- Analytics

- News and Tools

- Market News

- EUR/NOK extends the consolidation below 10.0000

EUR/NOK extends the consolidation below 10.0000

- EUR/NOK trades on a choppy fashion so far this week.

- The Norges Bank left the repo rate unchanged at 0.50%.

- The central bank signalled an interest rate hike in March.

EUR/NOK alternates gains with losses so far this week in the area just below the psychological 10.0000 mark.

EUR/NOK muted on NB decision, looks to oil

EUR/USD resumes the upside following Wednesday’s decline after the Norges Bank left the policy rate unchanged at 0.50% at its meeting on Thursday.

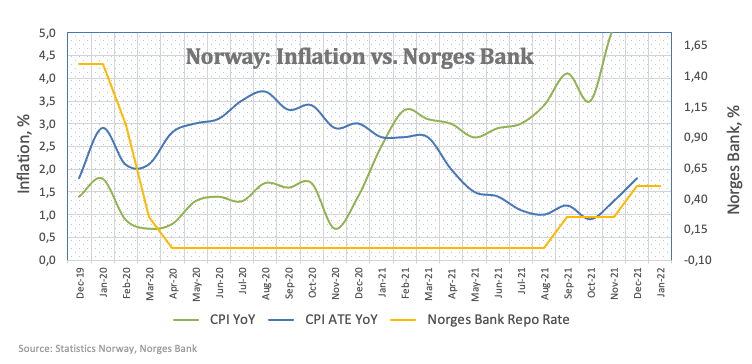

Indeed, the Scandinavian central bank matched estimates on Thursday although it reiterated its intention to hike the key rate at the March event. The Norges Bank justified the decision on the solid performance of the Norwegian fundamentals and noted that the elevated underlying inflation is now approaching the bank’s target.

The bank also noted that there is still uncertainty surrounding the progress of the omicron pandemic, while the Committee expressed its concerns over the potential increase in prices and wages stemming from the supply disruptions and price pressures overseas.

Despite prices of the barrel of the European benchmark Brent crude rose sharply since mid-December, NOK failed to appreciate in an equally (or even close) pace during the same period.

EUR/NOK significant levels

As of writing the cross is gaining 0.18% at 9.9777 and faces the next resistance at 10.0443 (55-day SMA) followed by 10.0782 (2022 high Jan.6) and then 10.1181 (200-day SMA). On the other hand, a breach of 9.9018 (2022 low Jan.13) would open the door to 9.8383 (low Nov.17 2021) and finally 9.8166 (low Nov.1 2021).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.