- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bulls move in for the kill at the 200-hour MA

Gold Price Forecast: Bulls move in for the kill at the 200-hour MA

- Gold bulls are stepping in and accumulation following the hourly bearish impulse is in play.

- US dollar remains firm but US 2-year yields are topping out. A correction to $1,818 is eyed for the sessions ahead.

At $1,813.56, gold, XAU/USD, is attempting to correct the New York session's sell-off from $1,820 and has eyes to $1,1818 within an otherwise bullish trend as determined by the 200 moving average. The US dollar strength has, until now, undermined the performance of the bulls but despite the fresh highs in the greenback, gold is robust.

The 2-year US Treasury yield is slowing up which could be helping to support gold prices but overnight, the benchmark US Treasury yields jumped to two-year highs and major equity market indexes dropped more than 1% on Tuesday. Traders have braced for the Federal Reserve to be more aggressive in tightening monetary policy to combat inflationary pressures.

Consequently, the US dollar hit a six-day high following the jump in Treasury yields. The US 10-year yield also hit a two-year peak of 1.866% overnight. In line with Treasury yields, the US dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

For the remaining five business days, there are no Fed speakers until Chair Powell’s post-FOMC decision press conference on January 26. ''Given this way US yields are moving, it’s clear that the Fed’s full-court press last week made a significant impression on the bond market,'' analysts at Brown Brothers Harriman explained.

''We fully expect a hawkish hold next week that sets up liftoff at the March 15-16 meeting. WIRP suggests a hike then is now fully priced in, followed by hikes in June, September, and December. The expected terminal Fed Funds rates are also starting to move towards 2.0%, which is a key part of the market repricing,'' the analysts added and noted that the equity markets are finally getting the message.

The Dow Jones Industrial Average sank by over 1.9% to 35,262 and the S&P 500 dropped 1.9% to 4,569.82. The Nasdaq Composite slumped 2.31% to 145,238. All sectors were in the red.

Meanwhile, gold trend-follower positioning is also topping out, leaving fewer marginal buyers in precious metals to offset the aggressive rise in rates, analysts at TD Securities explained.

''As the market continues to pencil in additional Fed rate hikes, with a full 4 hikes priced for 2022 and a near-certain March rate hike priced, precious metals appear vulnerable to a consolidation.''

Gold technical analysis

An interesting development is taking place on the lower time frames in gold for which could equate to a short term opportunity:

