- Analytics

- News and Tools

- Market News

- AUD/JPY Price Analysis: Surges to six-day high amid risk-on sentiment

AUD/JPY Price Analysis: Surges to six-day high amid risk-on sentiment

- AUD/JPY rises late in the session, supported by a risk-on sentiment fueled by Wall Street's advance.

- Buyers in control as the pair surpasses 97.00, aiming for a daily close above 98.00 for further gains.

- Despite the ascent, pullback risks persist; sellers may target levels below 97.00 for bearish momentum.

AUD/JPY edges higher late in Friday’s North American session, sponsored by a risk-on impulse, as the advance in Wall Street could appreciate it. Therefore, safe-haven peers are pressured while US Treasury yields retrace, a tailwind for riskier assets. At the time of writing, the AUD/JPY exchanged hands at 97.79, printing a new six-day high.

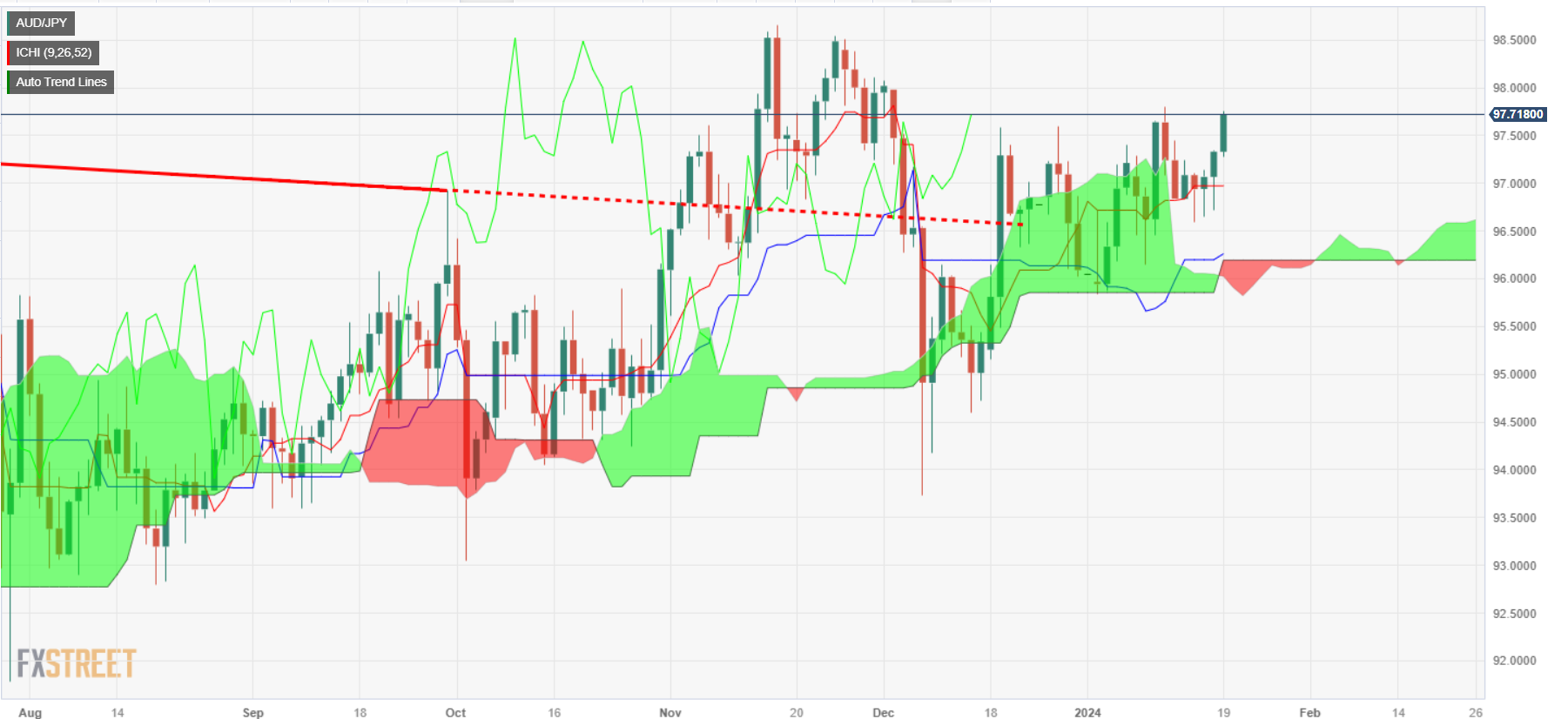

The pair began the week at around the lows of the week, below the Tenkan-Sen, but the AUD/JPY exchange rate was already above the Ichimoku Cloud (Kumo), suggesting that buyers were in charge. Consequently, they reclaimed 97.00 and, on Friday, extended its gains. Still, pullback risks remain, as buyers need a daily close above the 98.00 figure so they can remain hopeful of testing last year’s high of 98.58. Once those levels are surpassed, the next stop would be the 99.00 figure.

For a bearish case, sellers need to drive prices below 97.00, through the Tenkan Sen at 96.97, toward the January 16 low of 96.58. A breach of the latter will expose the Kijun-Sen at 96.18, ahead of the Senkou Span B and A, each at 96.14 and 96.01.

AUD/JPY Price Action – Daily Chart

AUD/JPY Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.