- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 06-11-2015.

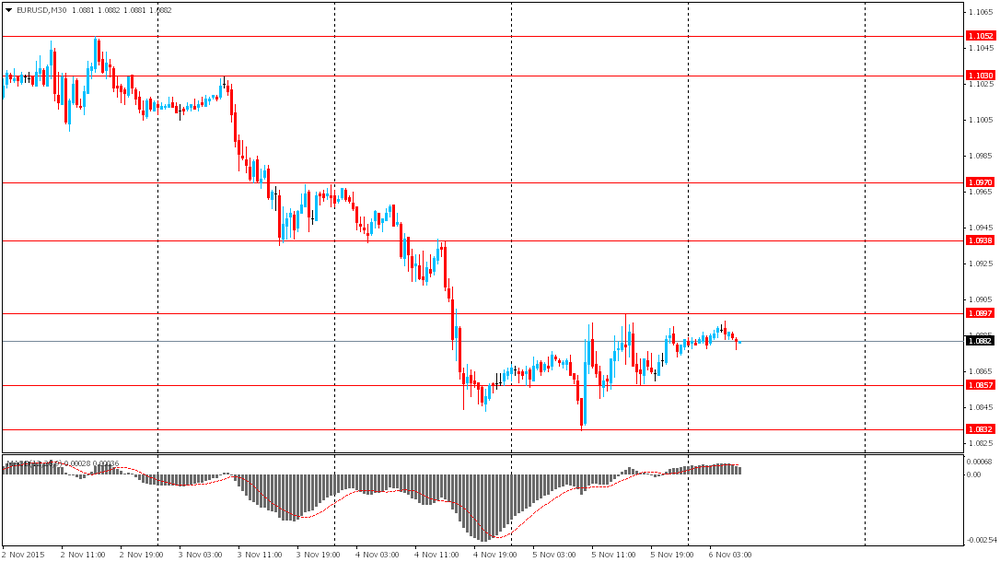

EUR/USD

Offers 1.0885 1.0900 1.0925-30 1.0960 1.0980 1.1000 1.1020-25 1.1050

Bids 1.0850-60 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.5200 1.5220 1.5245-50 1.5265 1.5280 1.5300 1.5325-30 1.5350 1.5370 1.5380-85 1.5400

Bids 1.5180 1.5165 1.5150 1.5125-30 1.5100 1.5085 1.5050-60 1.5030 1.5000

EUR/GBP

Offers 0.7185 0.7200 0.7225-30 0.7250 0.7275 0.7300

Bids 0.7145-50 0.7125 0.7100 0.7085 0.7050 0.7030-35 0.7000

EUR/JPY

Offers 132.80 133.00 133.20 133.50-60 133.75-80 134.00 134.30 134.50

Bids 132.25-30 132.00 131.80 131.50 131.30 131.00 130.85 130.50

USD/JPY

Offers 122.00 122.25-30 122.50 122.75 123.00 123.20 123.50

Bids 121.50-60 121.25-30 121.00 120.75-80 120.50 120.20-25 120.00

AUD/USD

Offers 0.7180-85 0.7200 0.7220 0.7250 0.7265 0.7280-85 0.7300

Bids 0.7125-30 0.7100-05 0.7080 0.7065 0.7050 0.7030 0.7000

USD/JPY 121.50 (USD 380m) 122.00 (1.7bln) 122.50 (859m)

EUR/USD 1.0800 (EUR 1.2bln) 1.0850 (864m) 1.0900 (1bln)

GBP/USD 1.5305 (GBP 195m)

USD/CHF 0.9900 (500m) 1.1000 (1.8bln)

USD/CAD 1.3145-55 (1.25bln) 1.3170 (301m)

AUD/USD 0.7000 (875m) 0.7200 (250m)

EUR / USD

Resistance levels (open interest**, contracts)

$1.1059 (3522)

$1.0980 (2055)

$1.0926 (378)

Price at time of writing this review: $1.0873

Support levels (open interest**, contracts):

$1.0815 (2240)

$1.0782 (4319)

$1.0742 (1619)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 62430 contracts, with the maximum number of contracts with strike price $1,1200 (4741);

- Overall open interest on the PUT options with the expiration date November, 6 is 57889 contracts, with the maximum number of contracts with strike price $1,0900 (5200);

- The ratio of PUT/CALL was 0.93 versus 0.99 from the previous trading day according to data from November, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (3234)

$1.5400 (1776)

$1.5301 (1090)

Price at time of writing this review: $1.5192

Support levels (open interest**, contracts):

$1.5099 (1927)

$1.5000 (1725)

$1.4900 (700)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 22633 contracts, with the maximum number of contracts with strike price $1,5500 (3234);

- Overall open interest on the PUT options with the expiration date November, 6 is 22098 contracts, with the maximum number of contracts with strike price $1,5200 (3021);

- The ratio of PUT/CALL was 0.98 versus 0.99 from the previous trading day according to data from November, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 Australia RBA Assist Gov Edey Speaks

04:00 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Leading Economic Index (Preliminary) September 103.5 102.1 101.4

05:00 Japan Coincident Index (Preliminary) September 112.2 111.9

The U.S. dollar little changed ahead of today's employment data release. A median forecast from economists surveyed by the Wall Street Journal suggests that the number of employed outside agricultural sector rose by 183,000 in October after a 142,000 increase in September. Analysts say that a strong report will intensify expectations for a rate hike in December.

The yen declined after Bank of Japan Governor Haruhiko Kuroda's speech. He said that he will study changes in the economy and make optimal decisions at every meeting. This means that Kuroda is ready to add more stimulus.

The Australian dollar was under pressure amid Australian GDP and inflation forecasts, which were released today. The Reserve Bank of Australia cut its 2015 GDP forecast to 2.25% from 2.5%. 2017 GDP forecast was lowered to 2.75%-3.75% from 3%-4%. The bank also cut its 2016 core inflation forecast to 1.5%-2.5% from 2%-3%. Inflation is expected to rise later on.

EUR/USD: the pair fluctuated within $1.0875-95 in Asian trade

USD/JPY: the pair rose to Y121.85

GBP/USD: the pair fell to $1.5200

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Industrial Production s.a. (MoM) September -1.2% 0.5%

07:00 Germany Industrial Production (YoY) September 2.3% 1.55%

07:45 France Trade Balance, bln September -2.98 -3.1

09:30 United Kingdom Industrial Production (MoM) September 1.0% -0.1%

09:30 United Kingdom Industrial Production (YoY) September 1.9% 1.3%

09:30 United Kingdom Manufacturing Production (MoM) September 0.5% 0.4%

09:30 United Kingdom Manufacturing Production (YoY) September -0.8% -0.9%

09:30 United Kingdom Total Trade Balance September -3.27

13:30 Canada Building Permits (MoM) September -3.7% 1.3%

13:30 Canada Unemployment rate October 7.1% 7.1%

13:30 Canada Employment October 12.1 10

13:30 U.S. Average workweek October 34.5 34.5

13:30 U.S. Average hourly earnings October 0% 0.2%

13:30 U.S. Nonfarm Payrolls October 142 180

13:30 U.S. Unemployment Rate October 5.1% 5.1%

15:00 United Kingdom NIESR GDP Estimate October 0.5% 0.6%

20:00 U.S. Consumer Credit September 16.02 17.5

21:15 U.S. FOMC Member Brainard Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.