- Analytics

- News and Tools

- Market News

- AUDUSD Price Analysis: Negative divergence triggers a bearish reversal, bears are hopeful below 0.6700

AUDUSD Price Analysis: Negative divergence triggers a bearish reversal, bears are hopeful below 0.6700

- A shift of market sentiment into a negative trajectory has weakened risk-perceived currencies.

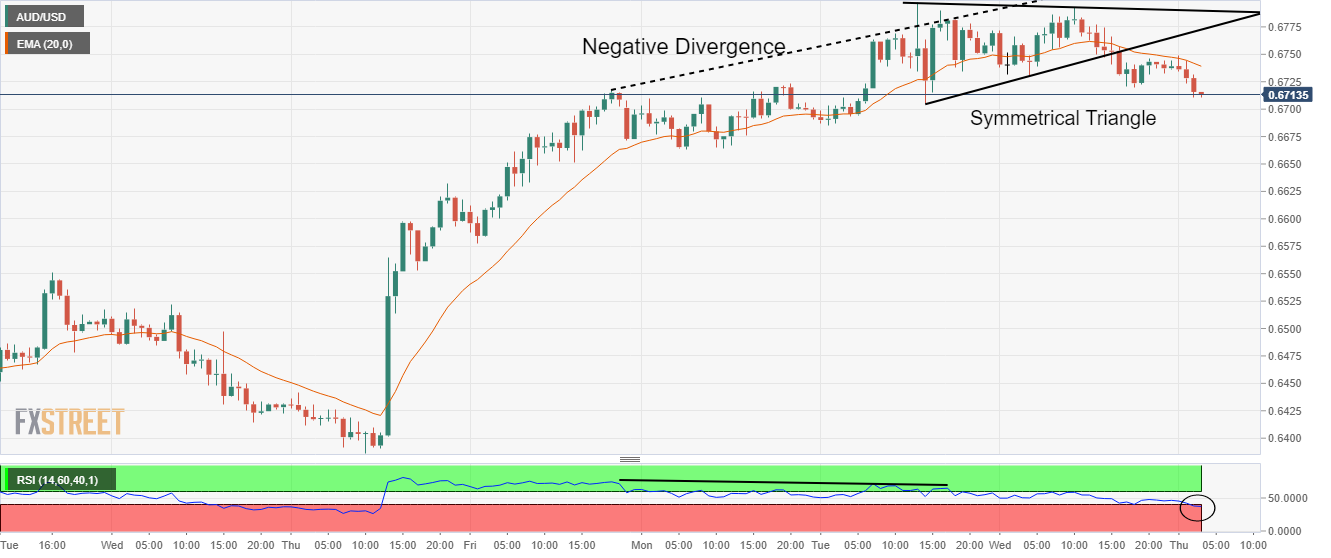

- The breakdown of the symmetrical triangle and activation of negative divergence has underpinned the Greenback.

- The 20-EMA is acting as a major hurdle for the asset.

The AUDUSD pair has delivered a downside break of the consolidation formed in a narrow range of 0.6716-0.6750 in the Tokyo session. The asset has sensed selling pressure as investors’ risk appetite has trimmed dramatically.

A recovery experienced in S&P500 futures in Asia is fading now. Meanwhile, the US dollar index (DXY) is oscillating near its immediate hurdle of 106.60. The 10-year US Treasury yields have also recovered to near 3.73%.

On an hourly scale, the asset has witnessed an expansion in volatility after a downside break of the Symmetrical Triangle formed around Tuesday’s high at 0.6800. Earlier, the major displayed a loss in the upside momentum after a formation of bearish negative divergence. The asset was continuously forming higher highs while the momentum oscillator, Relative Strength Index (RSI) (14) formed a lower high. Also, the RSI (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum has been activated.

The asset has also surrendered the cushion of the 20-period Exponential Moving Average (EMA), which signals that the short-term trend is bearish now.

A decisive move below the round-level support of 0.6700 will rag the asset towards Monday’s low at 0.6663, followed by November 8 high at 0.6550.

On the flip side, the Aussie bulls could regain traction if the asset recaptures Tuesday’s high near 0.6800. An occurrence of the same will drive the asset towards September 13 high around 0.6900 and a psychological resistance of 0.7000.

AUDUSD hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.