- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 07-05-2015.

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1251 -0,81%

GBP/USD $1,5415 +1,12%

USD/CHF Chf0,9221 +0,67%

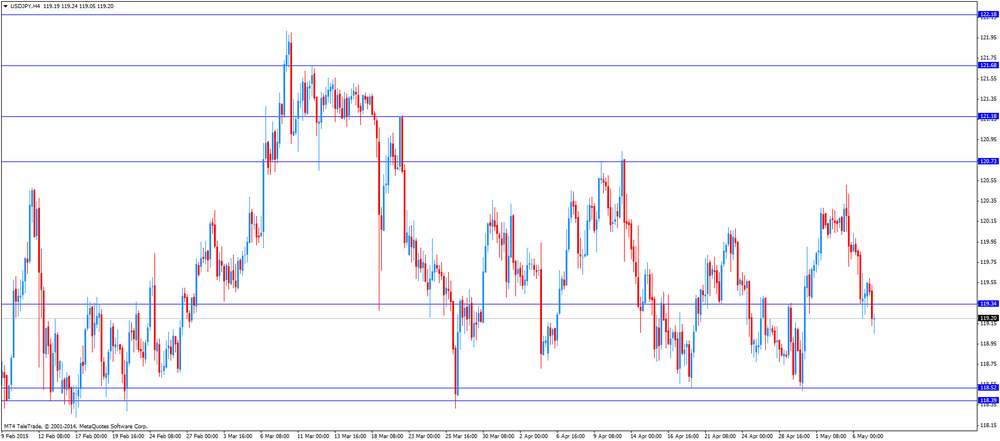

USD/JPY Y119,69 +0,21%

EUR/JPY Y134,67 -0,59%

GBP/JPY Y184,51 +1,33%

AUD/USD $0,7910 -0,73%

NZD/USD $0,7449 -0,64%

USD/CAD C$1,2110 +0,57%

(time / country / index / period / previous value / forecast)

01:00 China Trade Balance, bln April 3.08 39.45

01:30 Australia RBA Monetary Policy Statement

05:45 Switzerland Unemployment Rate (non s.a.) April 3.4% 3.3%

06:00 France Bank holiday

06:00 Germany Current Account March 16.6

06:00 Germany Industrial Production s.a. (MoM) March 0.2% 0.4%

06:00 Germany Industrial Production (YoY) March -0.3%

06:00 Germany Trade Balance March 19.2 19.7

07:00 United Kingdom Halifax house price index 3m Y/Y April 8.1% 7.8%

07:00 United Kingdom Halifax house price index April 0.4% 0.4%

07:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1%

07:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.9%

08:30 United Kingdom Total Trade Balance March -2.859 -2.95

08:30 United Kingdom Trade in goods March -10.3

12:15 Canada Housing Starts April 189.7 182

12:30 Canada Employment April 28.7 -5

12:30 Canada Unemployment rate April 6.8% 6.9%

12:30 U.S. Average hourly earnings April 0.3% 0.2%

12:30 U.S. Nonfarm Payrolls April 126 224

12:30 U.S. Unemployment Rate April 5.5% 5.4%

14:00 U.S. Wholesale Inventories March 0.3% 0.3%

The euro depreciated significantly against the dollar, falling below $ 1.1300, which was associated with the publication of a report on the number of initial applications for unemployment insurance in the United States. Ministry of Labor announced initial applications for unemployment benefits rose by 3,000 and reached a seasonally adjusted 265,000 in the week ended May 2nd. Economists expected 280,000 initial claims. The level of applications in the previous week has not been revised and remained at around 262,000 - the lowest since 2000. The moving average for the four weeks of initial claims fell by 4,250 last week to 279 500. The Labor Department said that no special factors did not affect the latest data. A report on Thursday showed that the number of repeat applications for unemployment benefits fell by 28,000 to 2.23 million in the week ended April 25 was the lowest level since November 2000.

