- Analytics

- News and Tools

- Market News

- When is the UK inflation and how could it affect GBPUSD?

When is the UK inflation and how could it affect GBPUSD?

The UK CPIs Overview

The cost of living in the UK, as represented by the Consumer Price Index (CPI) for April, is due early on Wednesday at 06:00 GMT.

Knowing the fact that Bank of England (BoE) Governor Andrew Bailey believes that interest rates in the United Kingdom have yet not been reached, today’s data will be watched closely by the GBPUSD traders.

The headline CPI inflation is expected to soften to 8.2% YoY figure versus 10.1% released for March while the Core CPI, which strips off volatile food and energy items, is seen steady at 6.2% YoY during April. Regarding the monthly figures, the CPI is expected to maintain a pace of 0.8% recorded in March.

It’s worth noting that easing labor market conditions due to higher interest rates reported last week also highlight the Producer Price Index (PPI) as an important catalyst for the immediate GBP/USD direction.

That being said, the PPI Core Output YoY is seen softening to 7.3% on a non-seasonally adjusted basis whereas the monthly prints could decelerate further to 0.1% versus 0.3% the prior release. Furthermore, the Retail Price Index (RPI) is also on the table for release, which is expected to drop to 11.1% YoY from 13.5% prior while the MoM prints could show a higher pace of 1.2% from 0.7% in previous readings.

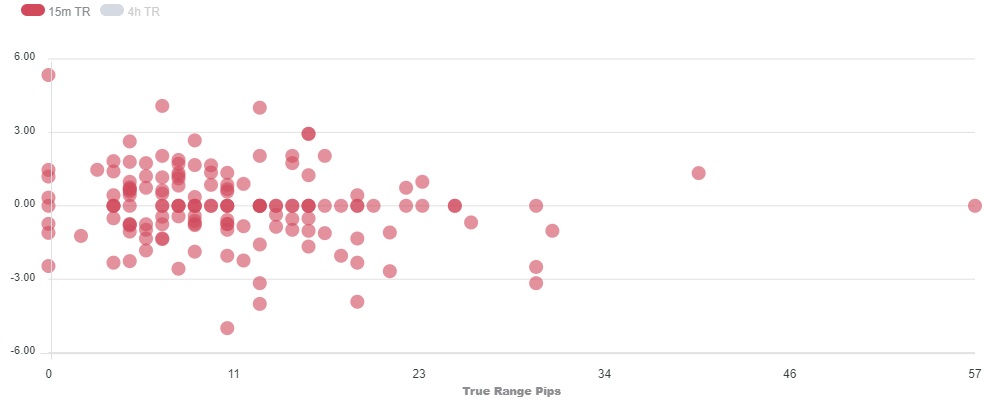

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 30-40 pips.

How could it affect GBP/USD?

UK’s inflation has remained tied to the double-digit territory for the past nine months. Think tanks believe that labor shortages and historically high food inflation are the real culprits of extremely stubborn inflation. Individuals are announcing early retirements and the Brexit event dropped the number of job-seekers from the UK market. No doubt, the duo of UK PM Rishi Sunak and UK FM Jeremy Hunt has taken some measures to force individuals for avoiding early retirement, however, those measures need plenty of time to act.

On Tuesday, BoE Chief Economist Huw Pill in his testimony agreed that the central bank misunderstood the strength and persistence of UK inflation. BoE Pill said, “We are trying to understand why we have made errors in inflation forecasts.” However, BoE policymaker remained confident that longer-term inflation expectations have not drifted away from the target.

While BoE Governor Andrew Bailey in his testimony in front of UK parliament's Treasury Select Committee (TSC) gave assurance that declining gas prices and losing momentum in food prices are weighing heavily on inflationary pressures. Private sector wages are not accelerating as expected, which could fade bumper retail demand.

Technically, GBP/USD has swiftly approached the upper portion of the Falling Wedge chart pattern on a two-hour scale in which each pullback is considered a selling opportunity by the market participants. Also, chances of a bullish reversal remain higher as BoE Bailey is expected to raise interest rates further. A 40.00-60.00 range oscillation by the Relative Strength Index (RSI) (14) will get a decisive move after the release of the UK Inflation.

Keynotes

GBP/USD Price Analysis: Remains inside falling wedge ahead of UK Inflation

GBP/USD looks to regain 1.2450, focus on UK inflation, BoE’s Bailey and Fed Minutes

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of the GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.