- Analytics

- News and Tools

- Market News

- RBA Statement: RBA jacks up its forecasts for inflation

RBA Statement: RBA jacks up its forecasts for inflation

The Reserve Bank of Australia's Monetary Policy Statement is out as follows offering updates in this quarterly release:

Reuters reports that Australia's central bank on Friday warned inflation was heading to three-decade highs requiring further hikes in interest rates that would slow growth sharply, making it tough to keep the economy on an "even keel".

''In its quarterly Statement on Monetary Policy, the Reserve Bank of Australia (RBA) jacked up its forecasts for inflation, downgraded the outlook for growth and foreshadowed an eventual rise in unemployment.

Yet even with further increases in rates, inflation was not expected to return to the top of its 2-3% target range until the end of 2024, pointing to a long period of pain ahead.''

"It is seeking to do this in a way that keeps the economy on an even keel," said RBA Governor Philip Lowe in the introduction to the 66-page statement.

"The path to achieve this balance is a narrow one and subject to considerable uncertainty."

Key notes

- Ready to do what is necessary to bring inflation back to 2-3% band.

- Seeking to restrain inflation while keeping economy on an even keel, this is a narrow path.

- Board expects to take further steps to normalise policy, but not on a pre-set path.

- Rate rises necessary to create more sustainable balance between demand and supply.

- Risk that high inflation gets built into wage and price setting behaviour.

- Inflation broad based but medium, long-term inflation expectations remain anchored.

- Rising cost of living, higher rates and falling house prices to weigh on economy.

- RBA downgrades outlook for economic growth, revises inflation forecasts sharply higher.

- Forecasts based on analyst, market pricing assume rates reach 3% by end 2022, decline a little by end of 2024.

- CPI inflation seen at 7.75% end 2022, 4.25% end 2023 and 3% end 2024.

- Trimmed mean inflation seen at 6% end 2022, 3.75% end 2023, 3% end 2024.

- GDP growth seen at 3.25% end 2022, 1.75% end of 2023, 2024.

- Unemployment seen at 3.25% end 2022, 3.5% end 2023, 4% end 2024.

- Wage price index seen at 3.0% end 2022, 3.6% end 2023, 3.9% end 2024.

- Around 60% of firms in liaison program expect wages to be high over year ahead.

- Many employers report they intend to increase headcount further but finding it hard to get workers.

- Risks to the global outlook are skewed to the downside given synchronised policy tightening.

