- Analytics

- News and Tools

- Market News

- USD/JPY bears move in on a critical daily support area ahead of US CPI

USD/JPY bears move in on a critical daily support area ahead of US CPI

- USD/JPY bulls could be about to move back in on the daily chart.

- US CPI will be key this week, with eyes on US yields.

USD/JPY has been in recovery mode for the best part of a week, but it came up against resistance following last week’s strong July labour market data in the US. On Monday, the pair is ending the New York session flat for the day at around 135 the figure having ranged between 134.34 and 135.58.

Analysts at ANZ Bank said that despite clear signs of a moderation in Gross Domestic Product growth globally, ''the slower growth and less accommodative monetary environment have yet to show up in increased labour market slack. Until clear evidence emerges that both labour markets and core inflation are moderating, central banks will remain dedicated to getting inflation down, a bias that points to the potential for further large incremental rate hikes.''

The focus for the week ahead will be the July US inflation data in Consumer Price Index that is expected to confirm core inflation (ex-food & energy) rose 0.5% MoM, up 6.1% YoY (5.9%). ''That is way too high for the Fed amid a tightening labour market. The priority of reducing inflation in order to underpin the expansion in domestic demand and sustainable jobs growth will ring loud and clear from the August 25-27 Jackson Hole symposium,'' analysts at ANZ Bank explained.

The analysts at ANZ Bank also said that before the Federal Open Market Committee meets again in September, it will also have the August CPI and labour market data. ''Unless that moderates meaningfully from July’s strong gains, the risks are significant that the Fed may need to hike rates by another 75bps at the 20-21 September meeting.''

Meanwhile, from a positioning perspective, JPY net short positions fell according to the latest CFTC data. In the spot market the JPY had recovered some ground vs the USD as US yields dropped back. ''The stronger than expected US July payrolls report, however, has subsequently caused US 2-year yields to push higher and this has lent fresh support to USD/JPY in the spot market,'' analysts at Rabobank explained.

USD/JPY technical analysis

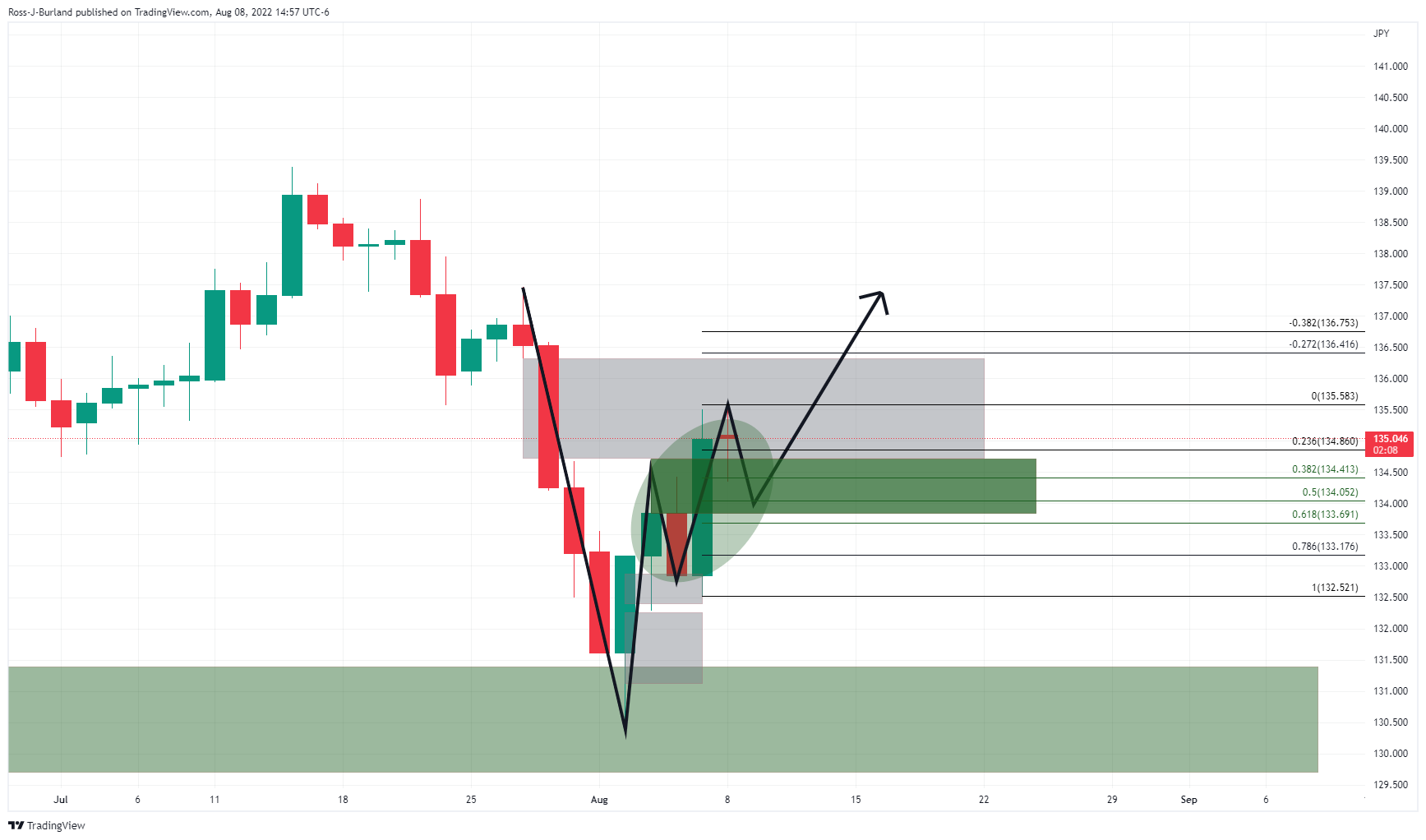

As per the prior analysis, USD/JPY Price Analysis: Bears are lurking within a strong bullish trend, the price moved in to correct the bearish impulse:

(Prior daily chart, above, prior H4 chart, below)

USD/JPY live market

As illustrated, the price indeed moved in towards the targetted area of mitigation as per the prior analysis forecasted and explained. At this juncture, there are prospects of a correction of Friday's bullish candle into the neckline of the W-formation as follows:

The upside prospects will send on the performance of US yields, but there are stacking up for a bullish continuation in the 10-year yields according to the recovery attempts within the broadening formation as follows:

The yield has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields, a weight for gold prices.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.