- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: Extends its downside, the next contention level is seen at 161.60

EUR/JPY Price Analysis: Extends its downside, the next contention level is seen at 161.60

- EUR/JPY loses traction amid the lack of a catalyst in early European session on Tuesday.

- The bullish outlook remains intact as the cross still holds above the key 100-hour EMA.

- The immediate resistance level is located at 161.46; the initial support level is seen at 161.60.

The EUR/JPY cross extends its downside during the early European session on Tuesday. That being said, the lack of a catalyst triggers the demand for safe-haven flows, which lifts the Japanese Yen (JPY) against the Euro (EUR). Market players await the speech by European Central Bank (ECB) President Christine Lagarde at high-level public discussion "Inflation kills democracy” at 06.00 GMT for fresh impetus. The cross currently trades around 161.83, losing 0.29% on the day.

On Tuesday, ECB Governing Council member Francois Villeroy de Galhau said that interest rates have reached a plateau where they will remain for the next few quarters. However, he dismissed discussion of a rate cut as premature.

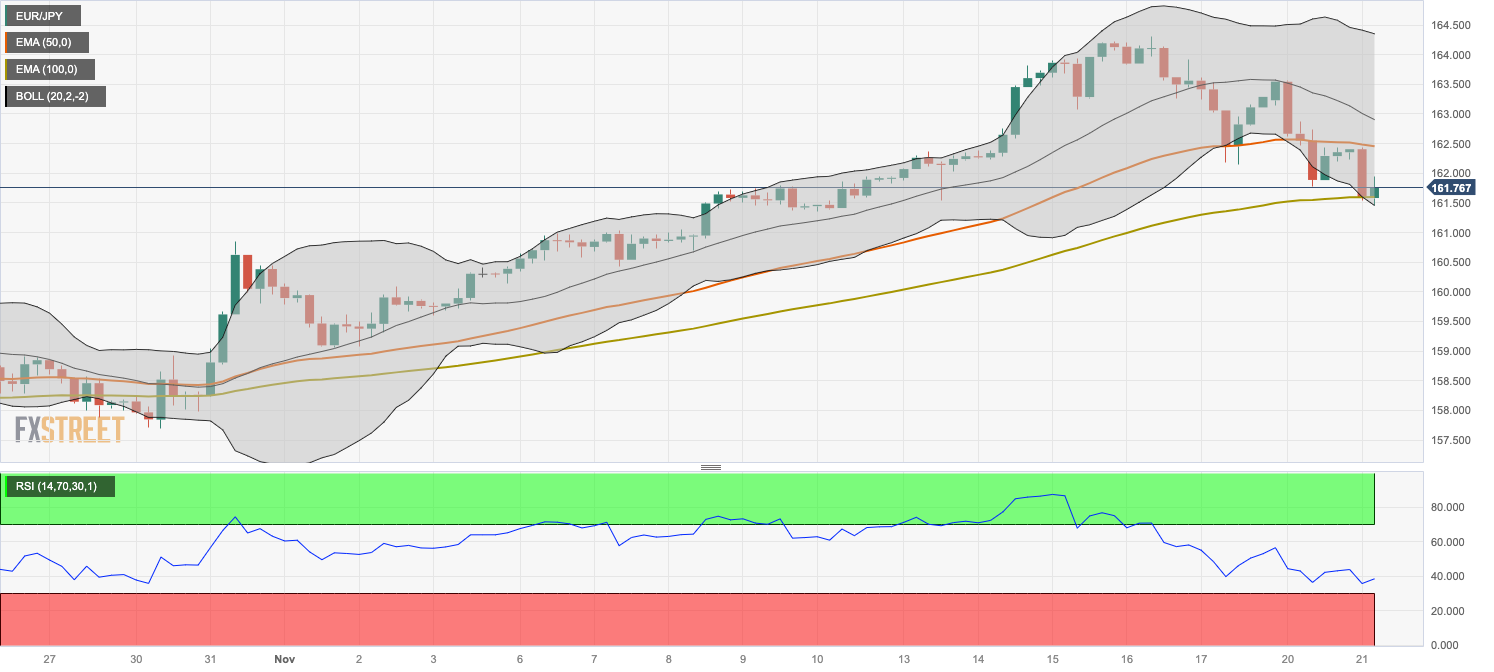

Technically, the bullish outlook remains intact as the cross still holds above the key 100-hour Exponential Moving Averages (EMAs) on the four-hour chart. However, the Relative Strength Index (RSI) is located in the bearish territory below 50, indicating the pair's upside is likely to remain limited in the near term.

The 50-hour EMA at 161.46 acts as an immediate resistance level for the cross. The additional upside filter to watch is a high of November 20 at 163.56. The next barrier is seen at the upper boundary of Bollinger Band and a high of November 16 at 164.34. A break below the latter will see the rally to the year-to-date (YTD) high of 164.21.

On the other hand, the initial support level for EUR/JPY is seen near the 100-hour EMA at 161.60. Further south, the cross will see the next downside target near the lower limit of the Bollinger Band at 161.48. A breach of the latter will see a drop to a high of October 31 at 160.85, followed by the psychological round figure at 160.00.

EUR/JPY four-hour chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.