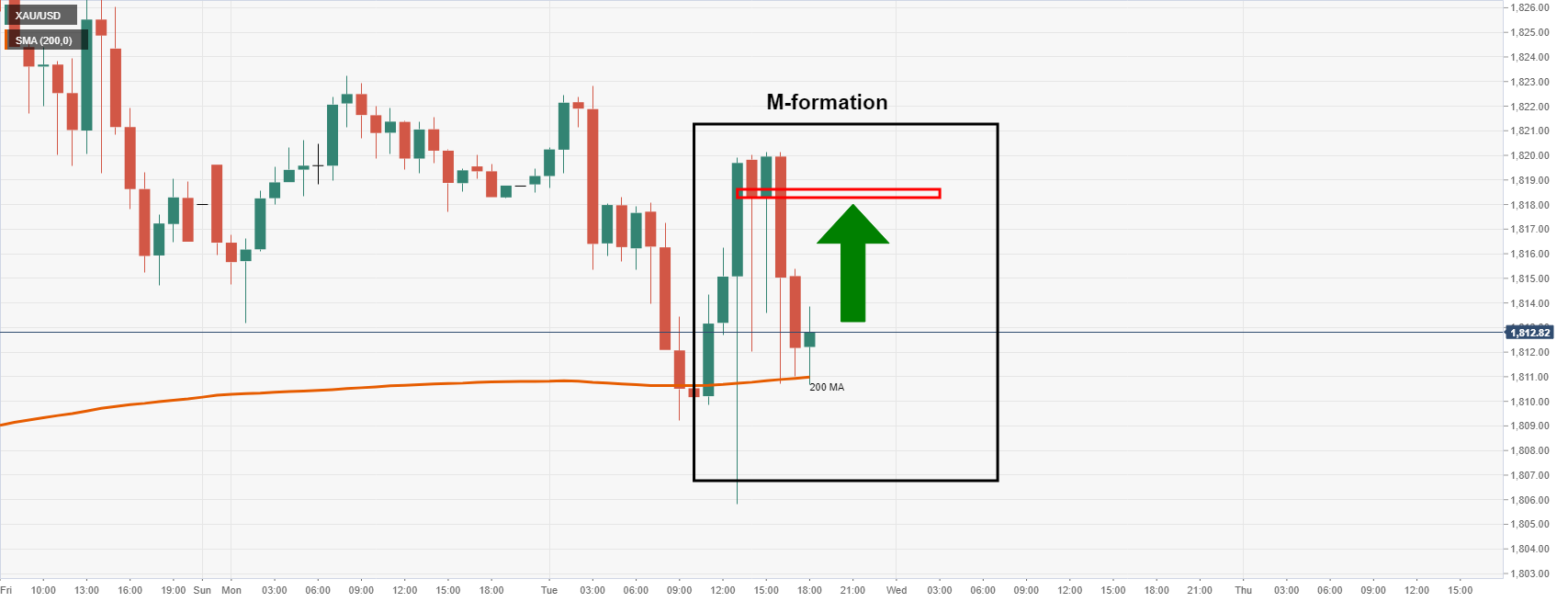

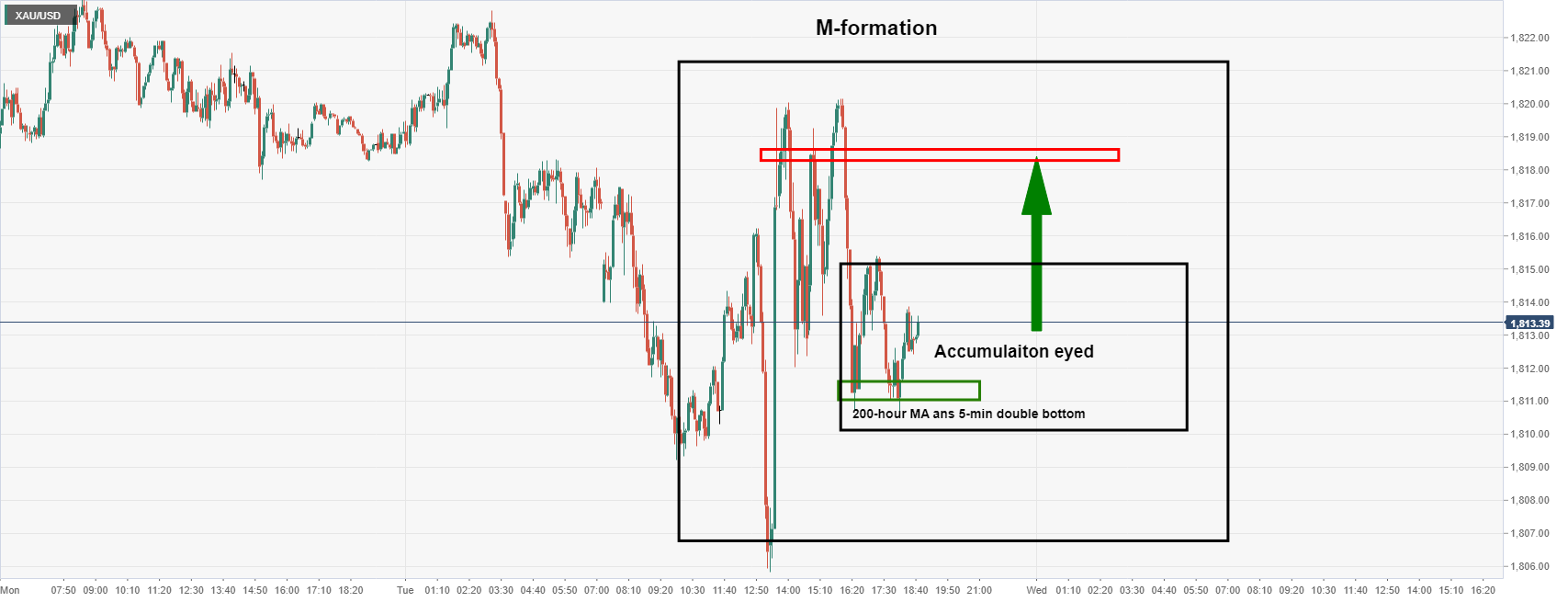

The price is already holding in bullish territory as per the 200-hour moving average. The M-formation is a reversion pattern that has a high completion rate. The price is often drawn in by the neckline of the formation, in this case, this comes in at $1,818.

Traders can take advantage of the lower time frames, such as the five-min chart, and monitor for accumulation and an optimal area to buy into what could turn out to be a correction of the hourly bearish impulse:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.