- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 02-03-2017.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0506 -0,38%

GBP/USD $1,2266 -0,20%

USD/CHF Chf1,0132 +0,44%

USD/JPY Y114,39 +0,59%

EUR/JPY Y120,19 +0,22%

GBP/JPY Y140,31 +0,40%

AUD/USD $0,7571 -1,37%

NZD/USD $0,7060 -1,16%

USD/CAD C$1,3389 +0,49%

01:45 China Markit/Caixin Services PMI February 53.1 53.3

05:00 Japan Consumer Confidence February 43.2 43.7

07:00 Germany Retail sales, real adjusted January -0.9% 0.2%

07:00 Germany Retail sales, real unadjusted, y/y January -1.1% 0.7%

08:50 France Services PMI (Finally) February 54.1 56.7

08:55 Germany Services PMI (Finally) February 53.4 54.4

09:00 Eurozone Services PMI (Finally) February 53.7 55.6

09:30 United Kingdom Purchasing Manager Index Services February 54.5 54.1

10:00 Eurozone Retail Sales (MoM) January -0.3% 0.4%

10:00 Eurozone Retail Sales (YoY) January 1.1% 1.6%

14:45 U.S. Services PMI (Finally) February 55.6 53.9

15:00 U.S. ISM Non-Manufacturing February 56.5 56.5

15:15 U.S. FOMC Member Charles Evans Speaks

15:15 U.S. FOMC Member Laсker Speaks

17:15 U.S. FOMC Member Jerome Powell Speaks

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

18:00 U.S. Fed Chairman Janet Yellen Speaks

-

Justice Dept must immediately appoint special prosecutor

-

Special prosecutor should not have any political ties

-

Sessions may end up being an object of investigation

-

New report makes it clear Sessions cannot possibly lead investigation into Russian interference in U.S Eeection

-

Cannot be 'even a scintilla of doubt' about attorney general's impartiality and fairness

-

Sessions' integrity in question, better for the country if he resigns

EURUSD: 1.0450 (458m) 1.0540-50 (522m) 1.0560 (364m)

USDJPY: 113.00 (USD 307m) 113.65-70 (631m)

GBPUSD: 1.2215 (401m) 1.2300 (390m) 1.2500 (352m)

AUDUSD: 0.7600 (AUD 211m) 0.7650 (385m) 0.7665 (240m)

EURJPY: 120.00 (EUR 347m)

EURNOK: 8.8700 (EUR 373m)

In the week ending February 25, the advance figure for seasonally adjusted initial claims was 223,000, a decrease of 19,000 from the previous week's revised level. This is the lowest level for initial claims since March 31, 1973 when it was 222,000. The previous week's level was revised down by 2,000 from 244,000 to 242,000.

The 4-week moving average was 234,250, a decrease of 6,250 from the previous week's revised average. This is the lowest level for this average since April 14, 1973 when it was 232,750. The previous week's average was revised down by 500 from 241,000 to 240,500.

Gross domestic product (GDP) grew 0.3% in December. With the exception of October, GDP has increased every month since June. Utilities, construction and wholesale trade were the main contributors to growth in December.

Goods-producing industries rose for the sixth time in seven months, up 0.5% in December. Service-producing industries were up 0.2%, as the majority of sectors grew.

After three consecutive monthly declines, the utilities sector grew 3.4% in December. Electric power generation, transmission and distribution (+3.3%) and natural gas distribution (+7.3%) both rose as seasonal weather returned across the country in December. In November, unusually warm weather led to lower demand for heating.

-

Precondition of conclusion of second review is clarity on medium term debt relief

-

Aim is for inclusion in ECB's QE programme the soonest possible

-

Greece needs to enter QE programme to prepare to go onto the markets on its own in Aug 2018

The euro area (EA19) seasonally-adjusted unemployment rate was 9.6% in January 2017, stable compared to December 2016 and down from 10.4% in January 2016. This remains the lowest rate recorded in the euro area since May 2009. The EU28 unemployment rate was 8.1% in January 2017, down from 8.2% in December 2016 and from 8.9% in January 2016. This is the lowest rate recorded in the EU28 since January 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 19.969 million men and women in the EU28, of whom 15.620 million were in the euro area, were unemployed in January 2017. Compared with December 2016, the number of persons unemployed decreased by 96 000 in the EU28 and by 56 000 in the euro area. Compared with January 2016, unemployment fell by 1.733 million in the EU28 and by 1.101 million in the euro area.

Euro area annual inflation is expected to be 2.0% in February 2017, up from 1.8% in January 2017, according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in February (9.2%, compared with 8.1% in January), followed by food, alcohol & tobacco (2.5%, compared with 1.8% in January), services (1.3%, compared with 1.2% in January) and non-energy industrial goods (0.2%, compared with 0.5% in January).

UK construction companies recorded a sustained expansion of overall business activity in February, with civil engineering replacing house building as the main growth driver. Residential activity increased at the slowest pace for six months, while commercial building declined for the first time since October 2016. The latest survey revealed a further solid expansion of employment numbers, despite a slowdown in new business growth to its weakest for four months. Meanwhile, intense cost inflation persisted in February, which was overwhelmingly linked to higher prices for imported materials.

