- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD looks to regain $1,900 as yields plummet, US inflation eyed – Confluence Detector

Gold Price Forecast: XAU/USD looks to regain $1,900 as yields plummet, US inflation eyed – Confluence Detector

- Gold price grinds higher after refreshing five-week high, prints three-day uptrend.

- Clear upside break of $1,865 support confluence keeps XAU/USD bulls hopeful.

- US regulators’ defence of SVB, Signature Bank fails to trigger rebound in US Treasury bond yields.

- US inflation data, consumer-centric figures, headlines surrounding SVB and Fed chatters will be crucial for near-term directions.

Gold price (XAU/USD) cheers the previous day’s upside break of the $1,865 hurdle, now support, to refresh a five-week high amid a broad risk-on mood. Adding strength to the precious metal’s advance is the broad-based US Dollar weakness as the US regulators’ efforts to tame the financial crisis, due to the Silicon Valley Bank (SVB) and Signature Bank fallout, fail to trigger a rebound in the US Treasury bond yields. The reason could be linked to the market’s fears that the Fed’s rate hikes have made the US banks fragile enough to trigger a recession, which in turn weighs on the Fed rate hike concerns despite the recently firmer US data and upbeat testimony from Fed Chair Jerome Powell.

It should be noted, however, that the Asia-Pacific equities’ inability to cheer the US Dollar weakness, despite rising of late, join the fears of fresh US-China tension to prod the Gold price upside. Furthermore, the cautious mood ahead of this week’s US Consumer Price Index (CPI) and the US Dollar’s notable fall despite posting a better-than-expected jobs report for February also challenge the XAU/USD bulls.

Also read: Gold Price Forecast: Acceptance above $1,900 is critical for XAU/USD, US CPI in focus

Gold Price: Key levels to watch

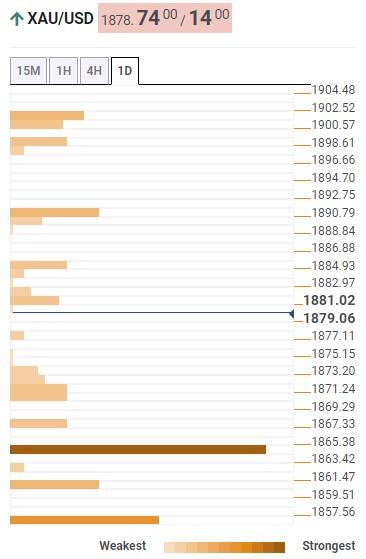

The Technical Confluence Detector shows that the Gold price is all set to reclaim the $1,900 threshold as the metal trades successfully beyond the $1,865 support confluence, now resistance, that comprise the Fibonacci 38.2% on one month.

That said, the Pivot Point One Week R1 guards the XAU/USD’s immediate upside near $1,890.

It should be noted that the Fibonacci 61.8% in one-month highlights the $1,902 as an extra filter towards the north.

Alternatively, the quote’s downside break of $1,865 resistance-turned-support will need validation from the $1,857 level, including Fibonacci 23.6% on one week, to recall the Gold bears.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.