Meanwhile, reports that next Monday Greece is unlikely to enter into an agreement with the EU, also pressured the single currency. EU Head Deysselblum said today that next Monday, Greece will likely not be agreed, adding that in the case of liquidity problems the country may face difficulties in complying with the deadlines. "From a political point of view, the only deadline is the end of June, when the end of the second term of the assistance program. However, there may be other deadlines - in case if Athens will mature liquidity problems, "- he said.

The pound traded in a narrow range against the US dollar on a background of ongoing general elections in the UK. They are considered the most unpredictable for many years. The first exit poll data will be available 21.00 GMT. During the last two elections, the results of such polls accurately predicted the results of the elections, so we should expect the pound fluctuations in response to any unexpected information obtained on the basis of surveys of voters. According to forecasts, the Conservatives need to get around 281 seats in parliament, Labour - 266 Liberal Democrats - 27, the Scottish National Party - 51, and the United Kingdom Independence Party - 1 seat. Higher rates Conservatives or the Liberal Democrats, who will bring them to obtain an absolute majority, probably led to a sharp increase in the pound. Increasing the number of votes cast in the Labour Party seems to have a negative impact on the pound, if it does not happen at the expense of the votes cast of the Scottish National Party, as in this case, the impact on the pound will not.

The dollar rose against the yen significantly, restoring all the lost positions yesterday. The US currency was supported by a report on applications for unemployment benefits. In addition, market participants are waiting for Friday's release of data on the US labor market. Economists forecast that employment will increase by 224,000 and the unemployment rate fell to 5.4% from 5.5%. If job growth does not accelerate, it could be a problem for Fed policy. Recall the recent series of disappointing US economic data undermined optimism about the economic recovery, prompting investors to reconsider the initial expectations of the Fed raising interest rates at the end of the year instead of the middle. Meanwhile, today the head of the Federal Reserve Bank of Chicago Charles Evans said the Fed could raise rates at any meeting of the Fed, but added that the start of tightening in 2016 will be better coordinated with the picture of inflation. The politician also added that he expects a rebound after the economic slowdown in the 1st quarter. In the 2nd quarter, it expects to see economic growth of 3%.

The State Secretariat for Economic Affairs (SECO) released its consumer climate index for Switzerland on Thursday. The SECO consumer climate index remained unchanged at -6 in the first quarter.

The future economic expectations subindex rose to -8 in the first quarter from -12 in the fourth quarter.

The unemployment trends subindex declined to 51 in the first quarter from 52 in the fourth quarter.

The assessment of previous economic trends subindex dropped to -22 in the first quarter from +1 in the fourth quarter.

The price trends over the last twelve months plunged to -3 in the first quarter from +32 in the fourth quarter, while the future price trends subindex declined to +6 from +29.

The Atlanta Federal Reserve bank President Dennis Lockhart said on Wednesday that he thinks the interest rate hike in the middle of the year will be appropriate. But interest rates could be hiked at each monetary policy meeting, he added.

Lockhart wants to be sure that the weak economic growth in the first quarter was temporary before raising interest rates. He noted that higher consumer spending is needed for the solid economic growth.

The Atlanta Federal Reserve bank president pointed out that the April labour market data will be very important to gauge economic momentum in the second quarter.

Lockhart is a voting member of the Federal Open Market Committee this year.

EUR/USD: $1.1250(E200mn), $1.1325, $1.1350, $1.1370, $1.1400(E507mn)

USD/JPY: Y119.00($1.5bn), Y119.75($$750mn), Y120.00(1.8bn)

GBP/USD: $1.5000(Gbp226mn), $1.5150(Gbp150mn)

EUR/GBP: Gbp0.7250-65(E210mn)

AUD/USD: $0.7890(A$349mn), $0.7900(A$440mn).

