- Analytics

- News and Tools

- Market News

- EUR/USD: Bulls remain hungry with 1.0500 in sight

EUR/USD: Bulls remain hungry with 1.0500 in sight

- EUR/USD extends the march higher near 1.0500.

- The risk rally continues to weigh on the dollar.

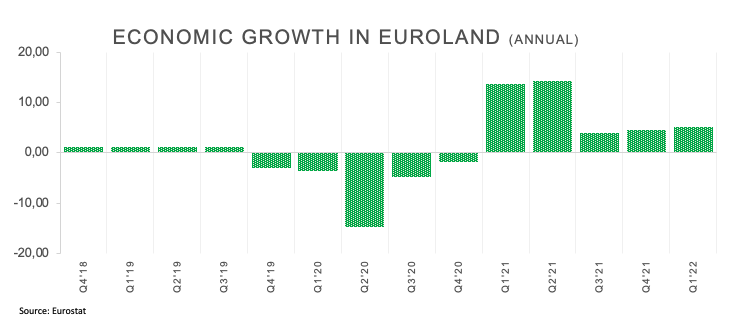

- Another revision of EMU Q1 GDP surprises to the upside.

The risk rally remains unabated so far and lifts EUR/USD to fresh 3-day highs in the boundaries of the 1.0500 mark on Tuesday.

EUR/USD now looks to 1.0500 ahead of Lagarde, Powell

EUR/USD prolongs its weekly recovery and adds to the current bounce off Friday’s 2022 lows around 1.0350 against the backdrop of quite a moderate improvement in the risk-associated complex across the board.

Extra gains in the pair comes in line with the recovery in US yields along the curve and another attempt of the German 10y Bund yields to revisit the key 1.00% barrier.

In the docket, further support for the European currency comes after another revision of Q1 EMU GDP now sees the bloc expanding 0.3% inter-quarter and 5.1% from a year earlier. Later in the session, Chairwoman C.Lagarde will speak at an event in Germany.

In the NA session, the focus of attention will be the speech by Chair Powell seconded by US Retail Sales, Industrial Production, Business Inventories and the NAHB Index.

In addition, FOMC’s Bullard, Harker and Mester are all due to speak.

What to look for around EUR

EUR/USD pushes higher and approaches the 1.0500 mark on the back of the persistent risk rally. Despite the pair removed some downside pressure, the broader outlook for the single currency remains entrenched in the negative territory for the time being. As usual, price action in spot should reflect dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by firmer speculation the ECB could raise rates at some point in the summer, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: EMU Flash GDP Growth Rate, ECB Lagarde (Tuesday) – EMU Final Inflation Rate (Wednesday) – ECB Monetary Policy Meeting Accounts (Thursday) – Germany Producer Prices, EMU Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro area. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is up 0.46% at 1.0478 and faces the next hurdle at 1.0492 (weekly high May 17) seconded by 1.0641 (weekly high May 5) and finally 1.0936 (weekly high April 21). On the other hand, the breach of 1.0348 (2022 low May 13) would target 1.0340 (2017 low January 3 2017) en route to 1.0300 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.