AUD/USD update

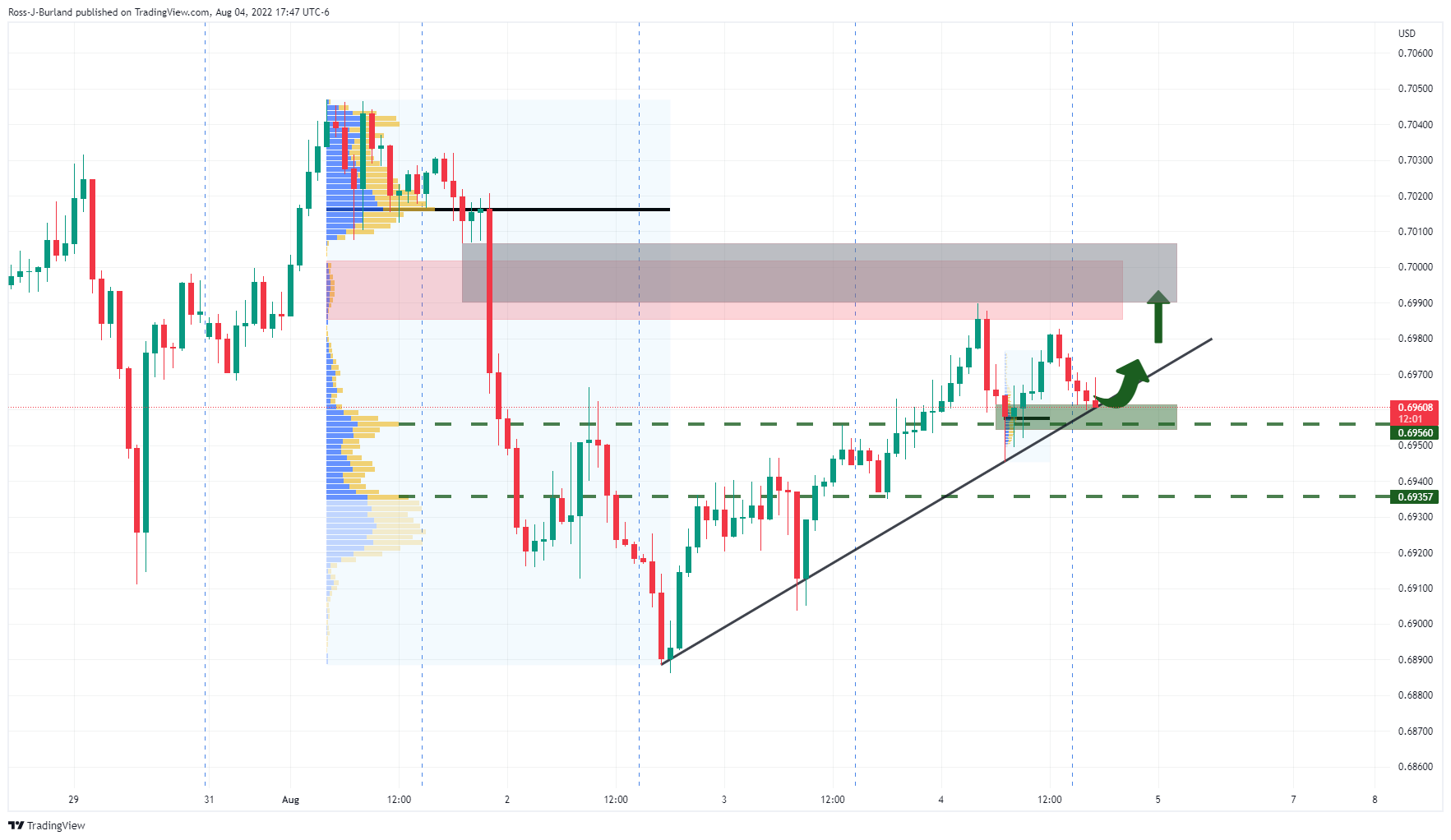

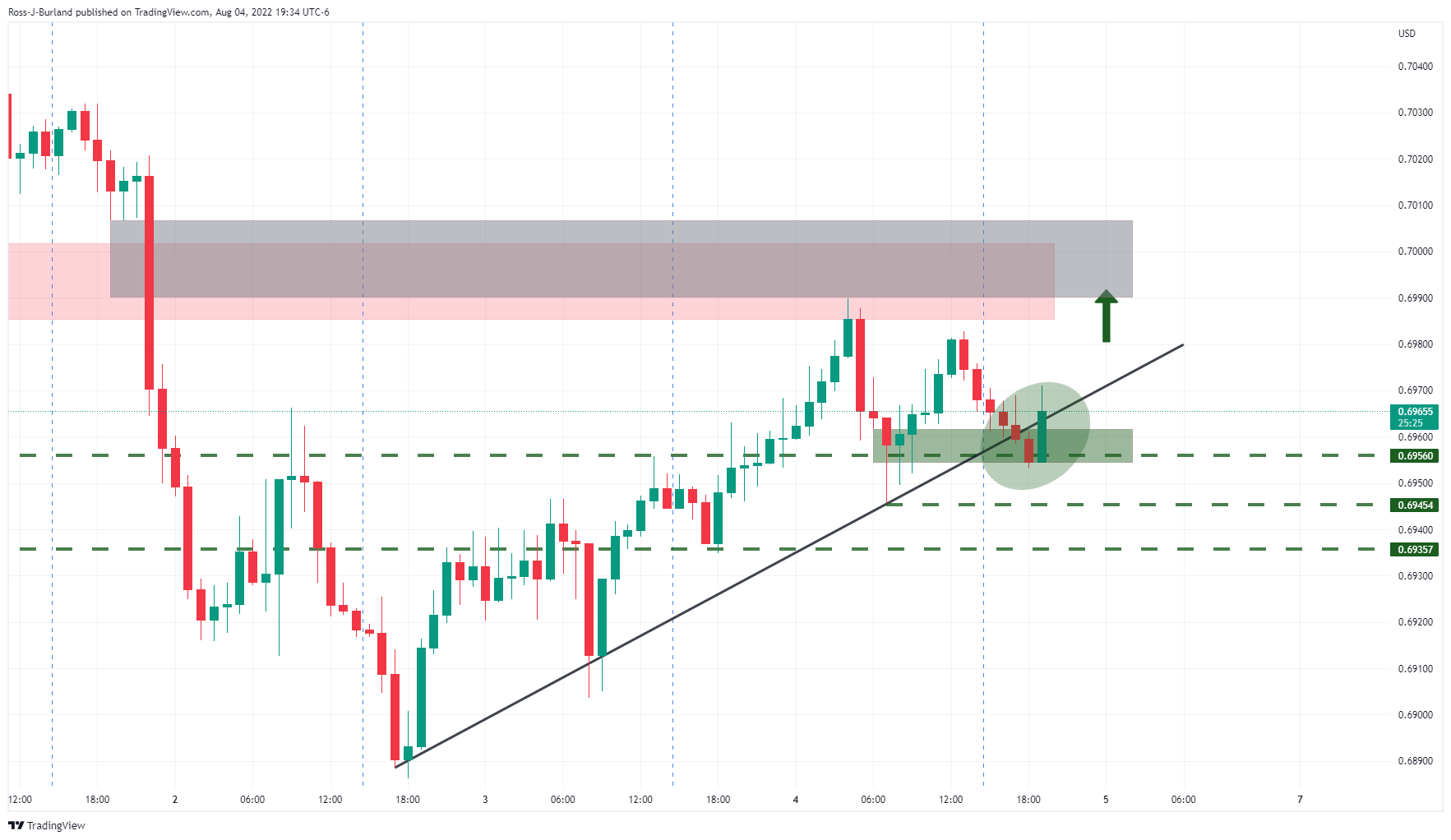

As per the pre-event technical analysis, AUD/USD Price Analysis: Bulls and bears battle it out at critical hourly support, the bulls are moving in at a key hourly level of support:

Update...

About the RBA Monetary Policy Statement

The RBA Monetary Policy Statement is released by the Reserve bank of Australia reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. It is considered as a clear guide to the future RBA interest rate policy. Any changes in this report affect the AUD volatility. If the RBA statement shows a hawkish outlook, that is seen as positive (or bullish) for the AUD, while a dovish outlook is seen as negatvie (or bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.