NZD/USD: $0.7525(NZ$473mn)

USD/CAD: C$1.1950($512mn)

Statistics Canada released housing market data on Thursday. Building permits in Canada soared 11.6% in March, exceeding expectations for a 2.5% gain, after a 0.3% decline in February. It was the biggest increase since September 2014.

February's figure was revised up from a 0.9% fall.

The increase was partly driven by a rise in construction permits for multifamily homes in Ontario and British Columbia.

Building permits for non-residential construction jumped 22.1% in March, while permits in the residential sector rose 6.6%.

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 02 in the U.S. climbed by 3,000 to 265,000 from 262,000 in the previous week, beating expectations for a rise by 18,000.

The previous week's reading was the lowest reading since April 2000.

Initial jobless claims remained below 300,000 the ninth straight week. That could be interpreted as the strengthening of the labour market.

The International Monetary Fund (IMF) expects the Asia-Pacific region to expand at 5.6% year-over-year in 2015 and 5.5% in 2016. But the region faces risks like rising debts, a stronger dollar and weaker-than-expected performances from China and Japan, the IMF noted.

On the other side, low commodity prices, strong labour markets and recoveries in the U.S. and Europe will support the region, the IMF added.

According to the French Customs, France's trade deficit widened to €4.575 billion in March from €3.623 billion in February.

February's figure was revised down from a deficit of €3.4 billion.

The increase of a deficit was driven by energy imports and lower aerospace exports.

Imports rose due to strong recovery in energy and due to strong demand for automobiles, capital goods and intermediate goods, while exports increased due to higher sales of automotive, pharmaceuticals, metals and electrical and electronic equipment.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Changing the number of employed April 48.1 Revised From 37.7 5.0 -2.9

01:30 Australia Unemployment rate April 6.1% 6.2% 6.2%

05:45 Switzerland SECO Consumer Climate Quarter I -6 -6

06:00 United Kingdom Parliamentary Elections

06:00 Germany Factory Orders s.a. (MoM) March -0.9% 1.5% 0.9%

06:00 Germany Factory Orders n.s.a. (YoY) March -1.3% 1.9%

06:45 France Industrial Production, m/m March 0.5% Revised From 0.0% 0.0% -0.3%

06:45 France Industrial Production, y/y March 1.2% Revised From 0.3% 1.3%

06:45 France Trade Balance, bln March -3.60 Revised From -3.44 -3.6 -4.58

07:00 Switzerland Foreign Currency Reserves April 522.4 Revised From 522.3 521.9

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to increase by 18,000 to 280,000.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. German seasonal adjusted factory orders jumped 0.9% in March, missing expectations for a 1.5% increase, after a 0.9% drop in February.

Industrial production in France fell 0.3% in March, missing expectations for a flat reading, after a 0.5% rise in February. February's figure was revised up from a flat reading.

The decline was driven by declines in the production of energy and water.

On a yearly basis, the French industrial production rose 1.3% in March, after a 1.2% gain in February. February's figure was revised down up a 0.3% rise.

France's merchandise trade deficit widened to €4.575 billion in March from €3.623 billion in February. February's figure was revised down from a deficit of €3.4 billion.

The Greek debt crisis still weighs on the euro.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The uncertainty around UK's parliamentary elections weighed on the pound. The win of the Conservatives is expected to have a negative impact on the pound as the Conservatives want to carry out a referendum on Britain's membership in the European Union (EU). The Labour Party said that the Britain's exit from the EU will be a catastrophe for the U.K. The Labour Party has promised to reduce the budget deficit.

The United Kingdom Independence Party (UKIP), a Eurosceptic and right-wing populist political party in the U.K., may win seats in the parliament. It will not will contribute to political stability in the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian building permits data. Building permits in Canada are expected to climb 2.5% in March, after a 0.9% drop in February.

The Swiss dollar traded mixed against the U.S. dollar after the economic data from Switzerland. The Swiss National Bank's foreign exchange reserves decreased to 521.888 billion Swiss francs in April from 522.399 billion francs in March. It was the first monthly decline in 2015.

