- Analytics

- News and Tools

- Market News

- NZD/USD bears step in from key resistance levels and eye a break of support structure

NZD/USD bears step in from key resistance levels and eye a break of support structure

- NZD/USD backs off from fresh bull cycle highs on hawkish Fed speakers.

- However, bulls can eye a move towards a 38.2% Fibonacci retracement near the 0.6470s.

- However, key support structure is eyed for a significant sell-off with 0.6200 a target area.

NZD/USD has been testing the 0.6420s in recent trade and a break thereof opens the risk of a significant downside correction for the week's cycle. The pair was sold off from critical resistance near the day's highs of 0.6530 and a low of 0.6418 has been achieved so far as market sentiment flips bearish.

''Global financial market sentiment remains fickle – bond yields are falling everywhere as recession fears bite, but at the same time many think the prospect of fewer hikes or eventual easing is a positive thing,'' analysts at ANZ Bank said in a note at the start of the early Asian day. ''Expect volatility to remain elevated into local Consumer Price Index data next week and the Federal Reserve decision the following week,'' the analysts said.

''NZ food prices today will be watched closely; many economists will finalise their CPI picks once it’s in hand. As these estimates are published, the Kiwi may see yet more volatility.''

Meanwhile, the US dollar is gaining traction despite weaker data that portrayed disinflationary tones, fueling the belief that the Federal Reserve will continue to reduce its tightening pace in upcoming meetings. However, Fed speakers later poured cold water on that which helped the US Dollar to pare back losses from the weak data. For instance, St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

NZD/USD technical analysis

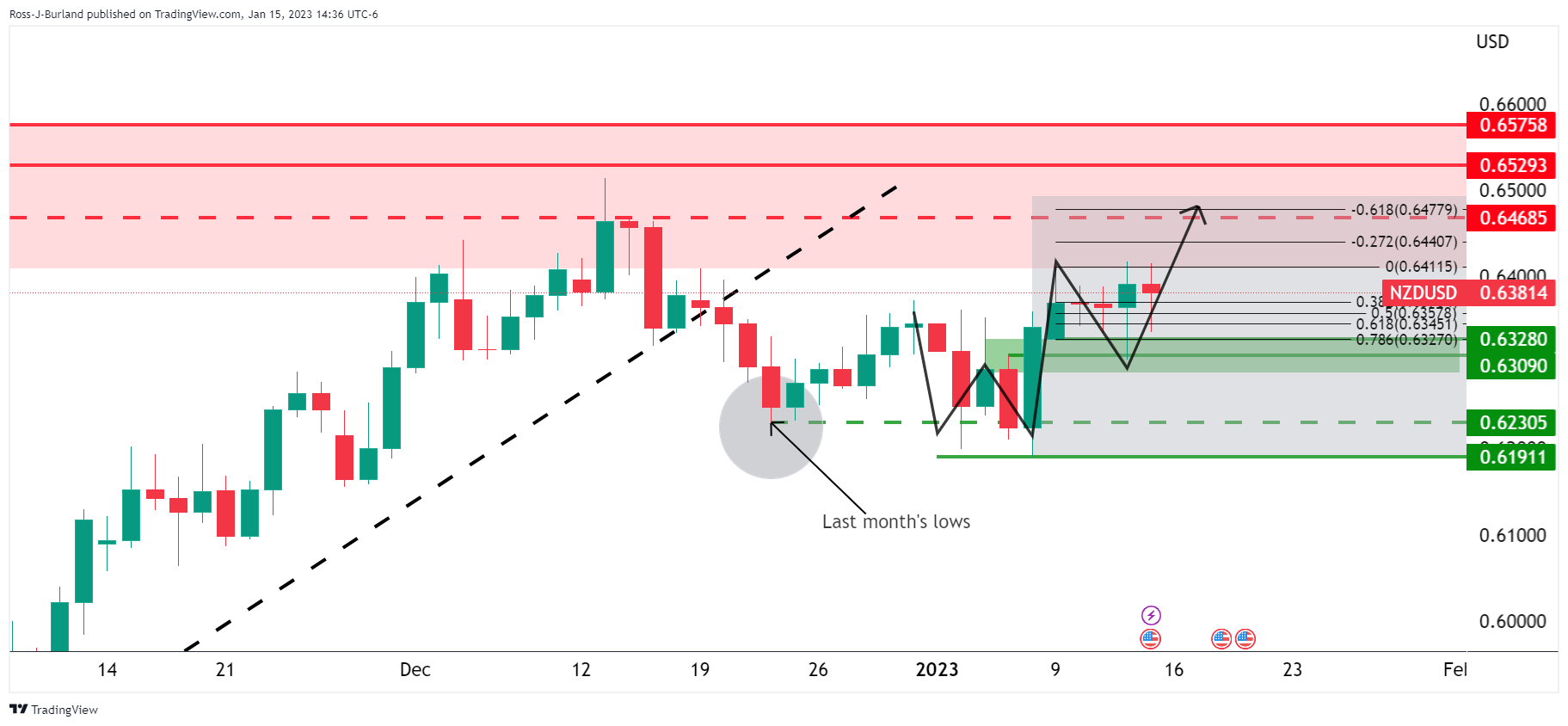

In prior analysis, it was shown that while being on the backside of the daily bullish impulse and trend, there were still prospects of a move into the trendline resistance, acting as the final push before a major bearish breakout:

The W-formation was highlighted as a bullish bottoming pattern and the fact that the price broke the monthly lows, we had breakout traders trapped.

