- Analytics

- News and Tools

- Market News

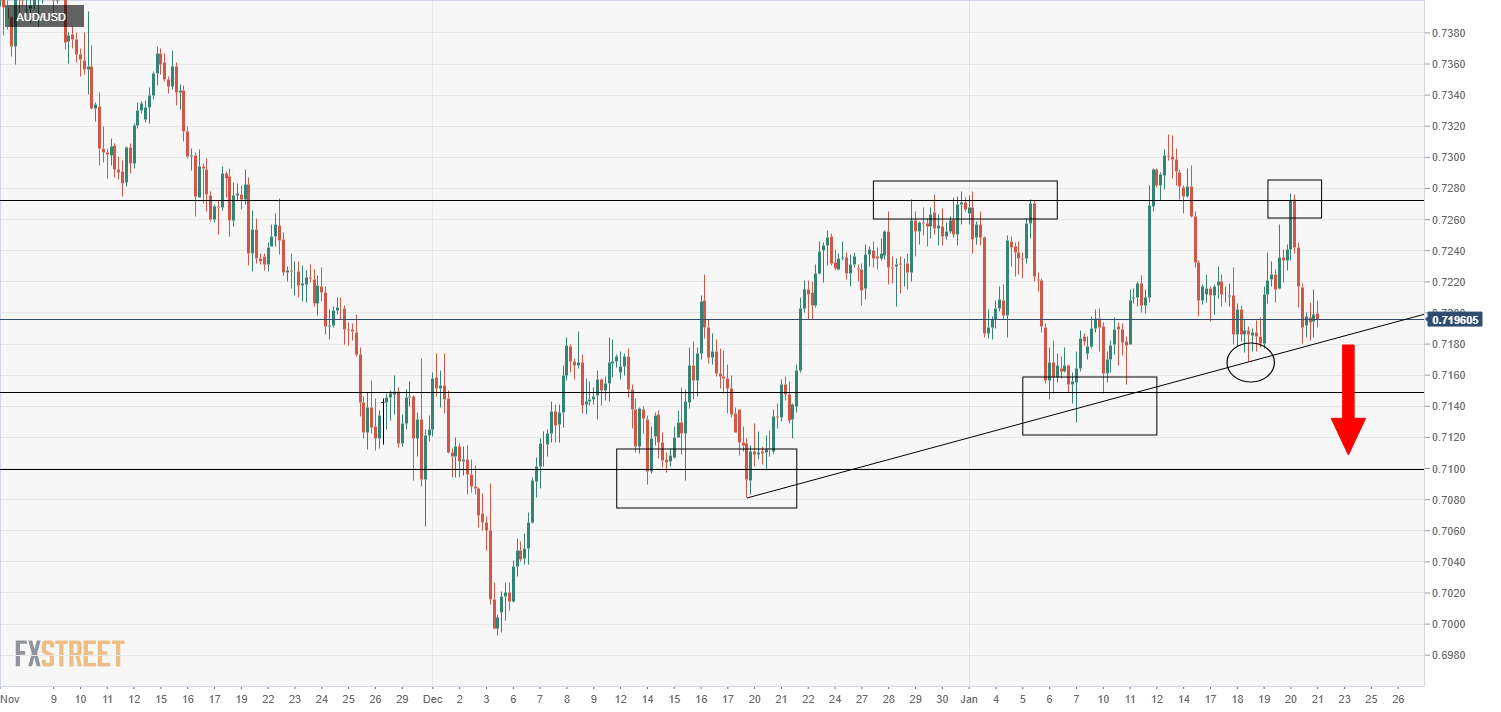

- AUD/USD consolidates close to 0.7200 level as risk-off flows weigh, but key uptrend still offering support

AUD/USD consolidates close to 0.7200 level as risk-off flows weigh, but key uptrend still offering support

- AUD/USD is currently trading close to the 0.7200 level, as downbeat global risk appetite weighs on the Aussie.

- For now, a key long-term uptrend from mid-December continues to offer support.

AUD/USD has consolidated close to 0.7200 and above a key long-term uptrend during Friday’s US session, after pulling back sharply from Thursday’s highs in the 0.7270s amid a downturn in global risk appetite. Traders seemed reluctant to force a bearish breakout below the upwards trendline that has supported the price action since mid-December this close to the weekend. Any push lower may have to wait until next week when more US equity earnings releases and what is likely to be a very hawkish Fed meeting risk putting US (and global) equities under further selling pressure.

A break below the key long-term uptrend would open the door to a test of support in the 0.7150 area and then perhaps a test of the annual lows around 0.7100. At current levels jus below the big 0.7200 figure, AUD/USD trades lower by about 0.2% on the week, as a broadly stronger dollar and weakness in risk assets in the latter half of the week outweighed earlier strength related to strong Australian economic data. Though this week’s labour market report does suggest a strong likelihood that the RBA axes its QE programme next month and brings forward rate hike guidance to allow for lift-off in 2022, the meeting remains some weeks away. Whilst next week’s Australia Q4 Consumer Price Inflation report could further spur hawkish RBA bets to the benefit of the Aussie, AUD/USD remains vulnerable to Fed-related USD flows and risk appetite.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.