- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bears on the backside, lining up to target $1,880s

Gold Price Forecast: Bears on the backside, lining up to target $1,880s

- Gold holds near $1,900 critical support as Fed hawks keep the greenback bid.

- The US dollar flipped bullish in the US session, leaving the outlook for Gold price bearish on a break below support.

Gold is holding near $1,900 towards the close for the day. XAU/USD travelled between a low of $1,896.67 and a high of $1,925.94 on the day but fell into the lows despite the US session as a weak US Dollar gained traction on hawkish comments from Federal Reserve speakers.

St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

However, investors expect the Federal Reserve to raise interest rates by just 25 basis points when its policy committee meets at month's end.

Fed official Loretta Mester also warned more hikes are needed and said,'' we're beginning to see the kind of actions that we need to see."

Her comments to the Associated Press fall in following today's slew of economic data, specifically the Producer Price Index and Retail Sales. These showed disinflationary tendencies in the data and reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

Gold technical analysis

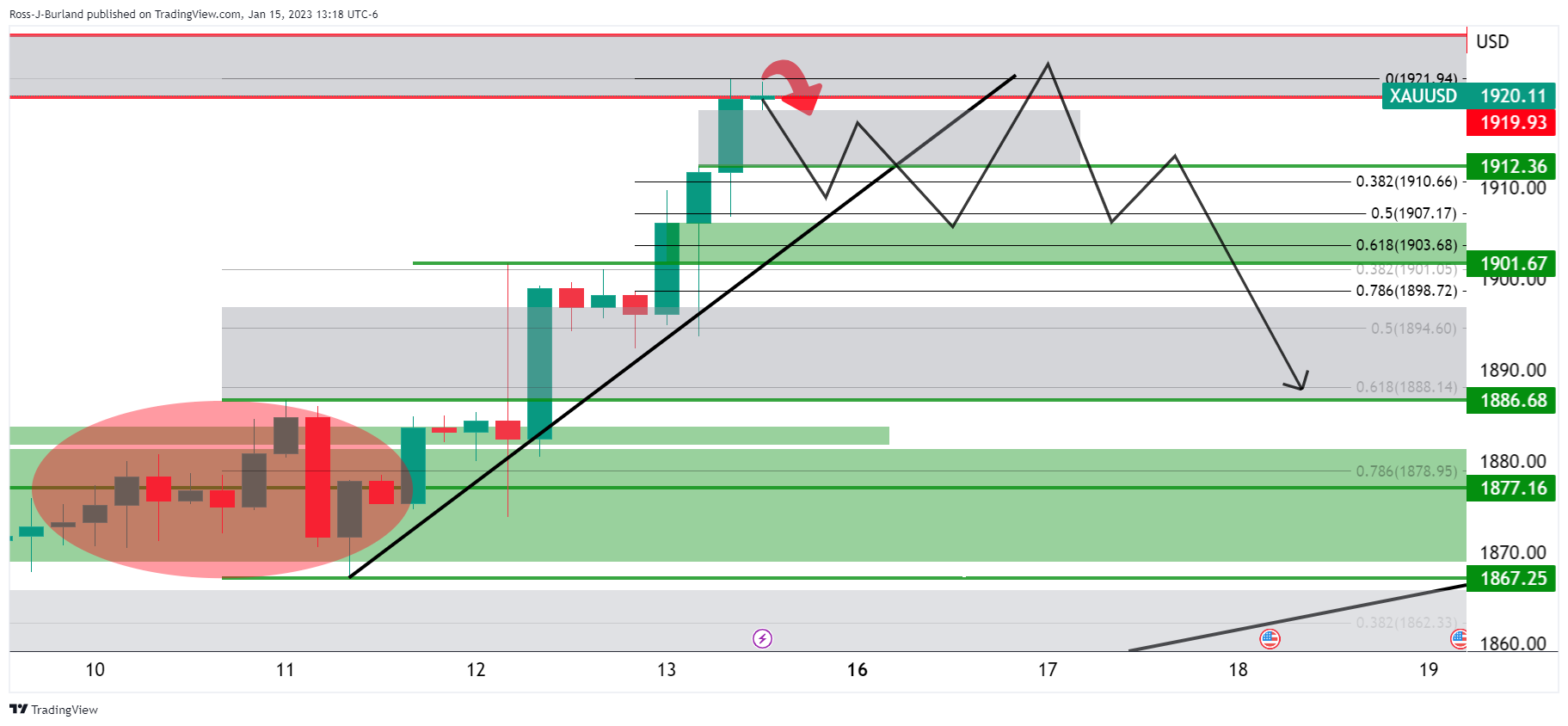

In this week's pre-open Gold price analysis, Gold, Chart of the Week: XAU/USD meets $1,920 resistance area, eyes on 4-hour structures to the downside, it was explained that the Gold price bears need to get the market on the backside of the 4-hour trendline as follows:

