- Analytics

- News and Tools

- Market News

- USD Index keeps the bid tone unchanged above 104.00 ahead of key data

USD Index keeps the bid tone unchanged above 104.00 ahead of key data

- The index extends the weekly recovery north of 104.00.

- A Fed’s pause now looks likely in at the June event.

- ADP report, weekly Claims, ISM Manufacturing next on tap.

The USD Index (DXY), which gauges the greenback vs. a basket of its main competitors, maintains the bid bias well in place beyond the 104.00 mark on Thursday.

USD Index now looks at data

The index advances for the third session in a row and extends the weekly optimism past the 104.00 hurdle on Thursday despite the recent U-turn in expectations of a rate hike by the Fed at the June 14 gathering.

The upbeat mood in the dollar also appears bolstered after the House of Representatives passed legislation Wednesday night to extend the suspension of the nation's debt ceiling until January 1, 2025. The timetable for avoiding an unprecedented debt default is highly constrained. The bill must now be enacted by the Senate before it can be delivered to President Joe Biden for signature.

On the latter, FOMC members Harker and Jefferson opened the door to a pause in the hiking cycle in June, according to their comments late on Wednesday, which ultimately morphed into an abrupt change of heart from investors and forced the buck to surrender part of the recent uptick to fresh highs near 104.70 (May 31).

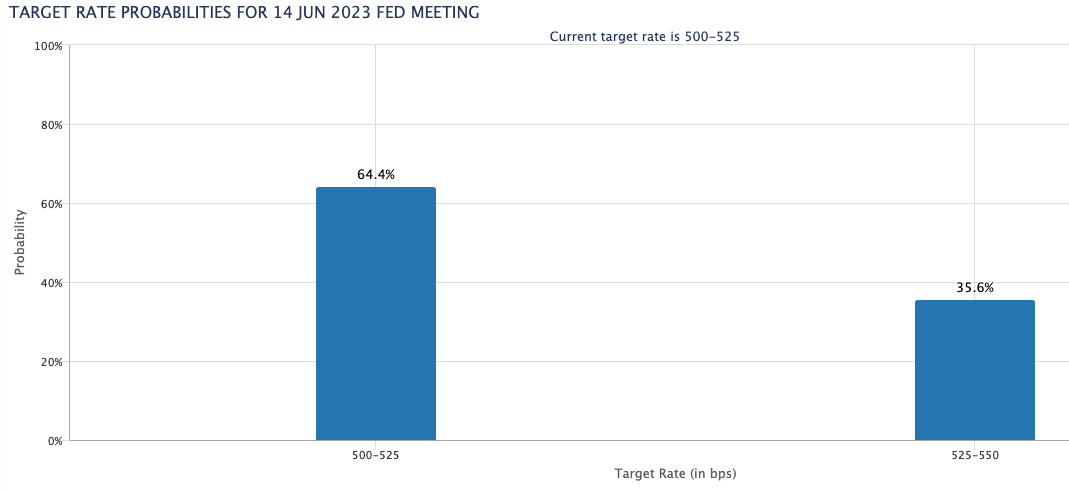

According to CME Group's FedWatch Tool, the probability of a pause at the Fed's meeting next month hovers around 65% (up from nearly 33% just a day ago).

Very interesting session in the US docket, as the labour market will take centre stage in the first turn with the publication of the ADP report and weekly Initial Claims, seconded by the always relevant ISM Manufacturing PMI, the final S&P Global Manufacturing PMI and Construction Spending.

What to look for around USD

The index keeps the positive performance above the 104.00 hurdle on the back of optimism surrounding the debt ceiling and persistent lack of traction in the risk-associated universe.

In the meantime, rising bets of another 25 bps at the Fed’s next gathering in June appear underpinned by the steady resilience of key US fundamentals (employment and prices mainly) amidst the ongoing rally in US yields and the DXY.

Favouring a pause by the Fed, instead, appears the extra tightening of credit conditions in response to uncertainty surrounding the US banking sector.

Key events in the US this week: ADP Employment Change, Initial Jobless Claims, Final Manufacturing PMI, ISM Manufacturing PMI, Construction Spending (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Debt ceiling. Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.24% at 104.48 and the surpass of 104.69 (monthly high May 31) would open the door to 105.61 (200-day SMA) and then 105.88 (2023 high March 8). On the flip side, the next support emerges at the 100-day SMA at 102.90 seconded by the 55-day SMA at 102.44 and finally 101.01 (weekly low April 26).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.