- Analytics

- News and Tools

- Market News

- EUR/USD: Fed's relatively dovish statement fails to move the needle out of familiar territories

EUR/USD: Fed's relatively dovish statement fails to move the needle out of familiar territories

- The Fed disappoints the US dollar bulls with a benign outcome in the statement.

- EUR/USD sits around pre-event levels awaiting Fed's chair Powell.

The Federal Open Market Committee's two-day meeting has concluded on Wednesday and the statement has been released along with the Fed's interest rate decision in a highly anticipated event for financial markets.

Markets were expecting the Fed to give guidance on asset purchases that were expected to conclude in March. However, traders were looking for hints around the starting point for QT or "sooner" and "faster" on hikes.

Fed's statement, key takeaways

A rather mixed and fairly dovish statement ticked some of the boxes as follows:

As expected, the benchmark interest rate was unchanged; The Target Range stands at 0.00% - 0.25% - Interest Rate on Excess Reserves is also unchanged at 0.15%.

There were no mentions of early rate hikes, let alone a 50bp hike (which some analysts have been expecting).

QE is not indicated to end early either and that the balance sheet shrinking would start after rate hikes commence.

The Fed has warned that soon it will be appropriate to raise rates.

The Fed has stated that both the economy/employment have strengthened and that jobs gains are solid.

"Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses," is an unchanged statement that indicates we are no closer to lift off than of the prior meeting.

Subsequent to this statement, Fed's funds futures are looking for four rate hikes for this year.

EUR/USD: Reaction and technical analysis

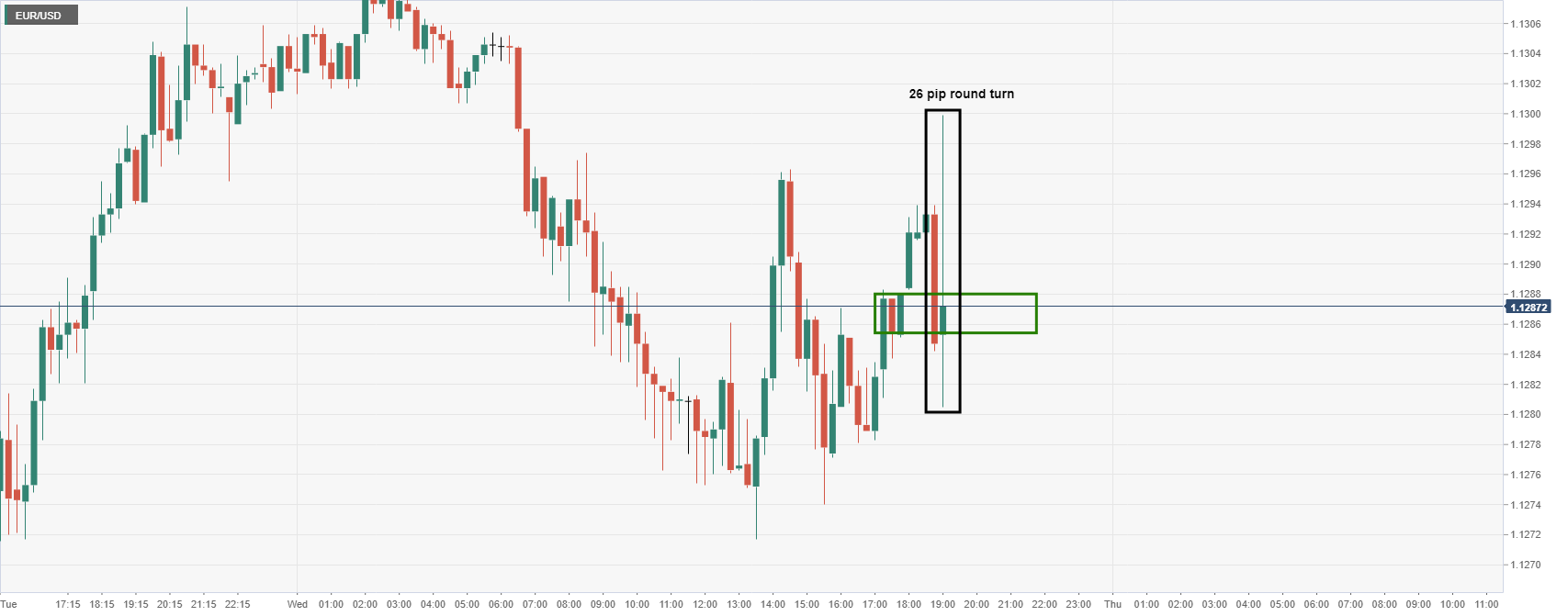

Following the Fed's statement, EUR/USD has made a round trip of between 26 pips and is pretty much stationed to where it was before the release:

