- Analytics

- News and Tools

- Market News

- AUD/USD now in limbo ahead of critical Aussie jobs data

AUD/USD now in limbo ahead of critical Aussie jobs data

- AUD/USD came under pressure again despite benign FOMC minutes.

- There could be some sideways action ahead of Thursday's Aussie jobs data.

- 0.6980 eyed as a resistance area and 0.7020 thereafter. Bears will need to break 0.6910 daily lows ahead of 0.6870.

AUD/USD is trading down 1.2% on the day despite a benign set of minutes of the Federal Open Market Committee (FOMC) policy decision that took place over the July 26-27 policy meeting. There was a knee-jerk reaction to the minutes that took the value of the US dollar lower but the dip was bought back shortly afterwards resulting in a turnover in the commodity-fx arena.

At the time of writing, AUD/USD is trading around 0.6937 and has travelled within a 0.6910 and 0.7026 range on the day so far. There was not an explicit message that rate hikes will be as aggressive in Sepement. ''The post-minutes reaction was likely driven by 'many FOMC members' flagging that 'it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation,''' analysts at TD Securities explained.

''This suggested to investors that the pace of rate hikes should slow, which pushed the pricing for a 75bp hike in September from 58% prior to the minutes to 47% and the terminal rate to 3.69% from 3.73% prior to the minutes,'' analysts explained. For that reason, US futures are pricing in a higher probability of a 50 bps hike for Sep after these minutes to around a 60% chance.

As a consequence, the DXY dropped 37 points to 106.385. The 10-year yield was under pressure, dropping 0.8% to 2.888% and well off the 2.919% highs for the day. The 2-year yield dropped by nearly 1.4%. This all enabled the Aussie to rally initially, however, as analysts at TD Securities argued, who believe the dovish reaction to the dated minutes may be unwarranted, ''markets should be taking their cue from hawkish Fed rhetoric in recent weeks rather than the minutes.''

The analysts explained that the Fed also discussed its desire to tighten financial conditions and the tightening that has occurred so far. ''However, financial conditions have recently eased and data has remained strong.''

Meanwhile for the day ahead, Aussie jobs data will be a critical feature of the Asian session. ''July is a seasonally strong month for job gains and we look for the unemployment rate to trend lower. Another strong labour print should give the RBA the assurance that the economy can withstand a cash rate of 3% by end-2022,'' the analysts at TDS said ahead of the data on Thursday.

AUD/USD technical analysis

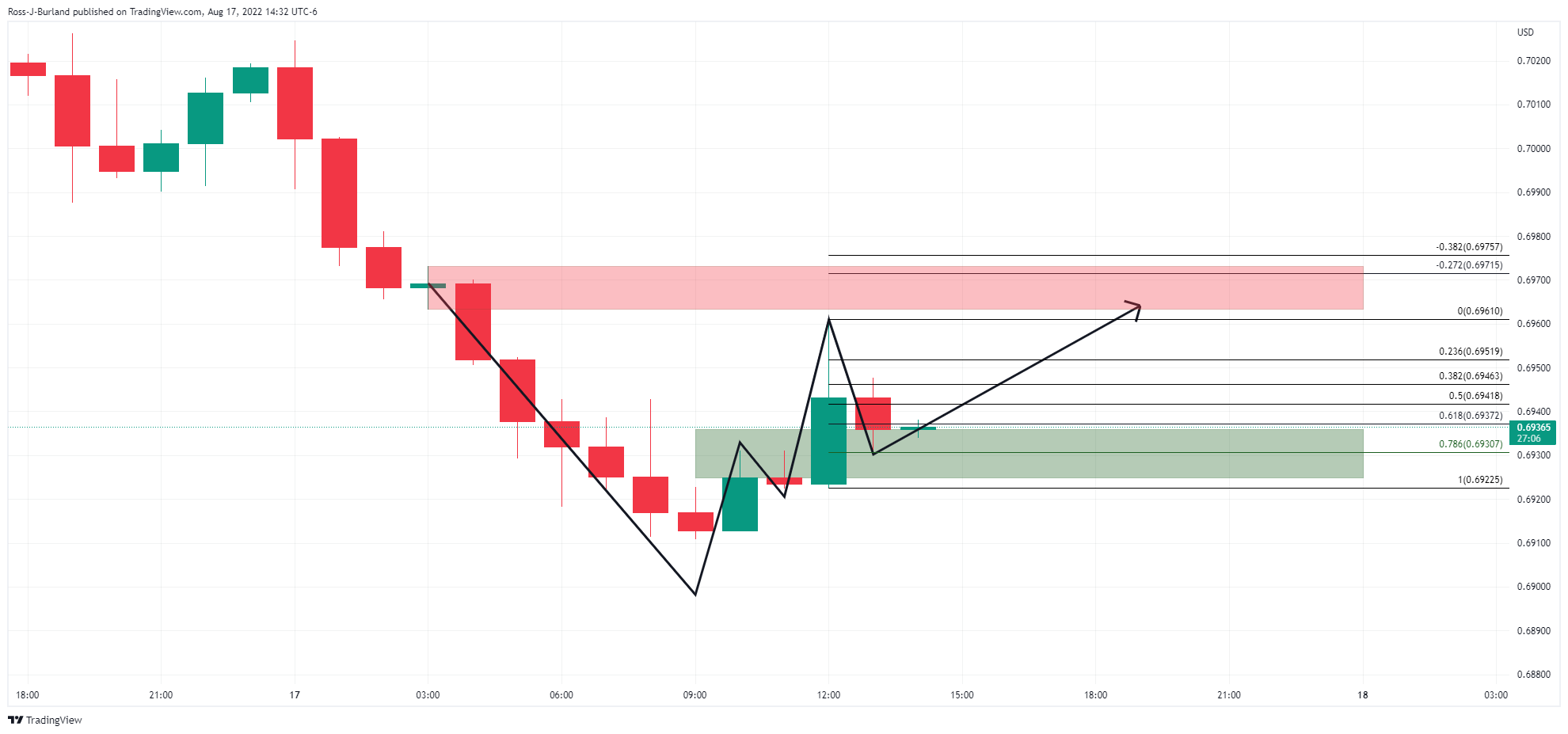

AUD/USD came under pressure again and met the neckline on the W-formation on the hourly chart. This is holding as a support so far with a perfect touch of the 78.6% Fibonacci level. Should this continue to hold, there could be some sideways action ahead of Thursday's data with 0.6980 eyed as a resistance area and 0.7020 thereafter. Bears will need to break 0.6910 daily lows ahead of 0.6870.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.