- Analytics

- News and Tools

- Market News

- EUR/USD recovering from the trip towards weekly lows

EUR/USD recovering from the trip towards weekly lows

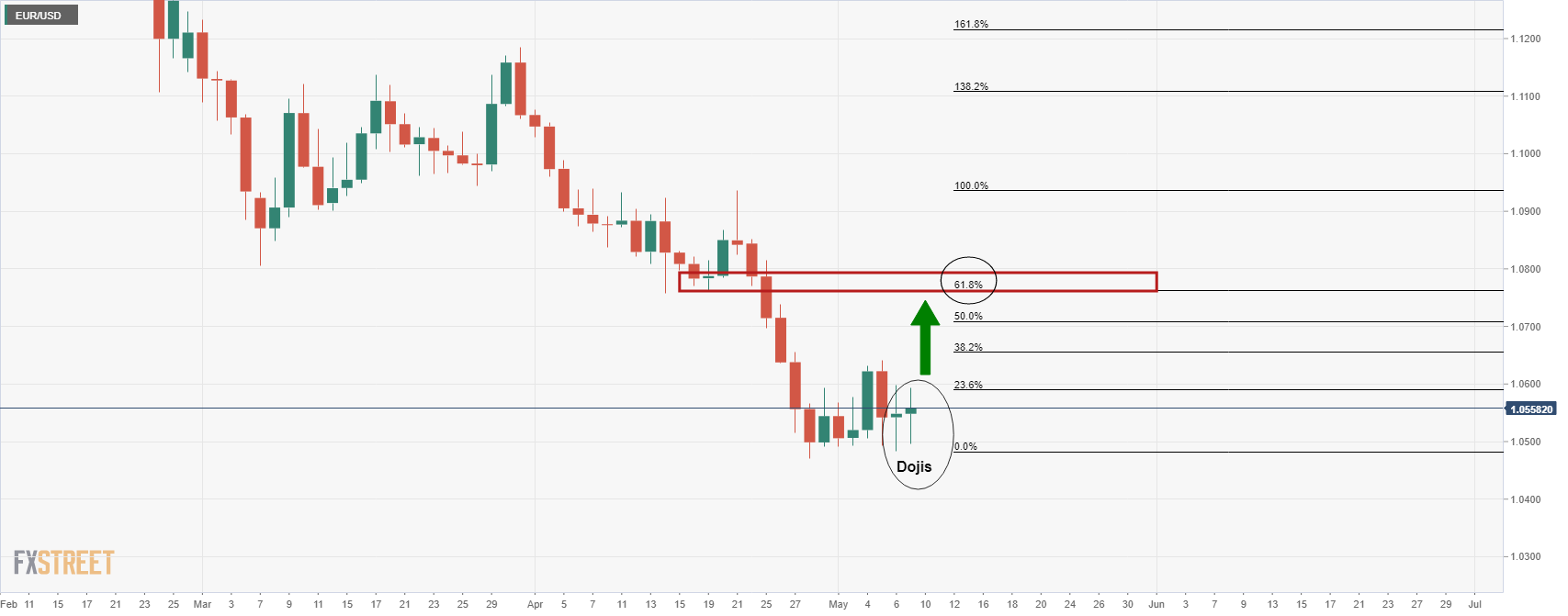

- Bullish tones emerging on the EUR/USD daily and weekly charts.

- Bulls on the lookout for a bullish engulfing close in the week that follows the Doji close of last week.

EUR/USD is back on the bid in late midday afternoon on Wall Street, trading 0.23% higher to 1.0570 at the time of writing. The pair was under pressure from the peak of the day at 1.0592 but it held above the 1.0495 lows.

There is little in the way that is driving the price other than ebbs and flows within an hourly consolidation between a 200 pip range, or thereabouts. More broadly, risk sentiment has weighed heavily on the euro stemming from the Ukraine crisis and now with the Chinese COVID risks and negative contagion ramifications for global growth.

Overnight, APAC stocks declined amid recent upside in yields and as participants digested a slowdown in Chinese trade data. ''Activity is grinding to a halt under Xi’s COVID Zero policy. Despite pledges to stimulate the economy, the measures announced so far have been minimal,'' analysts at Brown Brothers Harriman explained.

In the currency space, DXY remained firm against G10s across the board as equity futures pointed to soft open in European markets. The Federal Reserve's path to a series of interest rate increases has weighed on sentiment in the face of a potential global recession and given the proximity to the Ukraine crisis, the eurozone's economy is under scrutiny. Additionally, pressure on the EU to announce an energy embargo on Russia has raised questions about the economic cost to the region.

Consequently, EUR/USD sank to 1.04955 in Europe but US yields came under pressure after the benchmark 10-year note hit fresh 3-1/2 year highs as traders awaited consumer price data and the auction of $103 billion in new government debt later this week.

Ten-year Treasury yields fell 4.1 basis points to 3.083%, after hitting 3.203%, a level last seen in November 2018. The short-covering in the bond market has consequently seen the early EUR/USD dip below 1.0520 was bought and the single currency neared 1.0600.

EUR/USD technical analysis

Technically, upside risks could be emerging with the daily dojis at weekly support.

EUR/USD weekly chart

However, for a convincing bullish outcome, bulls will be on the lookout for a bullish engulfing close in the week that follows the Doji close of last week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.