- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 04-01-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0488 +0,79%

GBP/USD $1,2322 +0,69%

USD/CHF Chf1,0206 -0,65%

USD/JPY Y117,24 -0,43%

EUR/JPY Y122,96 +0,37%

GBP/JPY Y144,45 +0,26%

AUD/USD $0,7281 +0,88%

NZD/USD $0,6966 +0,73%

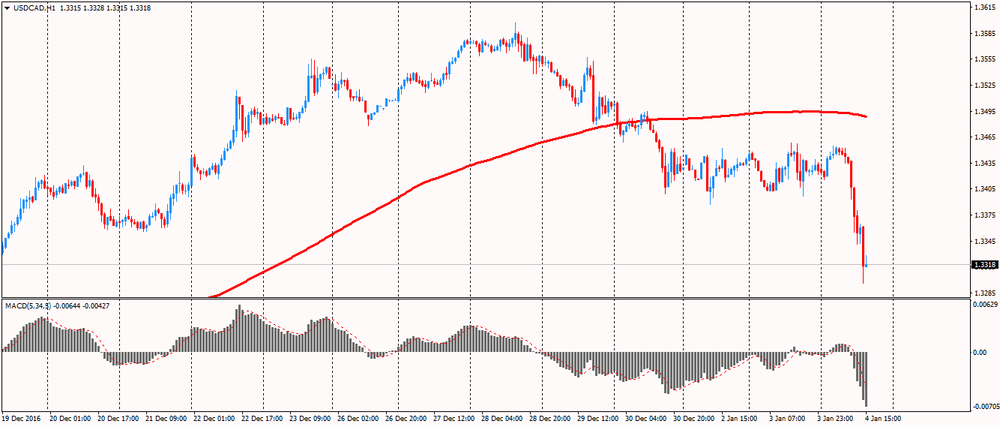

USD/CAD C$1,3299 -0,95%

01:45 China Markit/Caixin Services PMI December 53.1 53.3

08:15 Switzerland Consumer Price Index (MoM) December -0.2% -0.1%

08:15 Switzerland Consumer Price Index (YoY) December -0.3% 0.0%

09:30 United Kingdom Purchasing Manager Index Services December 55.2 54.7

10:00 Eurozone Producer Price Index, MoM November 0.8% 0.3%

10:00 Eurozone Producer Price Index (YoY) November -0.4% 0.1%

13:00 United Kingdom MPC Member Andy Haldane Speaks

13:15 U.S. ADP Employment Report December 216 170

13:30 Canada Industrial Product Price Index, m/m November 0.7%

13:30 Canada Industrial Product Price Index, y/y November 0.8%

13:30 U.S. Continuing Jobless Claims 2102 2051

13:30 U.S. Initial Jobless Claims 265 260

14:45 U.S. Services PMI (Finally) December 54.6

15:00 U.S. ISM Non-Manufacturing December 57.2 56.6

16:00 U.S. Crude Oil Inventories December 0.614 -2300

"1- The minutes from the December 14th FOMC meeting are likely to reveal modest optimism about the improvement in the recent data but a "cloud of uncertainty" about how fiscal policy could change the trajectory. While it seems likely that there will be some form of fiscal stimulus, the details are not yet apparent which makes it difficult to gauge the risks to the forecast. We therefore think the minutes will show that there was a conversation about the possible scenarios without committing to the outcome. We also think that Fed officials likely discussed the health of the labor market with a particular emphasis on measuring slack in the labor market given the drop in the unemployment rate to 4.6%. The labor force participation rate has edged higher this year, but in a very choppy fashion making it hard to decipher the trend. Moreover, the improvement in wages has been uneven, further complicating whether we have returned to full employment.

2- Inflation will also be in focus. The statement noted that although market measures of inflation compensation have moved up considerably, they remain low. And meanwhile survey-based measures remained little changed. Seemingly the Fed is not concerned about a rise in inflation expectations that could bias inflation higher. We think there will likely be a bit of a debate over the risks to inflation.

3- We will also look out for any conversation about risk management. Interestingly, Fed Chair Yellen did not talk about the asymmetry when policy is close to the effective lower bound. When asked about allowing the "economy to run hot" she said that it was not the Fed's intention to be behind the curve with policy. This was perceived to be a hawkish signal by the markets. It will be interesting to see the discussion among Fed officials about the risks".

Copyright © 2017 BofAML, eFXnews™

Euro area annual inflation is expected to be 1.1% in December 2016, up from 0.6% in November 2016, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in December (2.5%, compared with -1.1% in November), followed by services (1.2%, compared with 1.1% in November), food, alcohol & tobacco (1.2%, compared with 0.7% in November) and non-energy industrial goods (0.3%, stable compared with November).