March's figure was revised up from 522.323 billion francs.

The SECO consumer climate index for Switzerland remained unchanged at -6 in the first quarter.

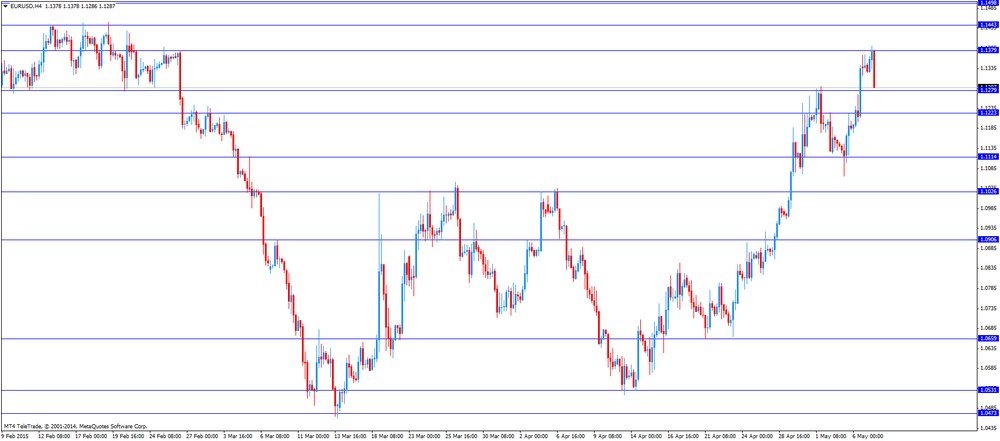

EUR/USD: the currency pair fell to $1.1286

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair decreased to Y119.05

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) March -0.9% 2.5%

12:30 U.S. Initial Jobless Claims May 262 280

23:50 Japan Monetary Policy Meeting Minutes

EUR/USD

Offers 1.1385 1.1400 1.1425 1.1445 1.1470 1.1485 1.1500

Bids 1.1330 1.1300 1.1285 1.1255-60 1.1220 1.1200 1.1180 1.1160 1.1140 1.1120

GBP/USD

Offers 1.5240-50 1.5265 1.5280 1.5300 1.5325-30 1.5350

Bids 1.5180-85 1.5160 1.5125 1.5100 1.5085 1.5065 1.5050 1.5030 1.5000

EUR/GBP

Offers 0.7485 0.7500 0.7525 0.7555-60 0.7585 0.7600

Bids 0.7450 0.7425-30 0.7400 0.7385 0.7365 0.7350 0.7330 0.7300-10

EUR/JPY

Offers 135.85 136.00 136.50 136.80 137.00

Bids 135.00 134 80 134.40 134.00 133.70 133.50

USD/JPY

Offers 119.65 119.85 120.00 120.25-30 120.50 120.80 121.00

Bids 119.25-30 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.7980 0.8000 0.8025 0.8050-60 0.8085 0.8100

Bids 0.7920-25 0.7900 0.7880 0.7850-55 0.7820-25 0.7800

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders jumped 0.9% in March, missing expectations for a 1.5% increase, after a 0.9% drop in February.

Domestic orders climbed by 4.3% in March, while foreign orders dropped by 1.65.

New orders from the Eurozone rose 2.5% in March, while orders from other countries decreased 4%.

The intermediate- and capital goods orders were up 0.9% and 1.3% in March. Consumer goods orders fell 2.2%.

The French statistical office Insee its industrial production figures on Thursday. Industrial production in France fell 0.3% in March, missing expectations for a flat reading, after a 0.5% rise in February. February's figure was revised up from a flat reading.

The decline was driven by declines in the production of energy and water.

On a yearly basis, the French industrial production rose 1.3% in March, after a 1.2% gain in February. February's figure was revised down up a 0.3% rise.

In the first quarter of 2015, industrial production grew 1.4%.