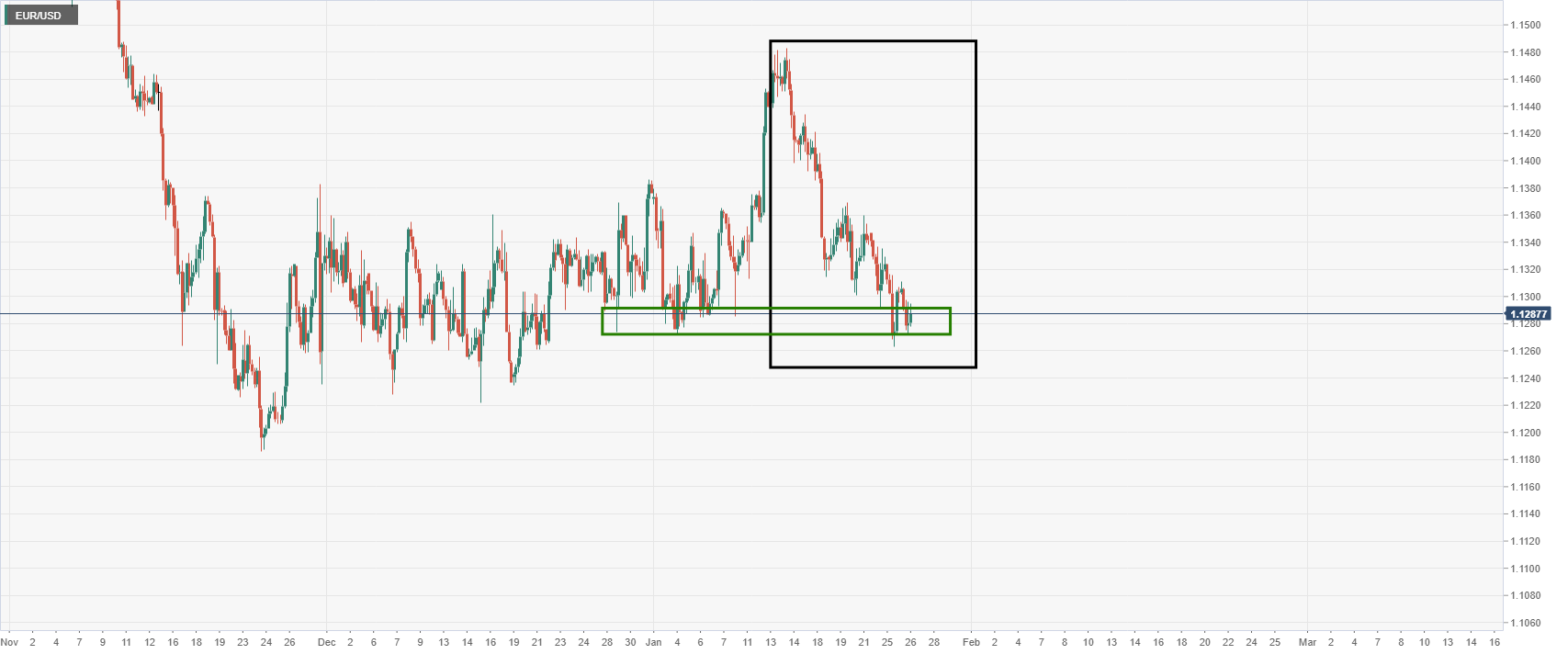

Meanwhile, the euro recently denied bulls an extension to and through the 1.15 psychological level when reaccumulation failed to play out following the breakout of the late 1.13 area near 1.1390:

Instead, the price plummeted back into the consolidation area, weighed heavily by risk-off markets due to geopolitical angst over tensions between Russia and the Ukraine:

Given that the statement is leaning slightly dovish compared to some of the more hawkish expectations in the markets, the US dollar could continue to struggle in the event that geopolitical angst abates. The euro would be expected to benefit in a pick up of risk apatite in global equities as well. EUR/USD bulls will need to get back above 1.13 the figure though...

Meanwhile, the markets will now look for clarity from the Fed's chair, Jerome Powell. His comments could provide volatility for EUR/USD traders:

Watch Live: Fed's chair, Jerome Powell

Jerome Powell, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 19:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.