The above Gold price schematic was illustrated as typical of such a breakdown and deceleration of the trend, in a) breaking the trendline, b) retesting the peak formation highs and c), eventually breaking the horizontal support structure.

Gold update

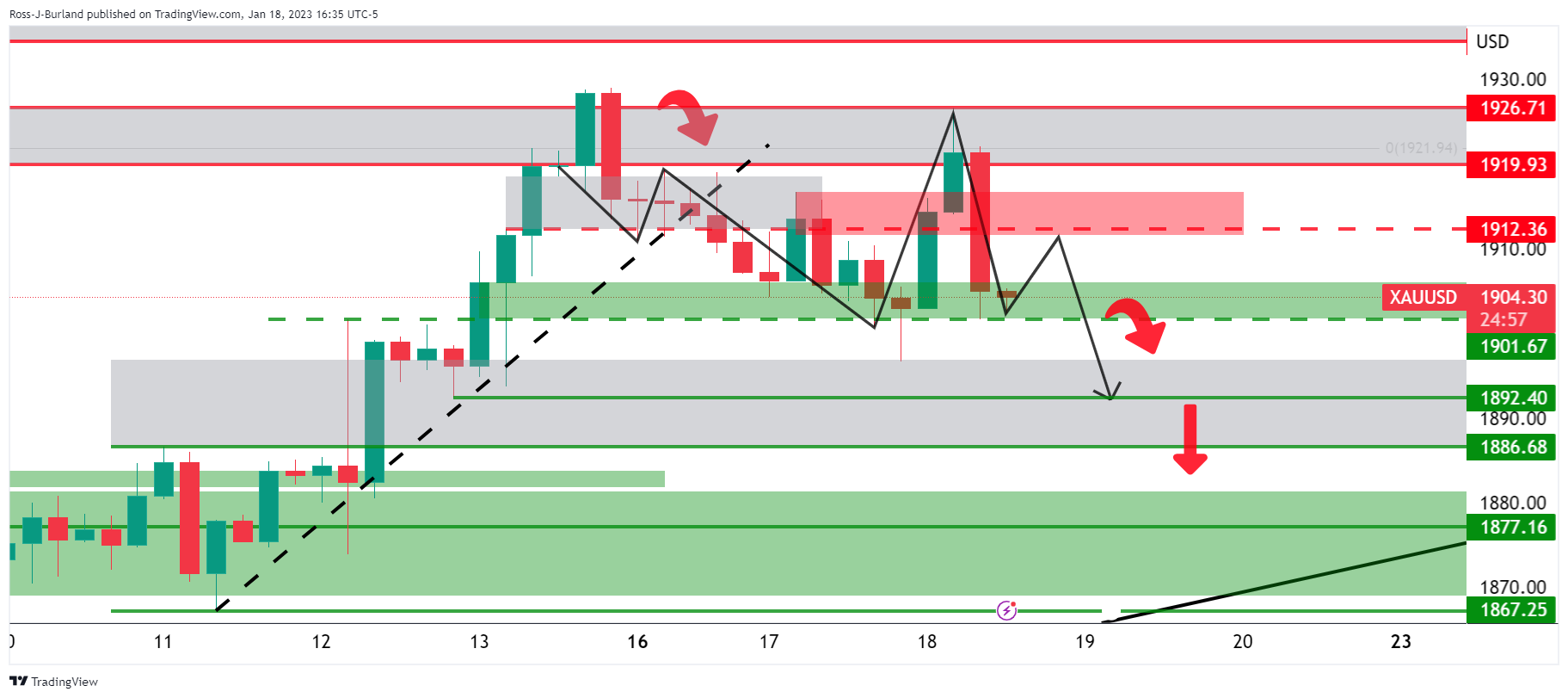

We have seen all of the criteria met for a move lower to $1,890 and then $1,880:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.