On a monthly basis, manufacturing output in France rose 0.3% in March, after a 0.5% gain in February.

Construction output climbed 0.9% in March from the previous year, after a 2.2% decrease in February.

EUR/USD: $1.1250(E200mn), $1.1325, $1.1350, $1.1370, $1.1400(E507mn)

USD/JPY: Y119.00($1.5bn), Y119.75($$750mn), Y120.00(1.8bn)

GBP/USD: $1.5000(Gbp226mn), $1.5150(Gbp150mn)

EUR/GBP: Gbp0.7250-65(E210mn)

AUD/USD: $0.7890(A$349mn), $0.7900(A$440mn).

NZD/USD: $0.7525(NZ$473mn)

USD/CAD: C$1.1950($512mn)

The Organization for Economic Cooperation and Development (OECD) said on Wednesday that the annual rate of inflation in its 34 members remained unchanged at 0.6% in March. The inflation target of most central banks in developed economies is 2%.

The inflation was driven by lower energy prices. Food prices increased.

The inflation excluding energy and food for the OECD area remained unchanged at 1.7%.

The Swiss National Bank's foreign exchange reserves decreased to 521.888 billion Swiss francs in April from 522.399 billion francs in March. It was the first monthly decline in 2015.

March's figure was revised up from 522.323 billion francs.

The decrease was likely driven by a weaker U.S. dollar.

The European Union (EU) Economic and Monetary Affairs Commissioner Pierre Moscovici said on Wednesday that Eurozone have to find a way to deal with the high public debt accumulated in 2008-2012. But he didn't say how to do it.

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.2% in April from 6.1% in March, in line with expectations.

The number of employed people in Australia fell by 2,900 in April, missing expectations for an increase by 5,000, after a gain by 48,100 in March.

March's figure was revised up from a rise by 37,700.

The decline in employment was driven by declines in full-time employment for males, which fell by 47,900, and part-time employment for females, which decreased by 10,700.

Full-time employment fell by 21,900, while part-time employment rose by 19,000.

The participation rate was 64.8%.

These figures might add pressure on the Reserve Bank of Australia to lower its interest rate again.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1523 (1878)

$1.1453 (1694)

$1.1405 (3164)

Price at time of writing this review: $1.1361

Support levels (open interest**, contracts):

$1.1281 (471)

$1.1217 (833)

$1.1178 (2870)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 63642 contracts, with the maximum number of contracts with strike price $1,1200 (6477);

- Overall open interest on the PUT options with the expiration date May, 8 is 92693 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.46 versus 1.42 from the previous trading day according to data from May, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5503 (2373)

$1.5405 (1025)

$1.5308 (1229)

Price at time of writing this review: $1.5227

Support levels (open interest**, contracts):

$1.5192 (1466)

$1.5094 (1539)

$1.4997 (2620)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 27423 contracts, with the maximum number of contracts with strike price $1,5000 (2861);

- Overall open interest on the PUT options with the expiration date May, 8 is 37245 contracts, with the maximum number of contracts with strike price $1,4800 (2747);

- The ratio of PUT/CALL was 1.36 versus 1.31 from the previous trading day according to data from May, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Changing the number of employed April 48.1 Revised From 37.7 5.0 -2.9

01:30 Australia Unemployment rate April 6.1% 6.2% 6.2%

The pound was little changed before U.K. elections on Thursday and Australia's dollar rose after the nation's unemployment rate remained below its peak.

The dollar was less than 0.4 percent from a three-month low amid concern a U.S. payroll report on Friday will add to signs the world's biggest economy is slowing. A gauge of the greenback is set for a four-week decline, its worst losing streak since 2013, as investors wait for more clues on the U.S. economy's direction and the Fed's ability to raise interest rates this year.

EUR / USD: during the Asian session, the pair was trading around $ 1.1340

GBP / USD: during the Asian session, the pair was trading around $ 1.5240

USD / JPY: during the Asian session the pair rose to Y119.60

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.