- Analytics

- News and Tools

- Market News

- When is the UK inflation and how could it affect GBP/USD?

When is the UK inflation and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for April month is due early on Wednesday at 06:00 GMT. Given the recently strong employment data, coupled with the increased odds of the Bank of England’s (BOE) faster/heavier rate hike trajectory, today’s data will be watched closely by the GBP/USD traders.

The headline CPI inflation is expected to refresh a 30-year high with a 9.1% YoY figure versus 7.0% prior while the Core CPI, which excludes volatile food and energy items, is likely to rise to 6.2% YoY during the stated month, from 5.7% previous readouts. Talking about the monthly figures, the CPI could increase to 2.6% versus 1.1% prior.

It’s worth noting that the recent pressure on wage prices and upbeat jobs report also highlight the Producer Price Index (PPI) as an important catalyst for the immediate GBP/USD direction. That being said, the PPI Core Output YoY may rise from 12.0% to 12.7% on a non-seasonally adjusted basis whereas the monthly prints may ease to 1.6% versus 2.0% prior. Furthermore, the Retail Price Index (RPI) is also on the table for release, expected to rise to 11.1% YoY from 9.0% prior while the MoM prints could inflate to 3.4% from 1.0% in previous readings.

In this regard, FXStreet’s Yohay Elam said,

All in all, a 9.1% annual increase in inflation is nothing to be cheerful about, and it supports further rate hikes by the Bank of England. However, policymakers have limited scope to act due to the nature of these price pressures. The old lady’s hands are tied.

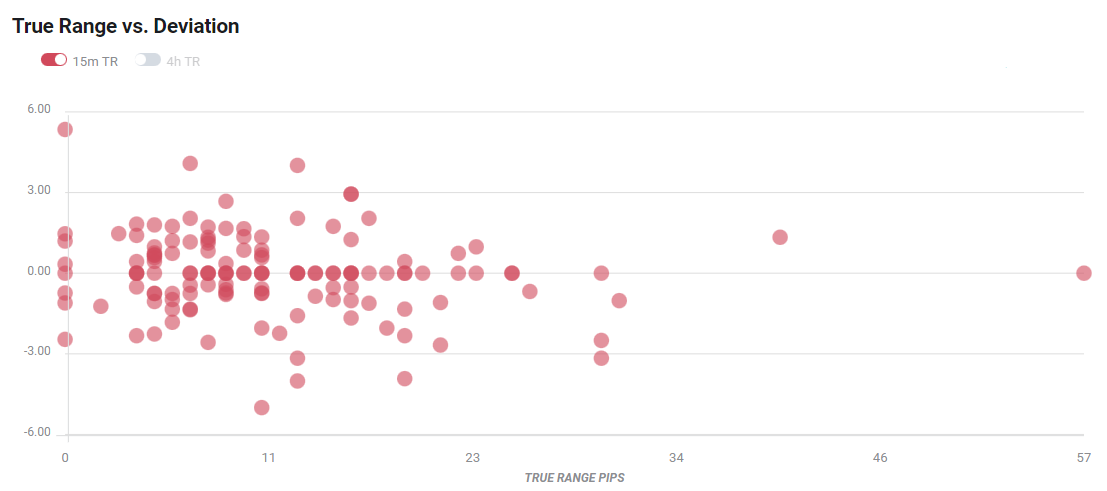

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could it affect GBP/USD?

GBP/USD remains pressured around the intraday low near 1.2470, snapping a three-day rebound from a two-year high, ahead of the key UK inflation data. The cable pair’s latest weakness could be linked to the US dollar’s rebound amid a risk-off mood and the hawkish Fedspeak. However, increasing odds of the Bank of England’s (BOE) faster/heavier rate hikes challenge the quote’s downside momentum.

That said, upbeat inflation data, which is more likely, can help the GBP/USD extend the latest advances for the time being. However, Treasury bond yields and GILTS are also likely to play an important role in determining short-term cable moves, which in turn suggests a pullback towards the recently flashed multi-month low.

Technically, the 20-DMA level near 1.2500 tests the GBP/USD buyers but a clear break of the one-month-old descending trend line, around 1.2250 at the latest, join the firmer RSI line to underpin bullish bias. Additionally, two-week-old horizontal support around 1.2400 could restrict the short-term pullback.

Key notes

UK CPI Preview: Inflation “apocalypse” priced in, GBP/USD has room to fall

GBP/USD Price Analysis: 20-DMA probes bulls near 1.2500 ahead of UK inflation

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.