- Analytics

- News and Tools

- Market News

- USD/JPY edges higher around no change BoJ following a shallow correction

USD/JPY edges higher around no change BoJ following a shallow correction

- USD/JPY bulls take the lead and run towards 115 the figure.

- The bulls have broken critical resistance, clearing the way for further upside.

USD/JPY is catching a fresh wave of demand as bulls continue to drive the price towards a 115 objective for the forthcoming sessions. The Bank of Japan has left rates unchanged and updated its forecasts as follows. Meanwhile, USD/JPY trades around 114.70 and has climbed from a low of 114.44 to reach a 114.73 high so far.

BoJ key takeaways

The BoJ has left the 10-year yield target unchanged at 0.00% and leaves the policy balance rate unchanged at -0.10%.

The BoJ cut the 2021 median Gross Domestic Product forecast to 2.8% from 3.4% but raised the 2022 median GDP forecast to 3.8% from 2.9%.

The central bank's 2023 median GDP forecast has moved to 1.1% from 1.3%.

It has left the 2021 core Consumer Price Index median forecast unchanged at 0.00% but has raised the 2022 core CPI median forecast to 1.1% from 0.9% and the 2023 core CPI median forecast to 1.1% from 1.0%.

The BoJ says the positive economic cycle will strengthen as rising income push up expenditure, including that for households.

The central bank says the developments in overseas economies seen as risks to the economic outlook while wage earners' income is likely to gradually rise reflecting higher wages for sectors facing labour shortages.

USD/JPY technical analysis

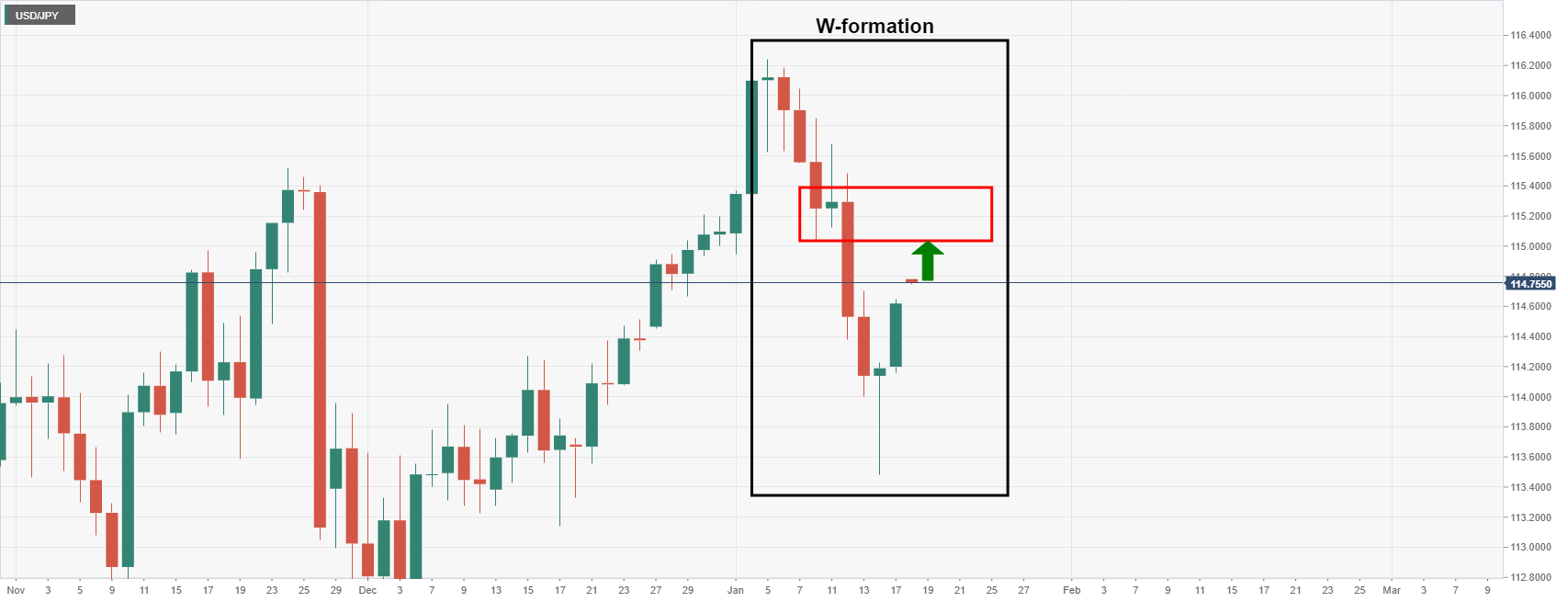

Following a shallow correction in late New York trade, The price is on target for a test of the neckline of the M-formation near 115 the figure. A break there could mitigate a further portion of the bearish impulse's range towards 115.50 as per the hourly chart below.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.