- Analytics

- News and Tools

- Market News

- Fed's Waller: Will not be head faked by one report

Fed's Waller: Will not be head faked by one report

Federal Reserve Governor Christopher Waller who last week said “we’ve still got a ways to go” before the US central bank stops raising interest rates, despite good news last week on consumer prices, jolting risk appetite, repeats the same hawkish rhetoric on Wednesday.

Waller continues to caution that officials were not close to a pause. He said today that there is still a ways to go on rates and but he is now "more comfortable" with smaller rate increases going forward after recent data showed the pace of price increases slowing.

In remarks prepared for delivery at an Arizona economic conference, Waller said it remains unclear how high the Fed will need to raise interest rates, and that he will not make a final decision about what to do at the Fed's Dec. 13-14 policy meeting until reviewing the rest of the data between now and then.

"I will not be head-faked by one report," Waller said of consumer price data released last week that saw larger-than-expected declines in both headline inflation and a narrower but more closely watched index of "core" prices. "We've seen this movie before."

Reuters reported that he also said the most recent reports were a "positive development" that he hoped would be "the beginning of a meaningful and persistent decline in inflation" back to the Fed's 2% target.

Key notes

After raising rates in atypically large three-quarter point increments at its last four meetings, Waller said that as it stands "the data of the past few weeks have made me more comfortable considering stepping down to a 50-basis-point hike," in December and possibly to smaller quarter-point increases after that.

Waller said signs the economy and wage growth are slowing have added to his sense that Fed policy is beginning to do its job.

He cautioned it was too early to pin down just how high rates may need to go.

"One report does not make a trend. It is way too early to conclude that inflation is headed sustainably down," he said. "Getting inflation to fall meaningfully and persistently toward our 2% target will require increases in the federal funds rate into next year. We still have a ways to go."

US Dollar update

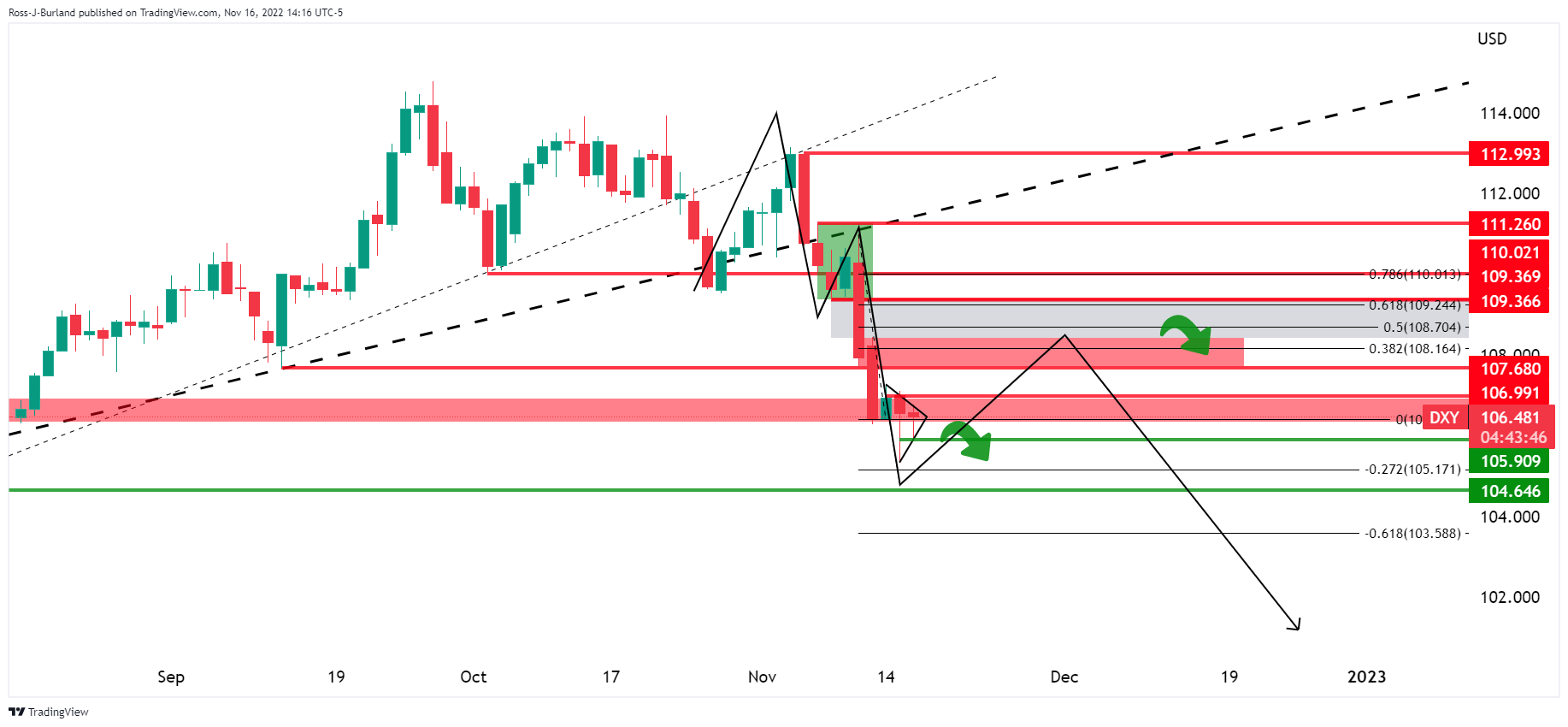

The US dollar index is coiled and could be subject to a breakout to the downside immanently. However, the M-formation is a reversion pattern that brings the risks of a move through current resistance into the Fibonacci scales with the 38.2% ratio as the first target around 108.00.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.