- Analytics

- News and Tools

- Market News

- USD/CAD bulls staying put with eyes on 1.3520

USD/CAD bulls staying put with eyes on 1.3520

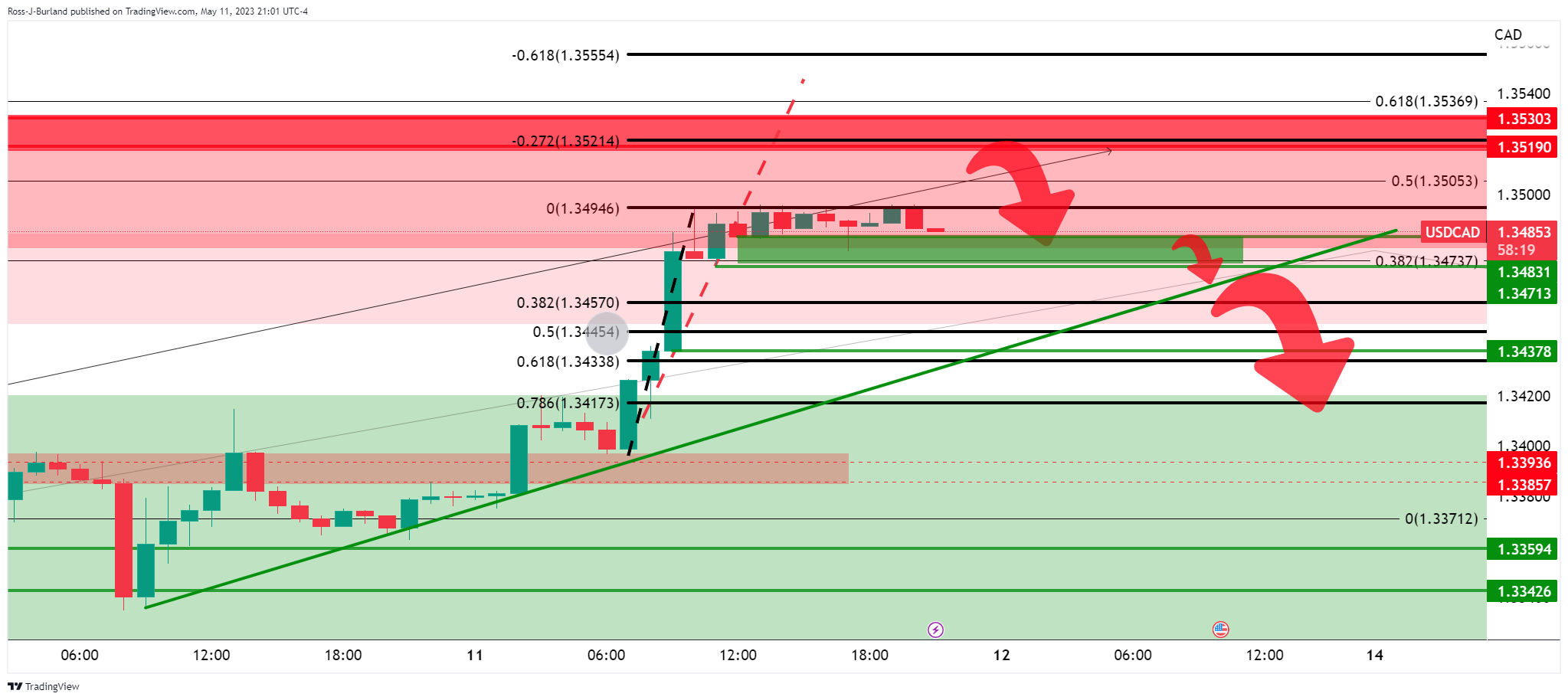

- USD/CAD bulls eye a run to test 1.3520.

- CAD is under pressure, consolidating at fresh cycle lows vs. the US Dollar.

USD/CAD is flat in the Toyo opening hour on Friday whereby the pair rallied from a low of 1.3375 to a high of 1.3495. CAD was therefore posting its biggest decline since early March, as oil prices dropped and US economic data added to evidence that the economy is slowing down.

First, in the US data, the number of Americans filing new claims for unemployment benefits leaped to a 1-1/2-year high last week, and producer prices rebounded modestly in April. U.S. weekly initial unemployment claims rose +22,000 to 264,000, showing a weaker labor market than expectations of 245,000.

In other related market events, crude oil and gasoline prices on Thursday posted moderate losses..Canada sends about 75% of its exports to the United States, including oil. Demand concerns weighed on crude prices as Thursday's weaker-than-expected economic news from China and the US, the world's two biggest crude consumers, sparked fears about a slowdown in the global economy that is bearish for energy demand.

´´The OPEC put, along with an expected resurgence in Chinese demand later this year, should keep oil prices on a firming trajectory. At the same time, CTA positioning remains near max-short levels, which suggests that this cohort will not contribute much to the additional downside,´´ analysts at TD Securities said.

Meanwhile, there has been an improved inflation outlook for the US and this has lowered Treasury yields on two-year notes (which can move in step with interest rate expectations, to 3.90% from above 4% at the end of last week. The yield on 10-year notes fell 5 basis points to 3.386%.

As a consequence, the futures markets are showing the probability that the Fed will raise rates again in June was 10.7%, up from 2.1% soon after the data's release. The odds that the Fed cuts rates later this year also rose.

USD/CAD technical analysis

- USD/CAD Price Analysis: Bulls eye 1.3520 while above 1.3470

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.