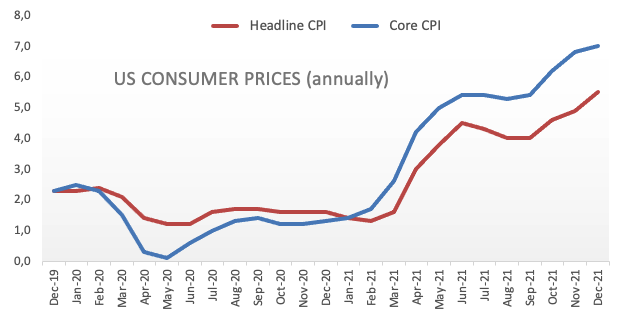

Indeed, the dollar’s selloff gathered steam after US headline inflation rose 7% in the year to December, level last seen back in 1982. Despite the high reading, the results fell in line with market expectations and underpinned the view that the Fed could initiate its normalization as soon as in March.

US yields, in the meantime, give away some gains so far on Thursday, although they remain largely near recent highs.

In the US calendar, the usual Initial Claims are due seconded by December Producer Prices. In addition, FOMC’s L.Brainard will testify before the Senate Banking Committee and Chicago Fed C.Evans (2023 voter, centrist) is due to speak.

What to look for around USD

The index lost the grip and dropped to new lows in the sub-95.00 area as market participants keep digesting the recent inflation figures amidst higher US yields and prospects of Fed’s tightening in March. On the supportive side for the greenback, Fed-speakers still point to a sooner-than-anticipated lift-off, the persistent elevated inflation, higher yields and the solid performance of the US economy.

Key events in the US this week: Initial Claims, FOMC L.Brainard Testimony, Producer Prices (Thursday) - Retail Sales, Industrial Production, Flash Consumer Sentiment, Business Inventories (Friday).

Eminent issues on the back boiler: Start of the Fed’s tightening cycle. US-China trade conflict under the Biden’s administration. Debt ceiling issue. Potential geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.25% at 94.74 and a break above 96.46 (weekly top Jan.4) would open the door to 96.90 (weekly high Dec.15) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.64 (100-day SMA) seconded by 93.27 (monthly low Oct.28 2021) and then 93.11 (200-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.