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

EUR/USD

Offers: 1.0450 1.0480-85 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0400 1.0380-85 1.0365 1.0345-50 1.0300

GBP/USD

Offers: 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids: 1.2250 1.2220 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8500 0.8525-30 0.8550 0.8575-80 0.8600

Bids: 0.8480 0.8450 0.8435 0.8400 0.8385 0.8350

EUR/JPY

Offers: 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.50 122.30 122.00 121.75 121.50 121.00

USD/JPY

Offers: 118.00 118.20-25 118.45-50 118.80 119.00

Bids: 117.50 117.20-25 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers: 0.7280 0.7300 0.73200.73500.7365 0.73800.7400

Bids: 0.7250 0.7225-30 0.7200 0.7175-80 0.7145-50 0.7100-10

At 54.4 in December, up from November's 53.9, the final Markit Eurozone PMI Composite Output Index signalled a faster rate of expansion than the earlier flash estimate. Manufacturing led the growth acceleration, with production increasing at the quickest pace since April 2014. Service sector activity also rose solidly, with the rate of increase staying close to November's 11-month high.

Chris Williamson, Chief Business Economist at IHS Markit said: "The final PMI data signal an even stronger end to 2016 than the preliminary flash numbers, though whether this provides a much-needed springboard for the euro area's recovery to gain further momentum in 2017 remains very uncertain. Much depends on political events over the course of the next year. "The survey data are signalling a 0.4% expansion of GDP in the fourth quarter, with growth accelerating in December as business activity rose at the fastest rate for over five-and-a-half years".

Germany's service sector remained in good health at the end of 2016, despite seeing growth of business activity ease slightly. New orders rose at a slower, yet still solid, pace amid reports of improving client demand. Outstanding business increased marginally for the second straight month, encouraging companies to raise their staffing levels further. Meanwhile, a combination of rising raw material costs (notably fuel) and greater wages led to a sharp increase in input prices. Charges rose more quickly as a result.

The final seasonally adjusted Markit Germany Services PMI Business Activity Index posted 54.3 in December, down slightly from November's 55.1 but still signalling robust growth. The latest reading marked the end of a strong final quarter, during which the sector has recovered growth momentum following a notable slowdown in September. The quarterly average (54.5) was the highest since Q1 2016. December's rise in activity was widely attributed to new business gains.

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

Информационно-аналитический отдел TeleTrade

The number of unemployed registered in the offices of the Public Employment Services has decreased in December by 86,849 people in relation to the previous month. In this way, the total number of registered unemployed is 3,702,974 people and continues in the lowest levels of the last 7 years. In seasonally adjusted terms, unemployment dropped in December in 49,243 people. With respect to December 2015, unemployment has decreased by 390,534 people, the largest decrease in a calendar year of the whole historical series.

-

At 08:00 GMT Spain's report on the change in the number of unemployed

-

At 19:00 GMT Fed meeting minutes

-

At 19:00 GMT the total sales of cars in the USA

EUR/USD

Resistance levels (open interest**, contracts)

$1.0707 (2025)

$1.0622 (707)

$1.0560 (250)

Price at time of writing this review: $1.0415

Support levels (open interest**, contracts):

$1.0339 (2219)

$1.0298 (2926)

$1.0246 (2214)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44738 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- Overall open interest on the PUT options with the expiration date March, 13 is 54777 contracts, with the maximum number of contracts with strike price $1,0000 (5067);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from January, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (563)

$1.2414 (251)

$1.2319 (124)

Price at time of writing this review: $1.2264

Support levels (open interest**, contracts):

$1.2181 (805)

$1.2085 (459)

$1.1988 (1333)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14375 contracts, with the maximum number of contracts with strike price $1,2800 (3009);

- Overall open interest on the PUT options with the expiration date March, 13 is 17183 contracts, with the maximum number of contracts with strike price $1,1500 (2970);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from January, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Overall operating conditions improved at the sharpest rate since December 2015, helped by stronger growth in both production and new orders. As a result, goods producers were more confident towards taking on additional workers, with the rate of job creation picking up to a 32-month high. Buying activity also rose at the quickest rate in nearly one year.

The headline PMI posted 52.4 in December, up from 51.3 in November, signalling a sharper improvement in manufacturing conditions in Japan. In fact, the latest reading was the highest since December last year and contributed to the strongest quarterly average since Q4 2015. The higher figure reflected increases in output, new orders and employment.

During his speech today, prime minister Shinzo Abe, said that for him and his cabinet the economy will be the top priority in 2017. Answering journalists' questions, the politician added that early elections are not planned and the government will continue to work with "abenomics".

Recall that to exit the crisis Shinzo Abe offers the program of "Three Arrows". The first of them - the achievement of the objectives for higher prices. Abe is also supporting stimulus measures from the budget. And finally, the third "Arrow" is aimed at developing measures to reform the public sector, which would help to attract investment, as well as the growth of consumption.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.