The upside towards 0.6480 was a probable scenario for this week to meet prior highs:

NZD/USD update

The price shot higher and exceeded the 0.6480s target, meeting higher resistance and the start of last year's lows as follows:

The bulls need to break out of these highs or face the prospects of a significant correction for days ahead towards 0.6200:

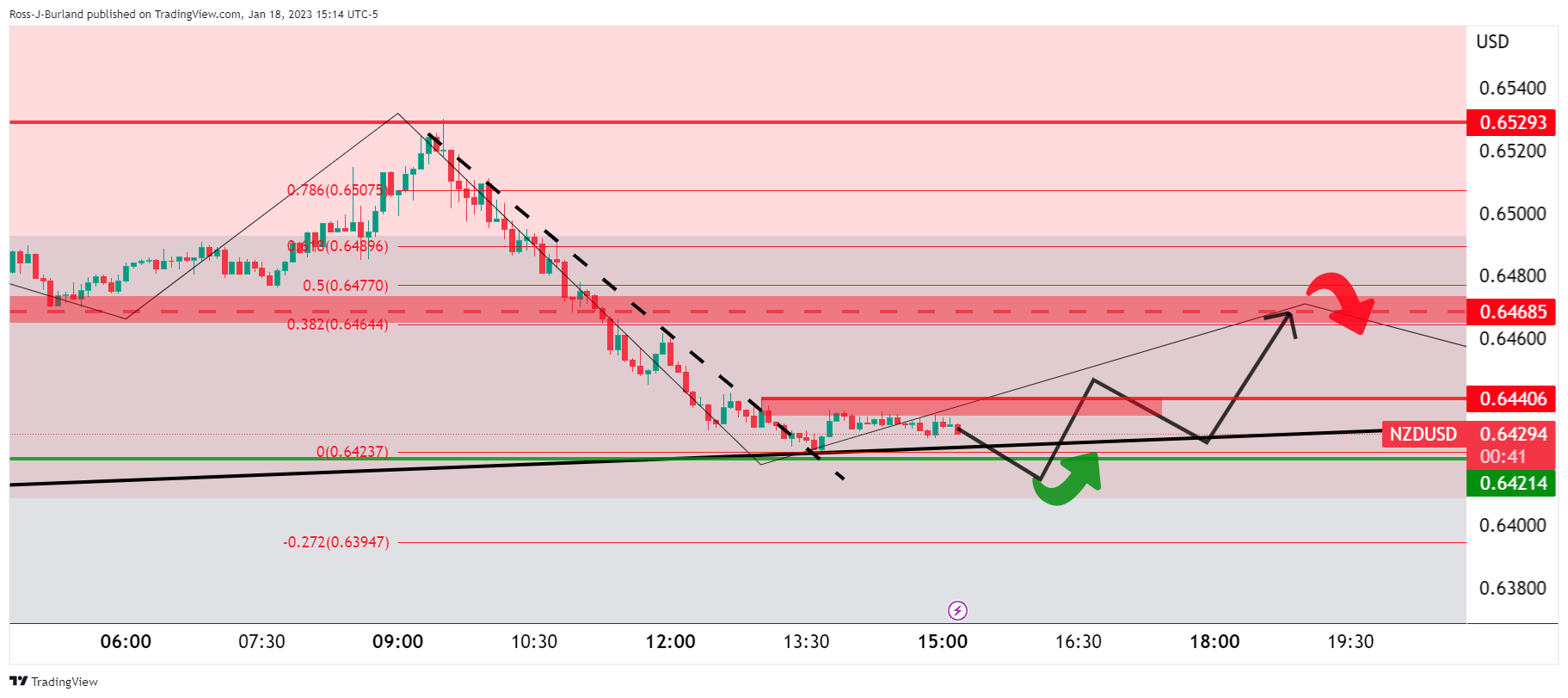

NZD/USD H1 chart

However, while on the front side of the micro supporting trendline on the hourly time frame, as illustrated below, there are prospects of a revisit to retest the M-formations neckline as follows:

The bulls can eye a move towards the 38.2% Fibonacci retracement of the prior bearish impulse from trendline support to target the 0.6470s on lower time frames, such as the 15-minute and 5-minute charts. A break of 0.6440 structure will be key in this regard.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.