- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD Bears lurking at key resistance, eyes on $1,795

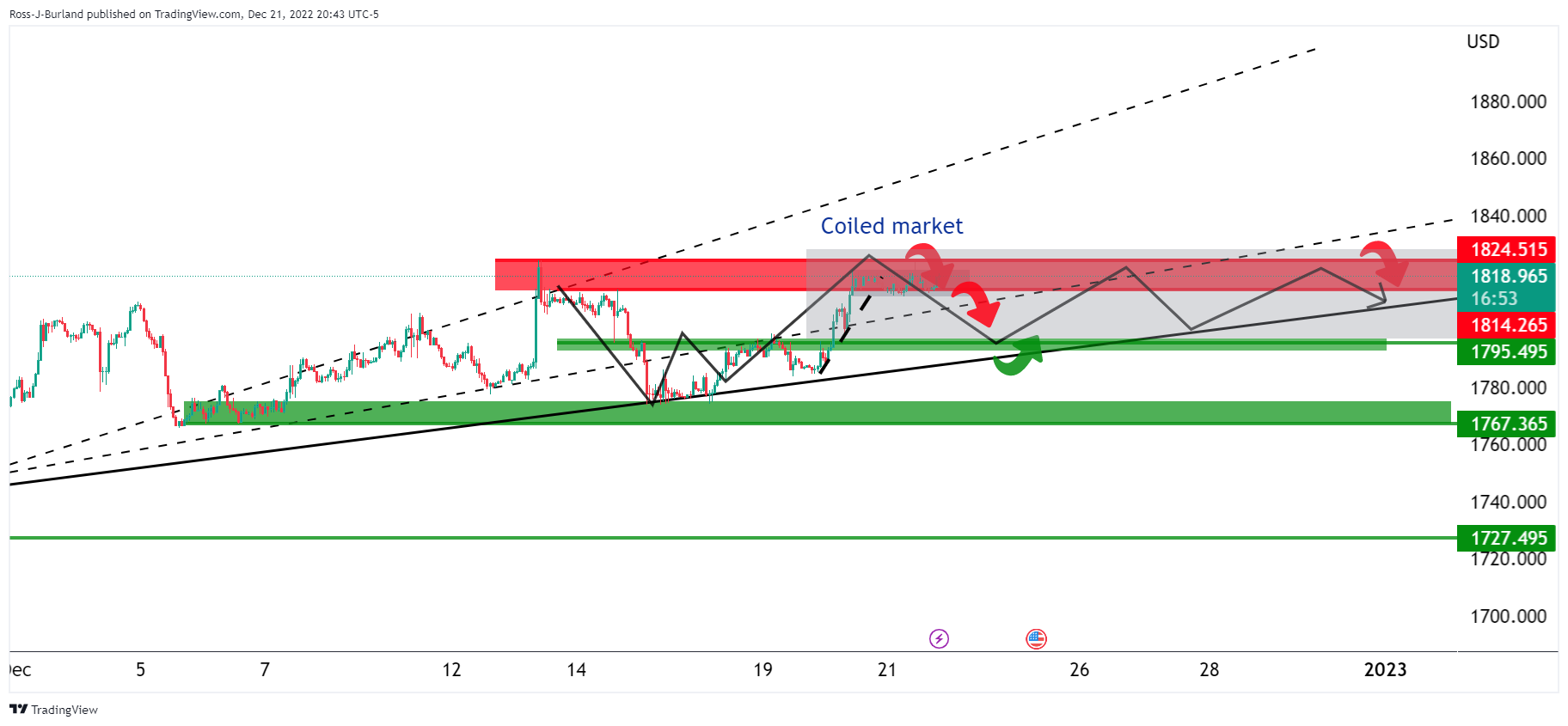

Gold Price Forecast: XAU/USD Bears lurking at key resistance, eyes on $1,795

- Gold bears could be about to make their move at resistance.

- The hawkish Fed is a thorn in the side of Gold bulls, eyes on $1,795.

Gold price is up 0.26% so far on Thursday, with the yellow metal now holding around $1,820 following a move from the lows of $1,813.46. Traders are waiting for key data today from the US calendar with US Gross Domestic Product for the third quarter and weekly US Jobless Claims due at 1330 GMT. This comes ahead of the core Personal Consumption Expenditure (PCE) data scheduled on Friday which will be of particular interest following the recent hawkish rate hike from the Federal Reserve, (Fed).

Earlier this month, the Fed rose rates by 50 bps, lower than the prior four consecutive 75 bps rate hikes. However, Fed Chairman Jerome Powell gave off hawkish comments during the press conference, referencing the board's desire to continue raising rates in 2023 despite the risks of a recession.

After rising as high as 5.5% after last week’s FOMC meeting, the terminal rate as seen by the swaps market fell back to just below 5.0%. Similarly, WIRP suggests a 50 bp hike on February 1 is only about 35% priced in, followed by a 25 bp hike on March 22 and 20% odds of one more 25 bp hike on May 3, analysts at Brown Brothers Harriman explained.

''We cannot understand why the markets continue to fight the Fed. With the exception of some communications missteps here and there, Powell and company have been resolute about the need to take rates higher for longer. Although the media embargo has been lifted, there are no Fed speakers scheduled this week.'' In this regard, rising interest rates increase the opportunity cost of holding bullion since it pays no interest and synchronised rate hikes have weighed on gold in 2022.

''Although we expect the US fed funds rate to peak at 5%, a pause in rate hiking should turn market sentiment in favour of gold,'' analysts at ANZ Bank explained. ''This comes as we approach the end of US dollar dominance, and a depreciation in the currency would add further support to investor demand. With the Fed suggesting rates will remain high through 2023, the risk of weak economic growth next year. Gold prices tend to come under pressure ahead of recessions, but then outperform other markets (such as equities) during them.''

Gold technical analysis

The Gold price 1-hour picture is bearish while below the resistance near $1,825 and on the backside of the micro trendline and there are eyes on eyes on $1,795.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.