- Analytics

- News and Tools

- Market News

- EUR/USD bulls eye a break into 1.0500 but bears are lurking

EUR/USD bulls eye a break into 1.0500 but bears are lurking

- This could be the Euro's final attempt while below 1.0450.

- A breach there, however, opens the risk of a move into the support quarter of the 1.04 area.

- A break of 1.0500 could be significant bullish development with the risk of a move to 1.0600.

EUR/USD was last up 0.1% at 1.0405, and has stuck to a range of between 1.0381 and 1.0448 while US markets are closed on Thursday for Thanksgiving and liquidity will likely be thinner than usual until Asia and Frankfurt crossover on Friday.

The euro held onto gains after the minutes of the European Central Bank's October meeting showed policymakers feared that inflation may be getting entrenched. This leaves the divergence between the Federal Reserve and the ECB thinner and may favour an upside bias for the euro for the medium term. In this regard, The U. Dollar has extended losses on Thursday after the minutes from the Federal Reserve's November meeting supported the view that the Fed will start to relax the pace of rate hikes into smaller increments, starting as soon as the next meeting in mid-December.

The minutes of the Nov. 1-2 meeting showed officials were largely satisfied they could now move in smaller steps, with a 50 basis point rate rise likely next month after four consecutive 75 basis point increases. In other key statements, the minutes showed that a slower pace of rate hikes would better allow the FOMC to assess progress toward its goals given the uncertain lags around monetary policy. A few participants said slowing the pace of rate hikes could reduce the financial system risks; others that slowing should await more progress on inflation.

The dollar index DXY, which measures the greenback against six major peers, was down 0.2% at 105.87, after sliding 1.1% on Wednesday. As Reuters noted, ''the Fed has taken interest rates to levels not seen since 2008 but slightly cooler-than-expected US consumer price data has stoked expectations of a more moderate pace of hikes.'' Consequently, the US Dollar index slide 5.2% in November, putting it on track for its worst monthly performance in 12 years.

Meanwhile, analysts at Rabobank are more pessimistic about the eurozone than what recent price action might otherwise say for the euro. ''The current economic outlook is more vulnerable given the impact of higher energy prices. By the ECB’s next policy meeting, Germany may already be in recession. As has been in the case in the UK in recent months, there is no guarantee that the EUR will respond favourably to higher rates if the economic backdrop appears grim. Although we see the risk of recession in the US next year, the outlook is not as severe as in Europe. ''

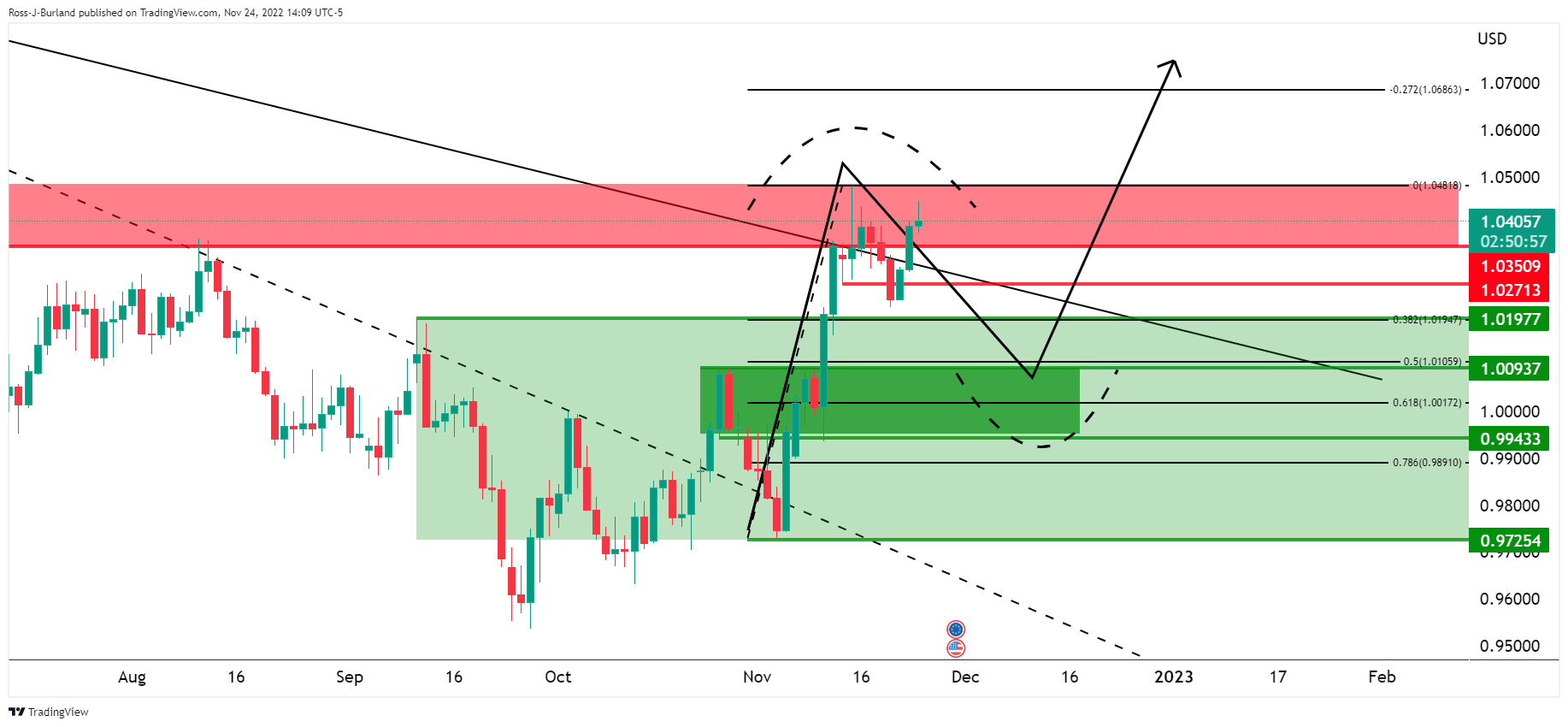

EUR/USD technical analysis

The euro is potentially topping out at this juncture, as per the daily chart.

While there is another push into the peak formation, this could be its final attempt while below 1.0450. A breach there, however, opens the risk of a move into the support quarter of the 1.04 area for the end of the week. A break of 1.0500 could be significant bullish development with the risk of a move to 1.0600.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.