- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Bears are moving in and eye a break of structure

AUD/USD Price Analysis: Bears are moving in and eye a break of structure

- AUD/USD bulls are in charge at the start of the week but bears are lurking.

- The US Dollar bulls need to show up to enable the Aussie is going to break the downside structure.

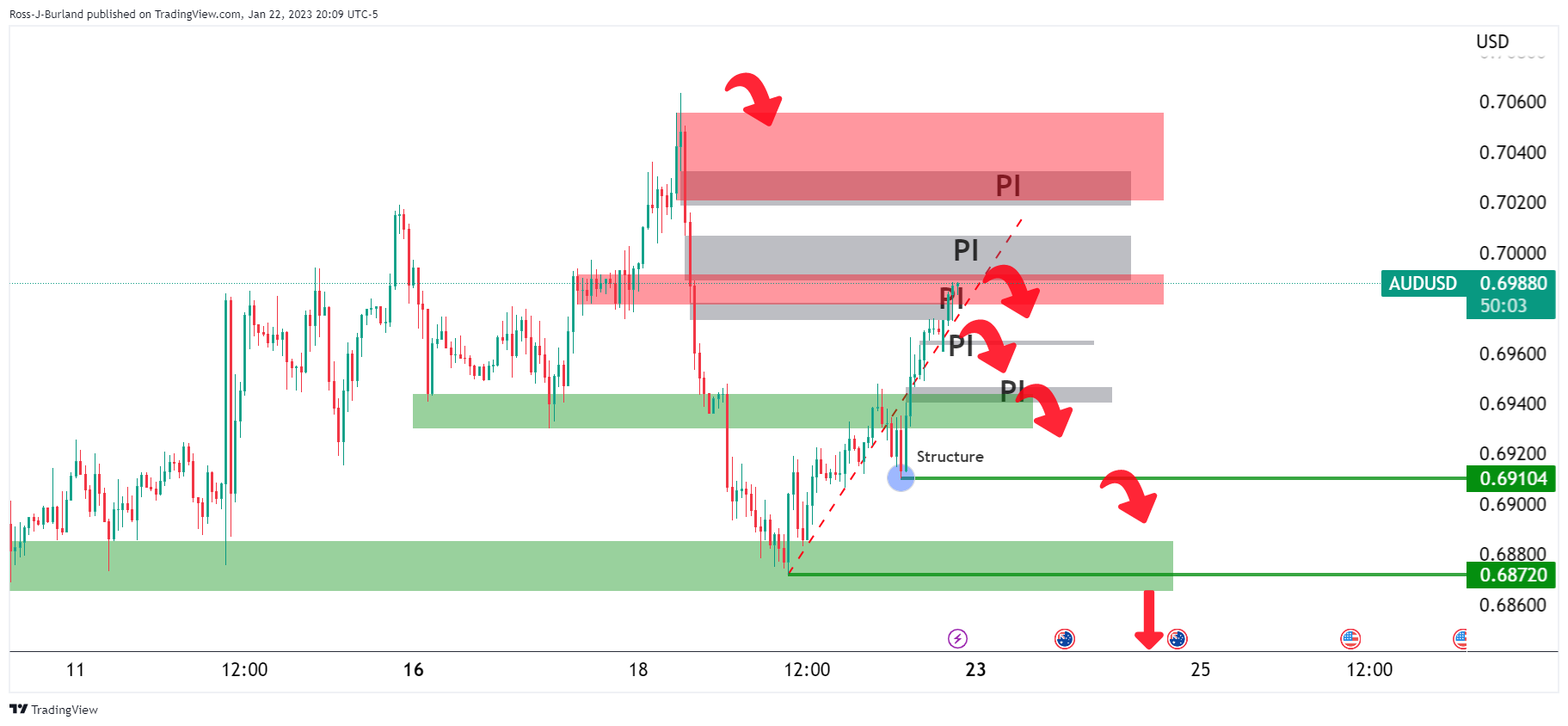

As per the start of the week's analysis, AUD/USD Price Analysis: Bulls eye 0.7020, bears target a break of H1 structure, 0.6910 and then AUD/USD starts off bid and eyes are on 0.7000/20, we have seen the initial balance continue to run higher, a touch above the 0.7020 stop hunt area into 0.7039 so far.

The bears are now on the lookout for the US dollar to firm up and how who is still the boss of the forex board. that might be a tall order considering the market's speculation that the Federal Reserve is on the verge of a major pivot, but the technicals speak for themselves.

The following illustrates the prospects for a downside correction in AUD/USD should all of the stars align this week, considering the red news scheduled on both the Aussie and US calendar.

AUD/USD prior analysis

As per the above's pre-market analysis, the initial balance for the week was on track for scoring territory into the price imbalances:

It was stated that there had been the potential for a move-up in the initial balance for the week to mitigate the imbalances to test the peak formation left behind from Wednesday's highs last week. The key areas to the downside were sighted as being 0.6950 and then 0.6910 ahead of 0.6870.

AUD/USD update

We have since seen the Asian, London and US opening hours conclude with the price reaching the extreme price imbalance and paint a W-formation on the trendline support. Given the price is now testing major resistance, a downside correction would be expected at this juncture to test the prior resistance around 0.7010.

However, if the downside thesis from that point is going to gather momentum, the US Dollar needs to make its move.

DXY technical analysis

The bulls are attempting to commit and 102.25 will be a key milestone if they can breach the level and get over the trendline resistance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.