- Analytics

- News and Tools

- Market News

- USD/TRY gathers steam and prints 2022 highs around 16.50

USD/TRY gathers steam and prints 2022 highs around 16.50

- USD/TRY advances to new peaks around 16.50.

- The lira comes under pressure following inflation data.

- US Nonfarm Payrolls comes next in the calendar.

Further depreciation of the Turkish currency lifts USD/TRY to fresh YTD tops around 16.50 on Friday.

USD/TRY up post-CPI, looks to US NFP

USD/TRY advances uninterruptedly since Monday and its seems to have accelerated the upside after inflation figures ran at the fastest pace in the last 24 years in May.

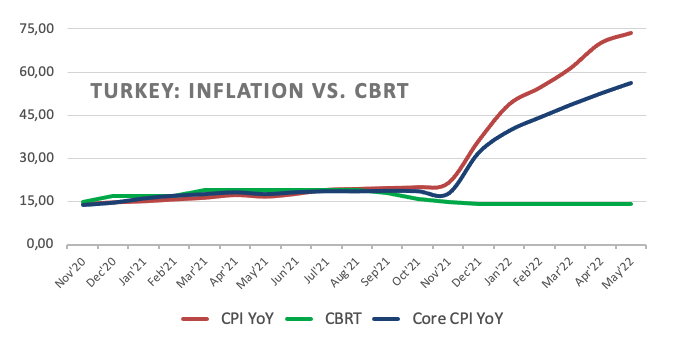

Indeed, inflation results showed the CPI rise at a monthly 2.98% in May and 73.50% vs. the same month of 2021. In addition, Producer Prices gained 8.76% inter-month and 132.16% from a year earlier.

If (and it is a big “if”) there is a silver lining following the CPI release, is that consumer prices rose less than initially estimated and at a slower pace than in previous months, hinting at the idea that inflation pressures might be running out of steam.

The deteriorated geopolitical landscape following the Russian invasion of Ukraine in combination with soaring energy prices and the depreciation of the lira were behind the May’s uptick in the CPI.

On another front, the pair should remain focused on the upcoming publication of the US Nonfarm Payrolls regarding the dollar’s near-term price action.

What to look for around TRY

USD/TRY keeps the underlying upside bias well and sound and looks to consolidate the recent surpass of the 16.00 yardstick for the first time since late December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Inflation Rate, Producer Prices (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.27% at 16.5025 and faces the next up barrier at 16.5029 (2022 high May 26) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the flip side, a breach of 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.