- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD struggles around $1,760 as Fed’s rate slowdown poses a double-edged sword

Gold Price Forecast: XAU/USD struggles around $1,760 as Fed’s rate slowdown poses a double-edged sword

- Gold price is facing hurdles while surpassing the immediate hurdle of $1,760.00.

- Investors see Fed’s rate hike slowdown as a double-edged sword as core CPI has not shown a meaningful slowdown yet.

- An improvement in US Durable Goods Orders poses a bullish filter for the core CPI data.

Gold price (XAU/USD) is facing barricades around the critical resistance of $1,760.00 in the early European session. The precious metal has refreshed its weekly high at $1,761.05, however, further upside seems capped despite a risk-on tone in the global markets.

The USD Index (DXY) is auctioning around its weekly support at 105.65 amid a sheer decline in safe-haven’s appeal. Meanwhile, S&P500 futures are behaving like a dead cat amid the holiday mood in the United States on account of Thanksgiving Day.

No doubt, the headline inflation numbers in the US economy have displayed signs of a decline, however, the core CPI numbers have not shown meaningful signs of slippage yet. Also, the US Durable Goods Orders data that was released this week showed improvement, which is a sign of acceleration in core inflation ahead.

Federal Reserve (Fed) policymakers are required to take significant precautions before making a strategic plan for December monetary policy meeting as a decision to a slowdown in the interest rate hike could be a double-edged sword for them.

Gold technical analysis

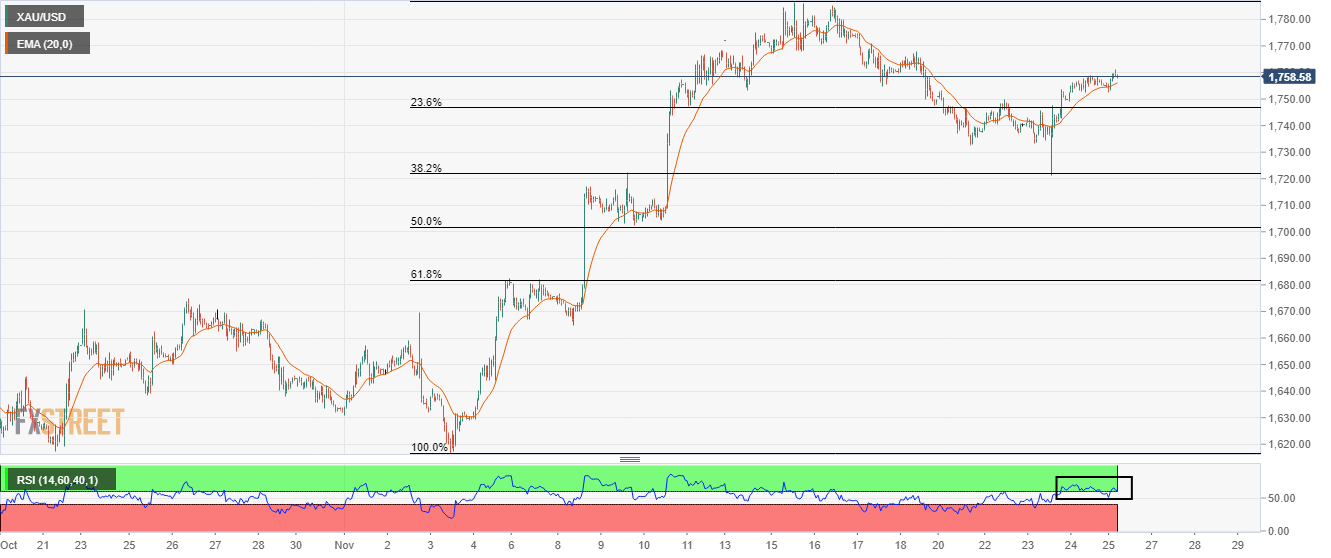

On an hourly scale, Gold price has displayed a steep recovery after testing the 38.2% Fibonacci retracement (plotted from November 3 low at $1,616.69 to November 15 high at $1,758.88) at $1,722.00. The precious metal has extended its recovery after testing the 20-period Exponential Moving Average (EMA) at $1,754.65.

Meanwhile, the Relative Strength Index (RSI) (14) has reclaimed the bullish range of 60.00-80.00, which indicates more upside ahead.

Gold hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.