- Analytics

- News and Tools

- Market News

- USD/MXN advances above the 18.00 figure as traders rush to safety

USD/MXN advances above the 18.00 figure as traders rush to safety

- USD/MXN turned positive after buyers stepped in and dragged prices above 18.00.

- US Initial Jobless Claims aimed higher, suggesting that the Fed could increase rates gradually.

- Inflation in Mexico cooled down, with analysts speculating that Banxico could rise in 25 bps increments.

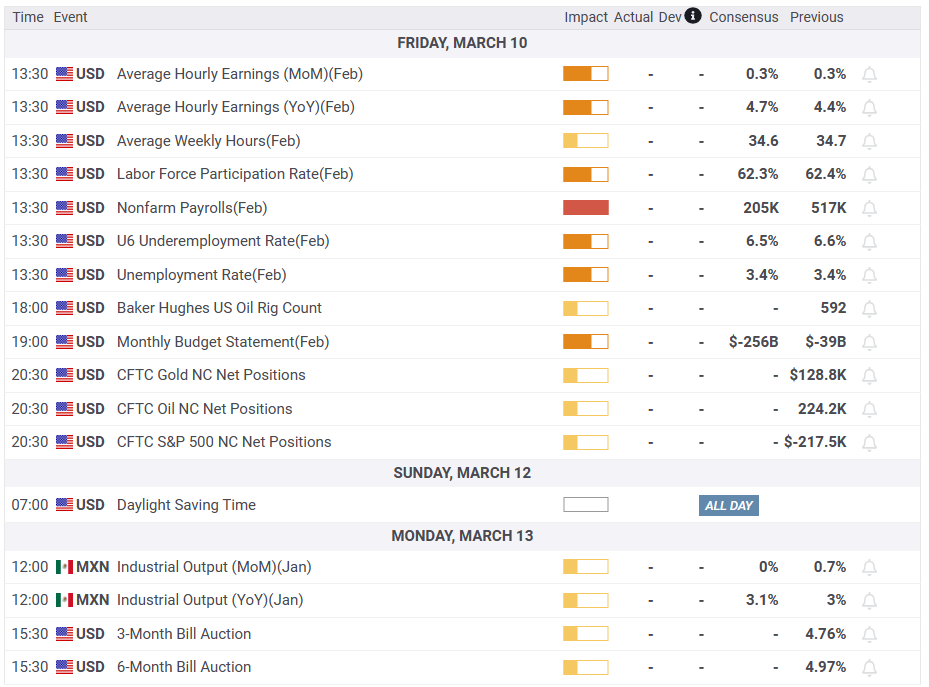

The Mexican Peso (MXN) is under pressure on Thursday; after reaching new 5-year lows at 17.8967, the UXD/MXN has risen back towards the 18.0800 area. Traders seeking safety ahead of important US economic data to be released, with the US Nonfarm Payrolls and next week’s CP, bought the US Dollar (USD). Hence, the USD/MXN climbs 0.60%, trading at around 18.0860.

Unemployment claims rose, though bolstered the USD vs. the MXN

Market mood has deteriorated, as shown by Wall Street, retracing its earlier gains. The Bureau of Labor Statistics (BLS) revealed the Initial Jobless Claims for the week ending on March 4 were 211K higher than expected at 195K. Although claims rose, the ADP Employment Change data, and job openings, continued to portray a tight labor market, justifying the Federal Reserve’s Chair Jerome Powell’s hawkishness at his appearance before the US Congress.

The US Dollar Index (DXY) is losing 0.38%, down at 105.250, putting a lid on the USD/MXN recovery towards the weekly highs at around 18.1788.

On the Mexican front, inflation slumped in the headline and core readings. The Consumer Price Index for February came at 7.62% YoY, below estimates of 7.68% and the previous month’s readings of 7.91%. Core CPI rose by 8.29% YoY, above the consensus but beneath January’s 8.45%.

“Today’s (inflation) print reduces the odds that (the Mexican central bank) chooses to go ahead with a 50 bps hike, though incoming data as well as the outlook for the Fed remain key influences on the bank’s decision,” Scotiabank economists said in a note.

Following the Mexican inflation release, the USD/MXN climbed above the $18.00 figure, extending its gains ahead of a busy US economic calendar. Nevertheless, the bias is downwards, but it could shift to neutral if buyers reclaim 18.3000.

USD/MXN Price action

The USD/MXN stages a recovery after trading below the $18.00 barrier during the last few days. Nevertheless, USD/MXN bulls are far ahead of declaring victory, as they need to reclaim the weekly high at 18.1788, followed by the 20-day Exponential Moving Average (EMA) at 18.2898. Once done, the USD/MXN could consolidate around the 18.1800-18.3000 area before testing the 50-day EMA at 18.6430. Otherwise, the USD/MXN is at the brisk of falling below 18.0000, which could pave the way for a new YTD low print.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.