At 52.5 in February, up slightly from 52.2 in January, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index (PMI) registered above the neutral 50.0 threshold for the sixth consecutive month. However, the rate of output growth remained weaker than its postreferendum peak (54.2 in December 2016) and subdued in comparison to the trends seen over the past three-and-a-half years.

Turnover in the retail sector fell by 2.0% in nominal terms in January 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Real turnover in the retail sector also adjusted for sales days and holidays fell by 1.4% in January 2017 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 0.6%.

The number of unemployed registered in the offices of the Public Employment Services has decreased in February by 9,355 people in relation to the previous month. This decline is the second best evolution of unemployment in the last 12 years this month. In the last 8 years unemployment has increased in February, on average, by 57,863 people. In this way, the total number of unemployed registered is 3,750,876 people, and continues in its lowest level of the last 7 years. In seasonally adjusted terms, unemployment dropped in the month of February in 32,711 people.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0654 (2892)

$1.0612 (3680)

$1.0582 (2397)

Price at time of writing this review: $1.0530

Support levels (open interest**, contracts):

$1.0484 (5016)

$1.0444 (4162)

$1.0398 (3626)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 73898 contracts, with the maximum number of contracts with strike price $1,0900 (4657);

- Overall open interest on the PUT options with the expiration date March, 13 is 84196 contracts, with the maximum number of contracts with strike price $1,0550 (5435);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from March, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.2500 (2375)

$1.2400 (896)

$1.2303 (769)

Price at time of writing this review: $1.2280

Support levels (open interest**, contracts):

$1.2199 (1642)

$1.2100 (1599)

$1.2000 (1952)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 34433 contracts, with the maximum number of contracts with strike price $1,2800 (3103);

- Overall open interest on the PUT options with the expiration date March, 13 is 37613 contracts, with the maximum number of contracts with strike price $1,1500 (3214);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from March, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

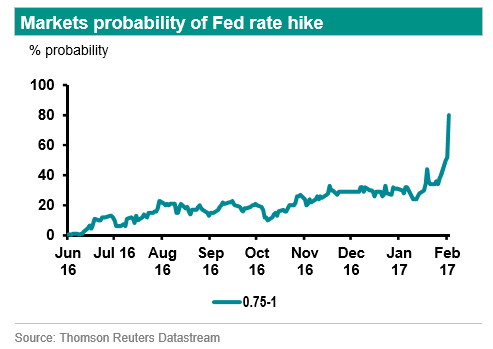

"We now expect the Fed to hike rates this month. The sharp year-to-date improvement in US business surveys signals the possibility of accelerating US growth in early 2017. Business surveys released so far in 2017 have been quite strong, with the January ISM manufacturing and non-manufacturing indices at or near one-year highs and consumer confidence surveys also trending up. Other data releases, including consumer spending, have also been stronger than expected.

We continue to forecast three rate hikes in 2017, but we have brought forward the next rate hike to March, while keeping the next two rate hikes in June and September.

The risks are tilted for a fourth rate hike, but this will depend crucially on the size and timing of the fiscal stimulus. Markets are currently pricing in two rate hikes this year".

Copyright © 2017 ABN AMRO, eFXnews™

In trend terms, the balance on goods and services was a surplus of $2,176m in January 2017, an increase of $520m (31%) on the surplus in December 2016.

In seasonally adjusted terms, the balance on goods and services was a surplus of $1,302m in January 2017, a decrease of $2,032m (61%) on the surplus in December 2016.

In seasonally adjusted terms, goods and services credits fell $945m (3%) to $31,796m. Non-monetary gold fell $671m (39%) and non-rural goods fell $403m (2%). Rural goods rose $57m (1%) and net exports of goods under merchanting rose $1m (17%). Services credits rose $72m (1%).

-

Credit conditions are as good as they were pre-crisis, with less risk because of greater capital requirements and other regulations

-

Fed procedures and legal framework ensure continuity between chairs

-

Levels of leverage and other financial indicators improved since crisis are not "flashing red"

Switzerland's real gross domestic product (GDP) has grown by 0.1% in the 4th quarter of 2016*. Private and government consumption has had a positive impact, while investment in construction and equipment has fallen slightly. The trade balance has also curbed GDP growth.

On the production side, healthcare and social work as well as financial services have boosted growth, while value added in manufacturing and energy production has declined. For 2016 as a whole, real GDP grew by 1.3% (+0.8% in 2015).

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 6.0% in January 2017 compared with the corresponding month of the preceding year. This was the highest increase of a yearly rate of change since May 2011 (+6.3%). In December and in November 2016 the annual rates of change were +3.5% and +0.3%, respectively. From December 2016 to January 2017 the index rose by 0.9%.

The index of import prices, excluding crude oil and mineral oil products, increased by 3.0% compared with the level of a year earlier.

The index of export prices increased by 1.8% in January 2017 compared with the corresponding month of the preceding year. In December and in November 2016 the annual rates of change were +1.1% and +0.3%, respectively. From December 2016 to January 2017 the export price index rose by 0.6%.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.